- Home

- News & Analysis

- Central Banks

- Eyes on the Fed and the Dot Plots

Eyes on the Fed and the Dot Plots

June 10, 2020By Deepta Bolaky

Global central banks have been a crucial part in providing aid and support to the global economy during the coronavirus pandemic. Faced with an unprecedented crisis, central bankers have rapidly deployed various monetary tools to keep credit flowing and support businesses and households. Given that interest rates were somewhat already at record-lows in many major countries, asset purchase schemes were widely used to put downward pressure on long-term rates. Monetary policies were also accompanied by huge fiscal intervention.

Also, in a coordinated action to enhance the provision of liquidity via the standing US dollar liquidity swap line, the Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Federal Reserve, and the Swiss National Bank have even agreed to lower their rates on currency swaps.

What’s Next?

The two-day Federal Open Market Committee meeting which will end on Wednesday with a statement followed by a press conference will be heavily eyed. Markets will likely look for clues on how the Fed’s is viewing the health of the economy after easing lockdown measures. Even though Friday’s jobs report came much better-than-expected and there was a decline in the unemployment rate from 14.7% to 13.3% in May, it is widely expected that the FOMC will keep rates steady near zero. The scenario of negative interest rates is also highly unlikely.

As the pandemic continues to create havoc on the global economy, it is also reshaping the political dynamics:

Quarterly Forecasts

Much attention will, therefore, be on the economic and interest rate forecasts. The Fed refrained from providing any forecasts during the pandemic given the tremendous uncertainties about the economic outlook. This Fed’s meeting has, therefore, the potential to move markets if much details are revealed about future plans and expectations for inflation, GDP and unemployment. The projections are expected to be much worse than the favourable outlook seen in the last forecasts back in December.

Dot Plots

High unemployment and weak inflation have been the key factors forcing central banks to keep rates at record low levels. The recent jobs reports came as a surprise and have raised expectations that the labour market may be rebounding at a quicker pace than expected. Investors would, therefore, look for explicit guidance from the Fed on how long they will likely keep rates near zero.

Even though the economic outlook remains highly uncertain, the so-called dot plot which shows the entries of the FOMC officials regarding the interest rate forecasts will be scrutinized for guidance.

Latest dot plots – December 2019

Yield Curve Control

As short-term interest rates approach zero, there have been recent speculations of the possibility that the Federal Reserve may control the yield curve and cap specific yields to cushion the impact of a downturn.

Stock Market

Global stocks have rallied significantly since March lows on the back of massive economic stimulus packages from central banks and governments which will likely stay in place for a while. In an extremely low-interest rate environment, quantitative easing and large fiscal policy measures have absorbed the pandemic-induced shocks and camouflaged the stark reality of the impact of the coronavirus.

On Monday, investors drove the S&P500 to a 15-week high, erasing its 2020 losses– lifted by heightened expectations of a quicker recovery and a supportive Federal Reserve.

After a great run to the upside, investors appear to be taking a pause and booked profits ahead of the Fed’s decision. Equity traders would want to hear that the Fed will stay accommodative, keep interest rates unchanged and remains committed to supporting the economy while still striking some optimistic tones on the recovery of the economy.

US Dollar

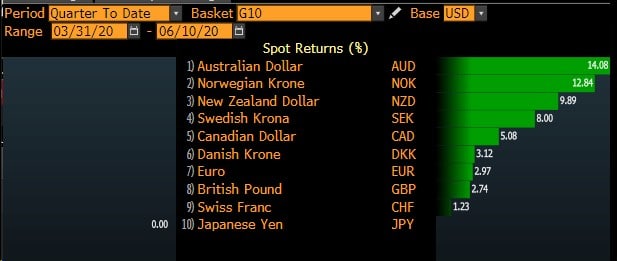

The US dollar was mostly weaker against major currencies as risk sentiment has improved lifted by heightened expectations of a quicker recovery following the reopening of economies earlier than initially expected. The surprising nonfarm payrolls have fueled those expectations and kept the greenback on the downside. If the Fed is set to look into the yield curve control as per the speculations, the US dollar may come under more pressure.

Source: Bloomberg

Gold

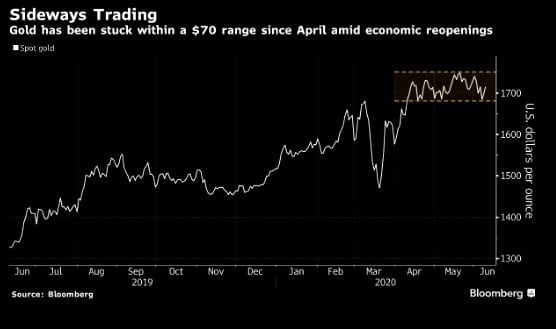

Amid the reopening of economies, geopolitical risks and a weaker US dollar, the precious metal has been trading sideways within a $70 range as traders wait for the next biggest catalyst. As of writing, gold has firmed higher above the $1,700. Gold traders will eye the outcome of the Fed’s two-day policy meeting.

XAUUSD (Daily Chart)

Source: GO MT4

By Deepta Bolaky

Disclaimer: Articles and videos from GO Markets analysts are based on their independent analysis. Views expressed are of their own and of a ‘general’ nature. Advice (if any) are not based on the reader’s personal objectives, financial situation or needs. Readers should, therefore, consider how appropriate the advice (if any) is to their objectives, financial situation and needs, before acting on the advice. For more information of trading, check out our forex trading courses.

Next: A Cautious Fed

Previous: The Reopening Experiment and Geopolitical Risks