- Home

- News & Analysis

- Articles

- Central Banks

- The Reopening Experiment and Geopolitical Risks

The Reopening Experiment and Geopolitical Risks

May 29, 2020By Deepta Bolaky

The Grand Reopening

Given the unprecedented nature of the Great Lockdown, the gradual reopening of economies are now being viewed as an experiment. World leaders are faced with tough decisions trying to manage unparalleled health and economic crisis and the differences of opinions over how, when and which businesses should resume. The uncertainties and the struggles of easing lockdown measures took the financial markets into unknown territory.

During the month, more countries were able to bring the coronavirus outbreak under control and take steps towards new normality. However, the threat of a second wave of outbreak and warnings that new clusters of cases in the northeast region of China show that patients appear to be carrying the virus for a “longer period of time” and take “longer to recover” remain key risk factors for the markets across the month.

Overall, investors cheered the reopening of economies and any positive news of the several vaccines under development.

Geopolitical Risks

Investors barely had time for a breather as the hopes behind the reopening of economies were overshadowed by the resurgence of geopolitical risks. The tensions between the US and China, Brexit and factors that are again challenging the unity of the Eurozone have come back to the fore of the markets.

As the pandemic continues to create havoc on the global economy, it is also reshaping the political dynamics:

US-China Relationship

In the middle of a pandemic, the world’s two most powerful economies are embroiled in a series of clashes which could take both countries to the brink of a “new cold war”:

- The Blame Game: Both the US and China are stuck in a war of words on who is to be blamed for the pandemic. The Trump Administration is focusing on China’s lack of transparency and the inadequate responses to the virus in the early stages while China is looking at the US’ mismanagement of the virus given their death toll is the highest in the world with around 103k deaths.

- The Politics: Beijing appears to be at the forefront of President Trump’s campaign while China, having emerged from the worst of the crisis better than other countries, wishes to regain its popularity following the initial crisis of confidence. China’s pledge of $2 billion to help the global fight against COVID-19 and that any vaccine discovered by China would be made a “global public good”.

- Senate Bill: Earlier this month, the Senate has passed a bill that could potentially delist Chinese companies from the American stock exchanges. The bill would require Chinese companies to establish they are not owned or controlled by a foreign government.

- Hong Kong: The latest fallout is about China’s move to pass a national security law in Hong Kong which could compromise the independence of the city. China is facing an international backlash given that the controversial law might tighten its grip over the former British colony. As a dominant Asian financial centre, the law is poised to muddle with the free and democratic capitalist system of the city. On Wednesday, Secretary of State Mike Pompeo said he certified to Congress that Hong Kong no longer enjoys a high degree of autonomy from China.

As of writing, investors are awaiting the press conference on Friday where the US President is scheduled to discuss China.

Brexit

The negotiations between the UK and the EU appear to have stalled. Prime Minister, Boris Johnson has reiterated a few times during the month that he has no intention to extend the transition period. The UK is, therefore, preparing its coronavirus-induced economy for a no-deal Brexit.

The clock is ticking as a decision for an extension would have to be made by June 30.

Europe’s Frugal Four

COVID-19 is testing the solidarity of the European members and may threaten to awaken a euro crisis. After a standoff between the EU and Germany, following a critical ruling on ECB’s quantitative easing program by Germany’s constitutional court, the gradual reopening of economies of member states within the Eurozone has brought some optimism. However, finding a compromise on the EU Recovery plan for Europe might prove to be challenging:

- France and Germany proposed to make outright grants to Europe’s mostly hit countries. They want to launch a temporary fund of 500 billion euro for EU budget expenditure.

- Austria, Denmark, the Netherlands and Sweden, dubbed as the “frugal four” put forward a counter-proposal to provide loans rather than grants to Southern European countries.

The European Commission trapped between the divergence of opinions has come forward on the 27th of May for a major recovery plan to “Repair and Prepare for the Next Generation”. In total the European Recovery Plan will put €1.85 trillion to help kick-start the Eurozone’s economy and ensure Europe bounces forward. The Commission’s proposal is a mix of grants and loans.

The recovery plan requires the unanimous backing of all 27 nations of the bloc and therefore, investors will probably wait for a compromise to sense the unity and solidarity of the EU members.

Stock Market

The combination of the two main themes – Reopening plans and the rising geopolitical tensions have buoyed risk sentiment, but an environment of caution prevails.

The government and central banks have absorbed nearly all the shocks of the virus on the financial markets by injecting massive liquidity in the economy, keeping credit flowing and supporting their economy with huge fiscal stimulus plan among many others unconventional plans. On the reassurance that the intervention measures are not going to fizzle out anytime soon, investors have pushed global stocks higher throughout the month on the back of easing lockdown measures. Major economies are opening at a quicker pace than anticipated, fanning hopes for a faster recovery.

World Equity Indices

Source: Bloomberg Terminal

European bourses are poised for their best May gains since the financial crisis. After China, Europe was considered as the epicentre of the virus and now the enthusiasm is built over the reopenings of countries within Europe and the massive interventions by governments and central banks.

However, the pace of the rally is ebbing as various geopolitical risks have crawled back to the fore of the markets. The impact of worsening US-China relationships has the potential to last longer than the negative effect of the pandemic.

