- Home

- News & Analysis

- GO Daily News

- Overnight on Wall Street: Wednesday 09 December 2020

Overnight on Wall Street: Wednesday 09 December 2020

December 9, 2020By Deepta Bolaky

@DeeptaGOMarkets

Equity Markets

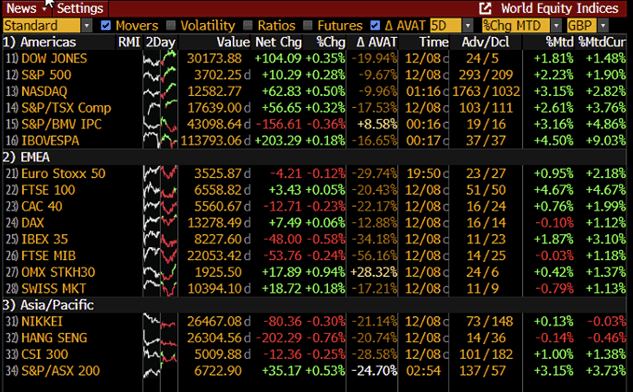

Stocks in the European and US session edged higher on promising vaccine updates and stimulus talks. Amid tougher lockdown restrictions in the US, a stopgap funding measure may be passed to avert a government shutdown. Majority of the major equity indices closed in positive territory while the FTSE index ended relatively flat driven mostly by the Brexit drama.

Source: Bloomberg Terminal

On Wall Street, technology stocks continued its rally pushing the Nasdaq Composite to a new fresh 2020:

- The Dow Jones Industrial Average added 104 points or 0.4% to 30,174.

- S&P 500 added 10 points or 0.3% to 3,702.

- Nasdaq Composite rose by 63 points or 0.5% to 12,583.

Currency Markets

In the FX space, major currencies were weaker against the US dollar. Major pairs are trading within familiar levels.

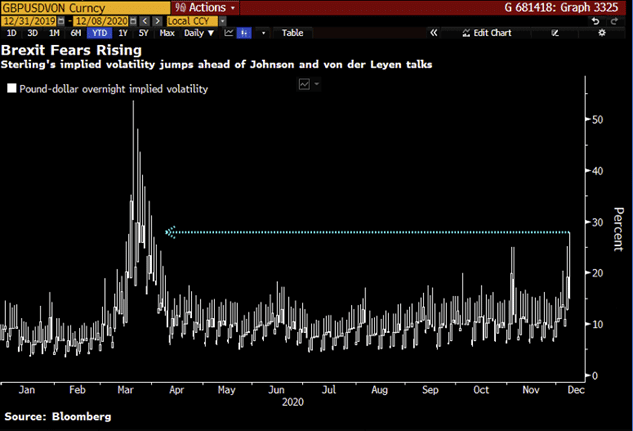

Source: Bloomberg

The British Pound remained among the worst G10 performers against the US dollar. The implied volatility in the Pound-dollar jumped to the highest since March as Brexit talks intensified ahead of the year-end deadline.

British Cabinet Minister announced an “agreement in principle” in a joint statement by the co-chairs of the EU-UK Joint Committee amid contradictory headlines:

“The parties have also reached an agreement in principle with respect to the decisions the Joint Committee has to take before 1 January 2021. In particular, this concerns the practical arrangements regarding the EU’s presence in Northern Ireland when UK authorities…”

The GBPUSD pair pared some gains and traded back above the 1.33 level.

Source: MT4

On the economic front, GDP figures in the Eurozone and ZEW surveys in Germany came out mixed:

Germany – ZEW surveys

- Economic Sentiment came above expectations at 55 in December

- Current Situation came in at -66.5 below the forecasts figure of 66 in December

Eurozone

- In the third quarter of 2020, seasonally adjusted GDP increased by 12.5% in the euro area and by 11.5%in the EU compared with the previous quarter.

- Compared with the same quarter of the previous year, seasonally adjusted GDP decreased by 4.3% in the euro area and by 4.2% in the EU in the third quarter of 2020, which represents a partial recovery after -14.7%and -13.9% respectively in the previous quarter

Commodities

Despite the latest positive news ranging from vaccine updates to the OPEC compromise deal, tougher lockdown restrictions and surging coronavirus cases are weighing on the oil market. Crude oil prices struggled to edge higher on Tuesday but remained in familiar levels.

The API reported a draw in the weekly crude oil stock to 1.141M in December 4 from previous 4.146M. As of writing, WTI Crude oil (Nymex) and Brent Crude (ICE) were trading at around $45.47 and $48.84 respectively. Traders will likely be eyeing the EIA report and updates on the pandemic risks for fresh trading impetus.

Gold

Gold

The precious metal is holding up to recent gains lifted by encouraging stimulus talks, geopolitical tensions between the US and China and surging coronavirus cases. As of writing, the XAUUSD pair was trading around $1,869.

Source: GO MT4

By Deepta Bolaky

Key upcoming events

- Westpac Consumer Confidence (Australia)

- Consumer and Producer Price Index (China)

- Trade Balance (Germany)

- BoC Rate Statement and Interest Rate Decision (Canada)

| Thursday, 10 December 2020 Indicative Index Dividends Dividends are in Points |

||||||

| ASX200 | WS30 | US500 | US2000 | NDX100 | CAC40 | STOXX50 |

| 0 | 3.553 | 0.264 | 0.128 | 0.394 | 0 | 0 |

| ESP35 | ITA40 | FTSE100 | DAX30 | HK50 | JP225 | INDIA50 |

| 0 | 0 | 1.271 | 0 | 0 | 0 | 0 |

Disclaimer: The articles are from GO Markets analysts, based on their independent analysis or personal experiences. Views or opinions or trading styles expressed are of their own; should not be taken as either representative of or shared by GO Markets. Advice (if any), are of a ‘general’ nature and not based on your personal objectives, financial situation or needs. You should therefore consider how appropriate the advice (if any) is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next: Overnight on Wall Street: Thursday 10 December 2020

Previous: COTD: GBPJPY – Bullish Sentiment On A Tightrope