- Home

- News & Analysis

- GO Daily News

- COTD: GBPJPY – Bullish Sentiment On A Tightrope

COTD: GBPJPY – Bullish Sentiment On A Tightrope

December 8, 2020GBPJPY – 4HR

GBPJPY –

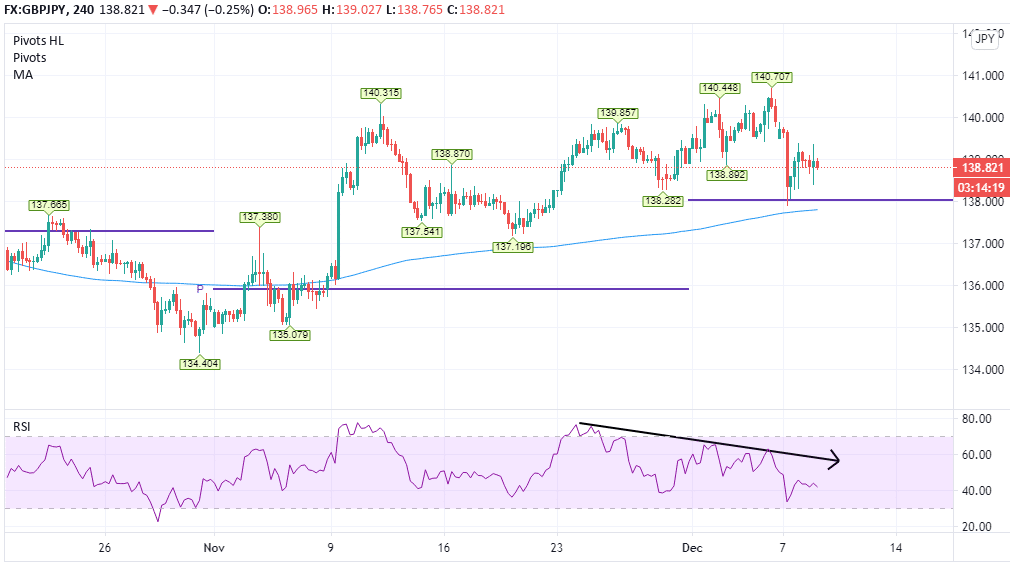

Last week we looked at EURGBP and the technicals relating to potential issues surrounding the trade talks deadline. Sticking with the general theme, today’s Chart of The Day focuses on another Sterling cross GBPJPY, possibly becoming more volatile over the coming days.

While somewhat choppy on the 4hr timeframe, the pair’s price action has steadily crept upwards, with buyers seemingly happy to buy the dips and maintain a bullish sentiment over the past month. However, without a successful trade negotiation between the UK and Europe, demand for the Pound could start to waver and flow through to a stronger Japanese Yen.

A potential sign of GBPJPY bulls deteriorating is the bearish divergence shown on the RSI indicator above. It suggests fewer market participants are willing to go long, and perhaps a price reversal is inevitable.

As long as the price stays above the 200 MA, the pair looks set to remain bullish in the short-term, with 138.00 providing adequate support. This level coincides with the current monthly pivot point, an indicator that’s consistently provided key support and resistance areas in recent times.

Should a trade deal be found between neighboring bodies, this scenario could spark a more significant rally upwards. Initial resistance sits at the 140.00 level, a price ceiling that bulls couldn’t breach throughout November despite multiple attempts. Above here, the previous high of 142.71 then becomes a valid target.

Should bearish sentiment begin to dominate and the 138.00 regions become compromised, the previous monthly pivot of 136.00 starts to resemble a reasonable downside target before consolidating around 134.60.

Note: Click on charts to enlarge.

By Adam Taylor CTEe

Sources: Go Markets, Meta Trader 5, TradingView, Bloomberg

Disclaimer: The articles are from GO Markets analysts, based on their independent analysis or personal experiences. Views or opinions or trading styles expressed are of their own; should not be taken as either representative of or shared by GO Markets. Advice (if any), are of a ‘general’ nature and not based on your personal objectives, financial situation or needs. You should therefore consider how appropriate the advice (if any) is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next: Overnight on Wall Street: Wednesday 09 December 2020

Previous: Today in Asia – 08 December 2020

.

.