- Home

- News & Analysis

- GO Daily News

- Today in Asia – 08 December 2020

Today in Asia – 08 December 2020

December 8, 2020By Deepta Bolaky

@DeeptaGOMarkets

After a mixed performance on Wall Street, Asian equities struggled to find any upside momentum. Geopolitics and virus concerns are the main driver of risk sentiment ahead of a busy week ahead. Brexit contradictory headlines, US Stimulus talks and US sanctions on Chinese legislators together with the ongoing surge in coronavirus cases are creating an environment of caution.

As of writing, major indices across the Asia/Pacific region were trading in the red. Japan’s Nikkei rose pared some losses and is currently down by nearly 40 points or 0.2% to 26, 507.46 following upbeat GDP figures and fresh talks about more stimulus programs.

CSI 300 index is trading relatively unchanged at 5,017.41 while the Hang Seng is down by 109 points or 0.4%.

World Equity Indices (% change)

Source: Bloomberg

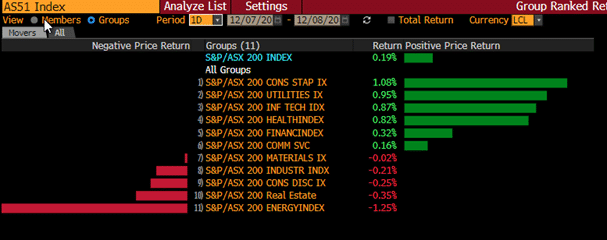

In the Australian share market, the S&P/ASX200 rose back in positive territory in the final hours of trading. The index closed 0.2% or 13 points higher to 6,687.70. The sector performance was mixed with Consumer Staples, Utilities, Information Technology and Financial Index leading gains while major losses were seen in the energy sector.

Source: Bloomberg Terminal

Link Administration Holdings surged by more than 13% following the announcement of a conditional, non-binding indicative proposal to acquire 100 per cent of the shares in Link Group by way of a Scheme of Arrangement from SS&C Technology, a Nasdaq listed global provider of investment and financial software-enabled services and software for the financial services and healthcare industries.

Currency Markets

The G10 currencies are mixed against the US dollar. As trade risks resurface with the US sanctions on Chinese officials and Brexit drama continue to dominate headlines, traders remain cautious. Major pairs traded withing familiar levels Commodity-currencies performing better than safe-haven currencies while the British Pound remained pressurised by Brexit back-and-forth negotiations.

Source: Bloomberg Terminal

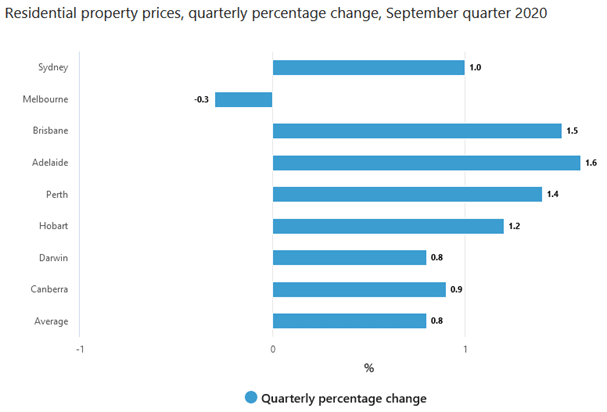

On the economic front, the House Price Index rose by 0.8% in the September quarter and 4.5% over the last twelve months. The rise was across all capital cities except Melbourne.

As of writing, the AUDUSD pair struggles to keep the 0.74 level.

Source: GO MT4

Looking Ahead

- BRC Like-for-Like Retail Sales (UK)

- House Prices Index (Australia)

- Unemployment Rate (Switzerland)

- ZEW Survey – Economic Sentiment and Gross Domestic Product (Eurozone)

- ZEW Survey – Economic Sentiment and Current Situation (Germany)

- Nonfarm Productivity and Unit Labor Costs (US)

By Deepta Bolaky

Disclaimer: The articles are from GO Markets analysts, based on their independent analysis or personal experiences. Views or opinions or trading styles expressed are of their own; should not be taken as either representative of or shared by GO Markets. Advice (if any), are of a ‘general’ nature and not based on your personal objectives, financial situation or needs. You should therefore consider how appropriate the advice (if any) is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next: COTD: GBPJPY – Bullish Sentiment On A Tightrope

Previous: Overnight on Wall Street: Tuesday 08 December 2020