- Home

- News & Analysis

- GO Daily News

- Overnight on Wall Street: Thursday 17 December 2020

Overnight on Wall Street: Thursday 17 December 2020

December 16, 2020By Deepta Bolaky

@DeeptaGOMarkets

Equity markets

Global equities are finding support on positive geopolitical headlines and the first round of vaccinations. Brexit is at a key turning point and investors are closely monitoring any statements or discussions to gauge the path towards a deal. In the final weeks leading up to the Brexit deadline, both the EU and the UK appear more committed coming to a compromise on the level playing field, governance and fisheries.

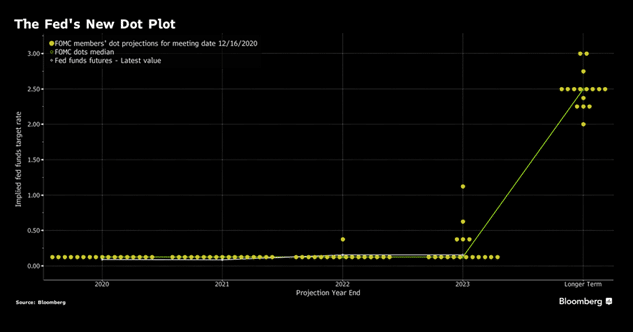

We are also seeing some positive headlines on the US stimulus front driving hopes of a relief package. The Federal Reserve was at the forefront of attention yesterday as, amid a stimulus gridlock, the post-election situation, the second wave of coronavirus outbreak and first immunisations in the US, investors were looking for the kind of support left from the central bank.

As widely expected, the Federal Reserve strengthened its commitment to support the U.S. economy, promising to maintain its massive asset purchase program until it sees “substantial further progress” has been made toward the maximum employment and price stability goals.

Wall Street ended on a mixed note as investors remain cautiously optimistic:

- The Dow Jones Industrial Average lost 45 points or 0.2% to 30,154.

- S&P 500 rose by 7 points or 0.2% to 3,701.

- Nasdaq Composite rose by 63 points or 0.5% to 12,658.

Currency markets

In the FX space, the US dollar swung between gains and losses following the headlines on stimulus and the Fed’s policy statement. Major currency pairs remained around familiar levels.

On the economic front, investors analyse the PMI reports across Germany, Eurozone, the UK and the US:

Germany – German economy shows ongoing resilience in December

- Flash Germany PMI Composite Output Index at 52.5 (Nov: 51.7)- 2-month high.

- Flash Germany Services PMI Activity Index at 47.7 (Nov: 46.0) – 2-month high.

- Flash Germany Manufacturing Output Index at 61.4 (Nov: 62.2) – 4-month low.

- Flash Germany Manufacturing PMI at 58.6 (Nov: 57.8) – 34-month high.

Eurozone – Eurozone economy close to stabilising as Flash PMI rises to 49.8

- Flash Eurozone PMI Composite Output Index at 49.8(45.3 in November) – 2-month high.

- Flash EurozoneServices PMI Activity Index at 47.3 (41.7in November)- 3-month high.

- Flash Eurozone Manufacturing PMI Output Index at 56.6 (55.3in November) – 2-month high.

- FlashEurozone Manufacturing PMI at 55.5 (53.8in November) – 31-month high.

United Kingdom – UK private sector output edges up in December. Rush to beat Brexit deadline boosts manufacturing orders, but port delays hit supply chains.

- Flash UK Composite Output Index Dec: 50.7, 2-month high (Nov final: 49.0)

- Flash UK Services Business Activity IndexDec: 49.9, 2-month high (Nov final: 47.6)

- Flash UK Manufacturing Output IndexDec: 55.3, 6-month low (Nov final: 56.7)

- Flash UK Manufacturing PMIDec: 57.3, 37-month high (Nov final: 55.6)

United States – Recovery momentum wanes amid rising virus cases and supply delays

- Flash U.S. Composite Output Index at 55.7(58.6in November) – 3-month low.

- Flash U.S. Services Business Activity Index at 55.3 (58.4 in November) – 3-month low.

