- Home

- News & Analysis

- GO Daily News

- Overnight on Wall Street: Wednesday 16 December 2020

Overnight on Wall Street: Wednesday 16 December 2020

December 15, 2020By Deepta Bolaky

@DeeptaGOMarkets

Equity markets

Risk sentiment was buoyed by the first round of vaccinations and the positive headlines on US stimulus putting aside further lockdown restrictions in Europe. Investors are closely monitoring the measures undertaken by governments from major economies to curb the spread of the virus. Germany, the fourth-largest economy in the world and Europe’s biggest economy went into a national lockdown. European markets rose higher on vaccine optimism despite the lockdown restrictions.

Major US equity indices rallied by more than 1% on the hopes of a stimulus breakthrough:

- The Dow Jones Industrial Average added 338 points or 1.1% to 30,199.

- S&P 500 rose by 47 points or 1.3% to 3,695.

- Nasdaq Composite rose by 155 points or 1.3% to 12,595.

Apple Inc drove the momentum in the US share market following the news that the iPhone giant is going to boost production by up to 30% year-on-year and is on track to smash previous records for the sale of its iPhone next year. The Company’s share price rose by more than 5% on Tuesday.

Currency markets

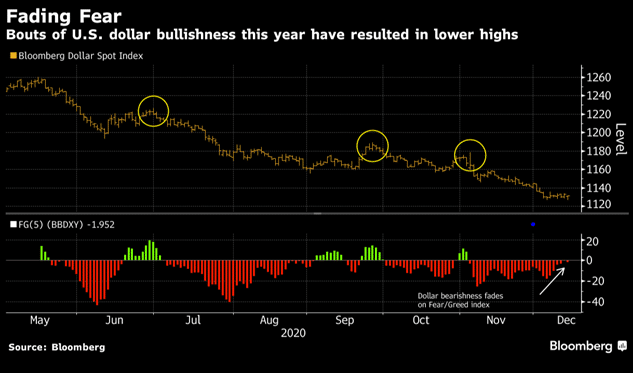

In the FX space, the US dollar remained under pressure and is among the weakest of the majors. The vaccine updates have helped fear to recede and the US dollar bullishness this year resulted in lower highs. Commodity prices were better bid following higher commodity prices.

Source: Bloomberg

On the economic front, the RBA minutes, Chinese data and UK jobs data. The Antipodean barely reacted on the dovish minutes as the trade row between China and Australia dominated headlines.

“The recovery was still expected to be uneven and protracted, with inflation remaining low. Substantial policy support would therefore be required for a considerable period”

Australian coal exports are at risk over the brewing tensions between the two countries. There is deep concern over reports that coal is the latest target in China. The AUDUSD pair firmed higher above the 0.75 level.

Source: GO MT4

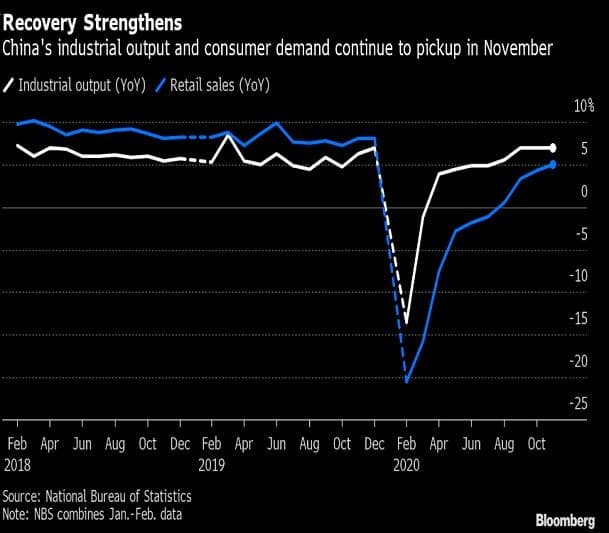

In China, Industrial output rose by 7% YoY while Retail Sales rose by 5% YoY. While the growth momentum for Retail Sales eased, the recovery continues in November.

In the UK, the employment reports were mixed:

- The UK unemployment rate, in the three months to October 2020, was estimated at 4.9%, 1.2 percentage points higher than a year earlier and 0.7 percentage points higher than the previous quarter.

- The Claimant Count increased slightly in November 2020, to 2.7 million; this includes both those working with low income or hours and those who are not working.

- Growth in average total pay (including bonuses) among employees for the three months August to October 2020 increased to 2.7%, and growth in regular pay (excluding bonuses) also increased to 2.8%.

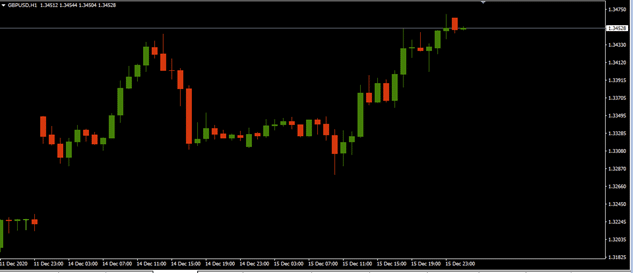

The British Pound was among the best performers following rising hopes of a deal over the weekend and at the start of the week. The GBPUSD rose to a high of 1.3469 on Tuesday.

Source: GO MT4

Commodities

The first round of immunizations and the overall optimism in the markets supported the oil market despite the further lockdown restrictions of major economies threatening lower demand and bearish API report. Crude oil prices stayed positive despite the API reporting an increase in crude oil inventories to 1.973M barrels versus 1.141M barrels during the week ending 11 December. As of writing, WTI Crude oil (Nymex) and Brent Crude (ICE) were trading at around $47.59 and $50.75 respectively. Traders will await the EIA report for fresh trading impetus.

Gold

Gold

The precious metal found some relief and edged higher on stimulus hopes. As of writing, the XAUUSD pair was trading around $1,853.

Source: GO MT4

By Deepta Bolaky

Key upcoming events

- Commonwealth Bank Manufacturing & Services PMI, Westpac Leading Index and HIA New Home Sales (Australia)

- Merchandise Trade Balance, Imports and Exports (Japan)

- Consumer & Retail Price Index, PPI Core Output, and Markit Manufacturing & Services PMI (UK)

- Markit Manufacturing & Services PMI (Germany)

- Markit Manufacturing & Services PMI and Labor Cost (Eurozone)

- BoC Consumer Price Index (Canada)

- SNB Quarterly Bulletin (Switzerland)

- Retail Sales, Markit Manufacturing & Services PMI, FOMC Economic Projections, Fed Interest Rate Decision, Monetary Policy Statement and Press Conference (US)

| Thursday, 17 December 2020 Indicative Index Dividends Dividends are in Points |

||||||

| ASX200 | WS30 | US500 | US2000 | NDX100 | CAC40 | STOXX50 |

| 0 | 0 | 0.18 | 0.215 | 0.239 | 0 | 0 |

| ESP35 | ITA40 | FTSE100 | DAX30 | HK50 | JP225 | INDIA50 |

| 8.275 | 0 | 9.306 | 0 | 0 | 0 | 2.974 |

Disclaimer: The articles are from GO Markets analysts, based on their independent analysis or personal experiences. Views or opinions or trading styles expressed are of their own; should not be taken as either representative of or shared by GO Markets. Advice (if any), are of a ‘general’ nature and not based on your personal objectives, financial situation or needs. You should therefore consider how appropriate the advice (if any) is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next: Overnight on Wall Street: Thursday 17 December 2020

Previous: EURJPY – Unearthing A Potential 2015 Target