- Home

- News & Analysis

- GO Daily News

- Overnight on Wall Street: Thursday 10 December 2020

Overnight on Wall Street: Thursday 10 December 2020

December 10, 2020By Deepta Bolaky

@DeeptaGOMarkets

Equity Markets

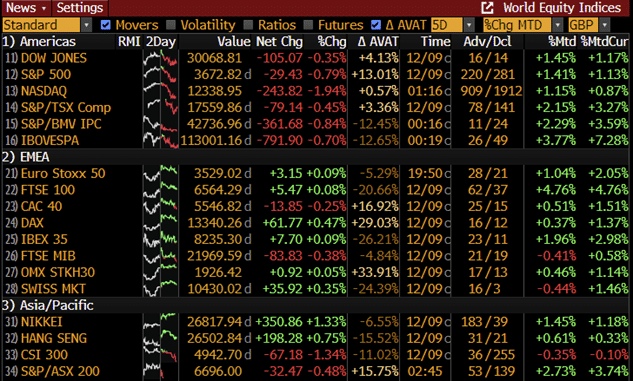

Global equities are swinging between losses and gains since the start of the week following conflicting headlines on vaccine, Brexit and US stimulus talks. European markets fared better than US stocks on Wednesday and managed to hold on to some gains.

Source: Bloomberg Terminal

On Wall Street, major US equity indices closed in negative territory but Nasdaq retreated by nearly 2% as technology stocks plummeted overnight:

- The Dow Jones Industrial Average lost 105 points or 0.4% to 30,069.

- S&P 500 dropped by 29 points or 0.8% to 3,673.

- Nasdaq Composite fell by 244 points or 1.9% to 12,339.

Currency Markets

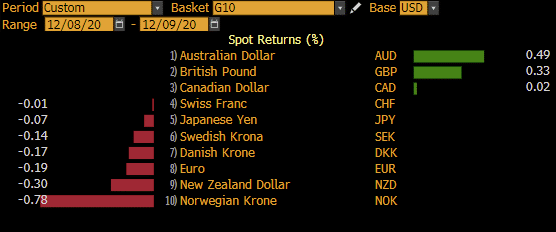

In the FX space, major currencies were mostly weaker against the US dollar. Commodity-linked currencies and the Pound were among the few currencies to have climbed higher against the US dollar.

Source: Bloomberg

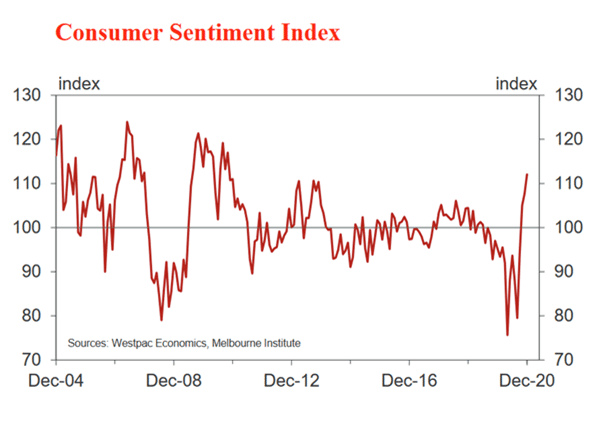

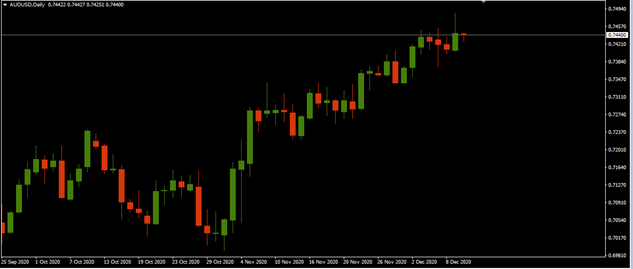

The Aussie dollar was further boosted by strong consumer confidence reported by Westpac-Melbourne Institute. The Index rose by 4.1% to 112 in December, reaching the highest level since 2010. The consumer confidence index hits a 10-year high indicating that sentiment has fully improved from the COVID recession.

