- Home

- News & Analysis

- GO Daily News

- Overnight on Wall Street: Tuesday 15 December 2020

Overnight on Wall Street: Tuesday 15 December 2020

December 14, 2020By Deepta Bolaky

@DeeptaGOMarkets

Equity markets

It was a mixed start to the week for the global stock market. Investors digested some positive news towards the end of last week and over the weekend. Despite ongoing tough negotiations, both the EU and the UK are keeping hopes alive following a promising phone call on Sunday. On the virus front, the first COVID-19 vaccination was administered to the US public on Monday providing some relief.

On Wall Street, the Dow and S&P 500 closed in negative territory while Nasdaq Composite edged higher boosted by the performance of the big tech companies:

- The Dow Jones Industrial Average lost 185 points or 0.6% to 29,862.

- S&P 500 dropped by 16 points or 0.4% to 3,647.

- Nasdaq Composite rose by 62 points or 0.5% to 12,440.

Currency markets

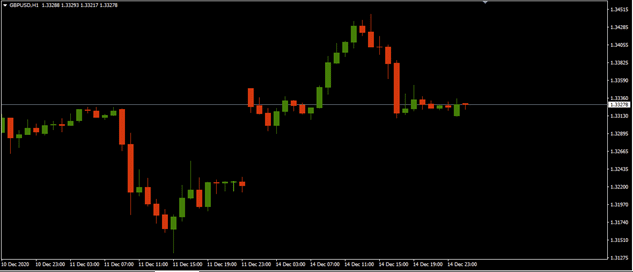

In the FX space, major currencies were mixed against the US dollar amid a relatively muted economic calendar. The greenback remains fundamentally weak against major pairs. Commodity-linked currencies firmer higher but pared gains towards the later session following weaker commodity prices. The Pound was among the few currencies to have climbed higher against the US dollar following hopes that Brexit talks were kept alive and a no-deal scenario might be avoided.

The GBPUSD pair gapped higher on the open and reached a high of 1.3445 before closing lower at 1.3324 on Monday.

Source: GO MT4

Commodities

Last week, the US FDA voting and authorisation of the vaccine in the US helped crude oil prices to extend gains. As of writing, WTI Crude oil (Nymex) and Brent Crude (ICE) were trading at around $46.94 and $50.29 respectively. Traders will likely keep monitoring weekly oil reports, vaccine updates and further lockdown measures for fresh trading impetus.

Gold

Gold

The precious metal struggled to find any upside momentum as US stimulus talks remain murky. As of writing, the XAUUSD pair was trading around $1,828.

Source: GO MT4

By Deepta Bolaky

Key upcoming events

- RBA Meeting Minutes (Australia)

- NBS Press Conference, Industrial Production and Retail Sales (China)

- Claimant Count, ILO Unemployment Rate, and Average Earnings (UK)

- Industrial Production (United States)

- GDT Price Index (New Zealand)

- BoC’s Governor Macklem Speech (Canada)

| Wednesday, 16 December 2020 Indicative Index Dividends Dividends are in Points |

||||||

| ASX200 | WS30 | US500 | US2000 | NDX100 | CAC40 | STOXX50 |

| 0 | 0 | 0.007 | 0.103 | 0 | 0 | 0 |

| ESP35 | ITA40 | FTSE100 | DAX30 | HK50 | JP225 | INDIA50 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Disclaimer: The articles are from GO Markets analysts, based on their independent analysis or personal experiences. Views or opinions or trading styles expressed are of their own; should not be taken as either representative of or shared by GO Markets. Advice (if any), are of a ‘general’ nature and not based on your personal objectives, financial situation or needs. You should therefore consider how appropriate the advice (if any) is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next: EURJPY – Unearthing A Potential 2015 Target

Previous: Overnight on Wall Street: Thursday 10 December 2020