- Flash U.S. Manufacturing PMI at 56.5 (56.7 in November) – 2-month low.

- Flash U.S. Manufacturing Output Index at 57.3 (59.2 in November) – 2-month low.

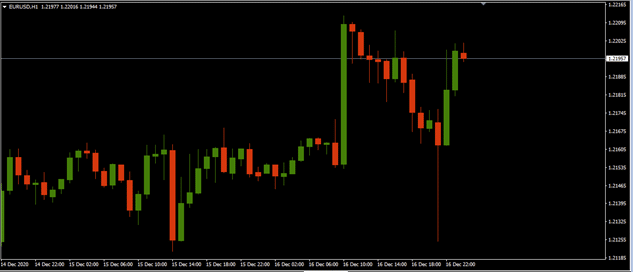

The EURUSD pair jumped to a high of 1.2212 before retreating lower to trade around the 1.21 level.

Source: GO MT4

Commodities

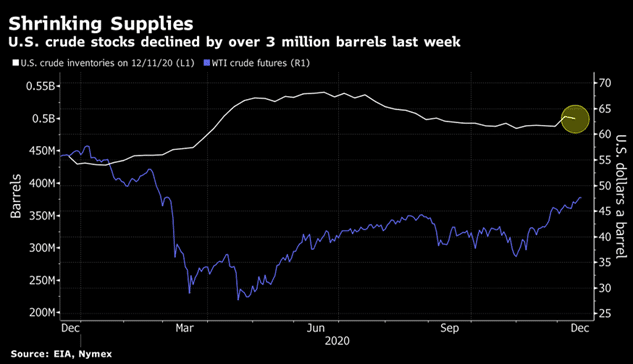

The first round of immunizations and the overall optimism in the markets supported the oil market despite the further lockdown restrictions of major economies threatening lower demand and bearish API report. Following the huge build up in crude oil inventories of 15.189M barrels reported by the EIA, we note that the crude oil stocks change was registered at -3.135M in December 11.

Crude oil prices edged higher on Wednesday on the decline in inventory stocks. As of writing, WTI Crude oil (Nymex) and Brent Crude (ICE) were trading at around $47.88 and $51.12 respectively.

Gold

Gold

The precious metal also swung between gains and losses throughout the session driven mostly by the Fed’s statement and stimulus talks. The XAUUSD pair firmed higher on stimulus hopes. As of writing, the XAUUSD pair was trading around $1,864.

Source: GO MT4

By Deepta Bolaky

Key upcoming events

- Gross Domestic Product (New Zealand)

- Full Time Employment, Employment Change and Unemployment Rate (Australia)

- SNB Interest Rate, Monetary Policy Assessment and Press Conference (Switzerland)

- Consumer Price Index (Eurozone)

- BoE MPC Vote Unchanged, Asset Purchase Facility, Vote Cut, Bank of England Minutes, Interest Rate Decision, Building Permits, Housing Starts, Jobless Claims, Philadelphia Fed Manufacturing Survey, and COVID-19 Vaccine Announcement (US)

- Trade Balance, Exports, and Imports (New Zealand)

| Friday, 18 December 2020 Indicative Index Dividends Dividends are in Points |

||||||

| ASX200 | WS30 | US500 | US2000 | NDX100 | CAC40 | STOXX50 |

| 0 | 0 | 0.273 | 0.1 | 1.417 | 0 | 0 |

| ESP35 | ITA40 | FTSE100 | DAX30 | HK50 | JP225 | INDIA50 |

| 2.98 | 0 | 0 | 0 | 0 | 0 | 0 |

Disclaimer: The articles are from GO Markets analysts, based on their independent analysis or personal experiences. Views or opinions or trading styles expressed are of their own; should not be taken as either representative of or shared by GO Markets. Advice (if any), are of a ‘general’ nature and not based on your personal objectives, financial situation or needs. You should therefore consider how appropriate the advice (if any) is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next: Overnight on Wall Street: Tuesday 05 January 2021

Previous: Overnight on Wall Street: Wednesday 16 December 2020