The highlights of the index are mainly centralized around the speed of the recovery seen after just eight months into the pandemic compared to the GFC and the recession seen in the early 1990s. The AUDUSD pair reached a high of 0.7485 before retreating lower.

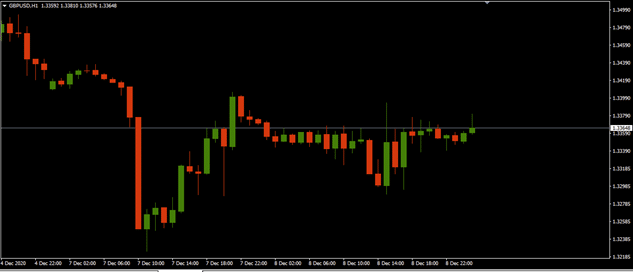

Source: MT4

The meeting in Brussels and an agreement in principle helped the Pound to edge higher. Despite contradictory headlines, Brexit negotiations are still ongoing allowing traders to hold on the hopes of an agreement before the year-end deadline.

As of writing, the GBPUSD pair is trading around the 1.33 level.

Source: GO MT4

Commodities

Crude oil prices struggled to edge higher despite the latest positive news ranging from vaccine updates to the OPEC compromise deal as tougher lockdown restrictions, surging coronavirus cases and bearish weekly oil reports weighed on the oil market.

Unlike the API which reported a draw in the weekly crude oil stock to 1.141M in December 4 from previous 4.146M. Crude stocks rose by a massive 15.189M barrels last week versus expectations for a drop of 1.424M.

As of writing, WTI Crude oil (Nymex) and Brent Crude (ICE) were trading at around $45.68 and $48.86 respectively.

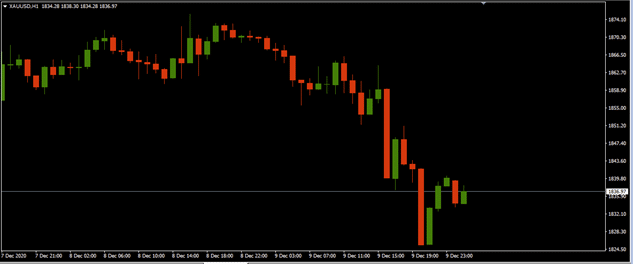

Gold

Gold

The precious metal fell on Brexit, coronavirus updates and deadlock in stimulus talks. As of writing, the XAUUSD pair was trading around $1,836.

Source: GO MT4

By Deepta Bolaky

Key upcoming events

- European Council Meeting (Eurozone)

- Consumer Inflation Expectations (Australia)

- Manufacturing & Industrial Production, and Gross Domestic Product (UK)

- ECB Interest & Deposit Rate Decision and ECB Monetary Policy Statement and Press Conference (Eurozone)

- Consumer Price Index, Jobless Claims, and Monthly Budget (US)

- REINZ House Price Index and Business NZ PMI (New Zealand)

| Friday, 11 December 2020 Indicative Index Dividends Dividends are in Points |

||||||

| ASX200 | WS30 | US500 | US2000 | NDX100 | CAC40 | STOXX50 |

| 0.039 | 0 | 0.087 | 0.069 | 0 | 0 | 0 |

| ESP35 | ITA40 | FTSE100 | DAX30 | HK50 | JP225 | INDIA50 |

| 19.446 | 0 | 0 | 0 | 0.578 | 0 | 0 |

Disclaimer: The articles are from GO Markets analysts, based on their independent analysis or personal experiences. Views or opinions or trading styles expressed are of their own; should not be taken as either representative of or shared by GO Markets. Advice (if any), are of a ‘general’ nature and not based on your personal objectives, financial situation or needs. You should therefore consider how appropriate the advice (if any) is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next: Overnight on Wall Street: Tuesday 15 December 2020

Previous: Overnight on Wall Street: Wednesday 09 December 2020