- Home

- News & Analysis

- GO Daily News

- Overnight on Wall Street: Tuesday 05 January 2021

Overnight on Wall Street: Tuesday 05 January 2021

January 4, 2021By Deepta Bolaky

@DeeptaGOMarkets

Equity markets

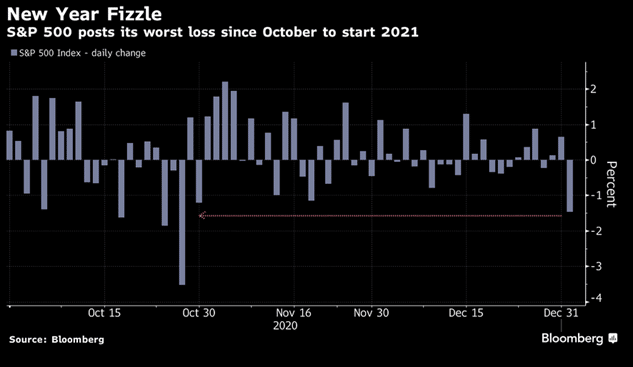

Global equities started the new year on a mixed note as investors digested the rising number of coronavirus cases in major economies, further social distancing measures and lockdowns, and the runoff elections in the US which will likely determine the first two years of the Biden administration.

European stocks rallied on Monday lifted by the overall optimism around the Brexit agreement and the roll-out of vaccinations despite the threat of further lockdowns. Europe and the UK are moving on with an EU-UK Trade and Cooperation Agreement bringing much relief to the European markets. The FTSE100 ended 111 points or 1.7% higher at 6,572 pts.

Wall Street ended in the red dragged by virus woes and runoff elections. Major US equity indices erased more than 1% on the first trading day of the new year:

- The Dow Jones Industrial Average lost 383 points or 1.3% to 30,224.

- S&P 500 dropped by 55 points or 1.5% to 3,701.

- Nasdaq Composite fell by 190 points or 1.5% to 12,698.

Currency markets

In the FX space, the US dollar index which tracks the performance of a basket of currencies against the greenback firmed during the course of the day after gapping lower. As risk aversion crept into the markets, traders sought safety with haven assets.

Source: GO MT4

The Pound was among the worst performers as England went into lockdown again which is expected to last until mid-February. The GBPUSD pair dropped from 1.36 level to the 1.35 level on Monday.

Source: GO MT4

Commodities

Crude oil prices struggled to find a firm direction amid fresh restrictive measures in major economies and following an important OPEC+ meeting. In a highly volatile trading environment, crude oil prices retreated lower. As of writing, WTI Crude oil (Nymex) and Brent Crude (ICE) were trading at around $47.62 and $50.65 respectively.

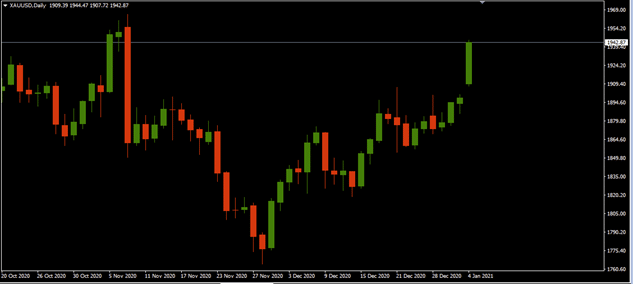

Gold

Gold

The precious metal rallied as investors remain cautious despite the roll-out of vaccinations. The spread of the virus continues to create havoc threatening to hinder global recovery. After gapping higher on the open, the XAUUSD pair soared above the $1,940 mark.

Source: GO MT4

By Deepta Bolaky

Key upcoming events

- Retail Sales and Unemployment Rate (Germany)

- Fed’s Mester Speech, ISM Manufacturing Employment Index, Manufacturing PMI, Manufacturing New Orders Index, and Fed’s Williams Speech (US)

- Consumer Price Index (Switzerland)

| Wednesday, 06 January 2021 Indicative Index Dividends Dividends are in Points |

||||||

| ASX200 | WS30 | US500 | US2000 | NDX100 | CAC40 | STOXX50 |

| 0.129 | 0 | 0.054 | 0.04 | 0 | 0 | 0 |

| ESP35 | ITA40 | FTSE100 | DAX30 | HK50 | JP225 | INDIA50 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Disclaimer: The articles are from GO Markets analysts, based on their independent analysis or personal experiences. Views or opinions or trading styles expressed are of their own; should not be taken as either representative of or shared by GO Markets. Advice (if any), are of a ‘general’ nature and not based on your personal objectives, financial situation or needs. You should therefore consider how appropriate the advice (if any) is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next: Overnight on Wall Street: Wednesday 06 January 2021

Previous: Overnight on Wall Street: Thursday 17 December 2020