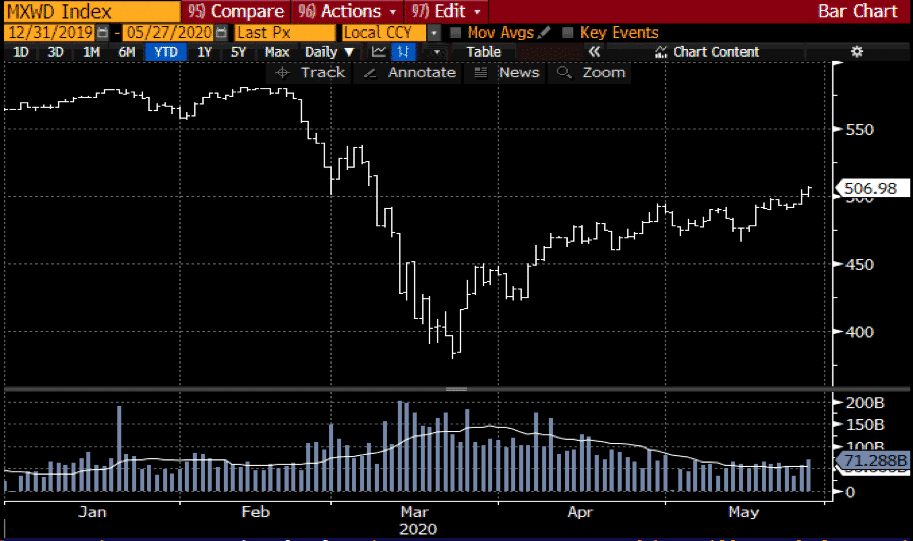

MSCI All Country World Index

Source: Bloomberg Terminal

Hong Kong and Chinese stocks struggled to rally like their counterparts as investors remain focused on Hong Kong security law and the protests in one of Asian’s biggest financial hub. World leaders were quick to condemn the controversial security law. The heightened tensions between the two countries have returned to the fore of the markets at a time where investors were buoyed by the reopening economies narrative.

Is the stock rally sustainable? The US-China relationship remains a key geopolitical risk that investors cannot ignore. The gradual return to normal and the several potential vaccines under development may quickly be overshadowed by geopolitical jitters if the situation between the US and China worsen.

Forex

Major currencies were stronger against the US dollar as risk sentiment has improved and haven currencies like the US dollar, the Yen and Swiss franc have lost momentum. Commodity-lined currencies were among the best performers against the US dollar lifted by higher commodity prices.

Source: Bloomberg

The Antipodeans

Australia and New Zealand were able to better contain the spread of the virus and eased lockdown measures quicker compared to its peers. After the Australian Treasury announced the $60 billion accounting error, investors were reassured that the Australian economy was not as severely impacted as initially forecasted. The RBA also appeared less-dovish compared to other central banks and has even started to scale back bond-buying purchases. There were enough positive developments to help the Aussie dollar and Kiwi to rally.

Both the AUDUSD and NZDUSD pairs are back to trading in the familiar levels seen before the sharp plunge linked to the coronavirus jitters. However, the US-China tussle is keeping a lid on gains and at those levels, traders will likely await for fresh positive catalysts to push the pairs higher.

AUDUSD and NZDUSD (Daily Chart)

Source: GO MT4

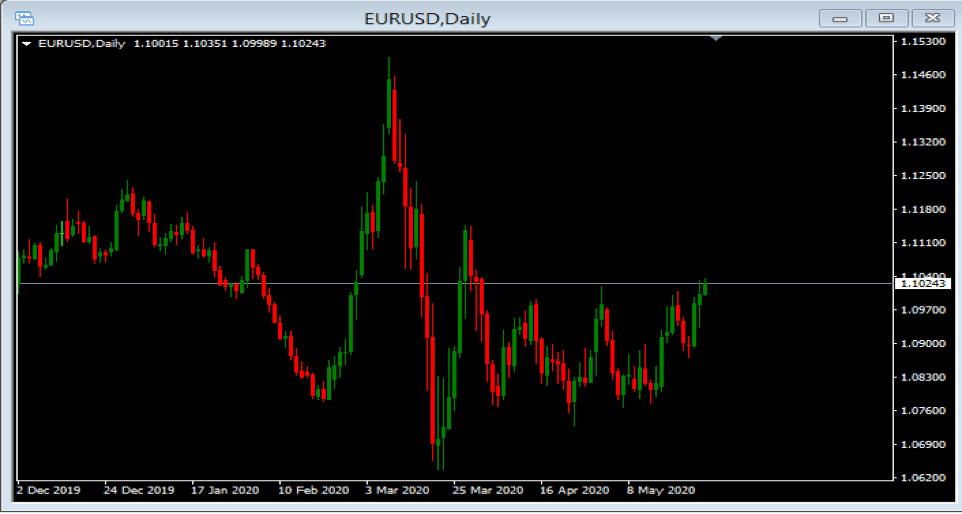

The Euro

The shared currency was unable to benefit fully from the overall risk-on sentiment and the weakness of the US dollar – dragged by the political dynamics within the Eurozone. Until geopolitical risks recede and there is a compromise on the EU recovery plan, the EURUSD pair may struggle to firm outside its current range and significantly above the 1.10 level.

EURUSD (Daily Chart)

Source: GO MT4

The Pound

The Sterling Pound remained on the downside as Brexit uncertainties resurfaced. The negotiations have stalled and with the deadline for extending the transition period coming closer, traders are finding a little positive narrative to rule out a no-deal Brexit. All eyes on the resumption of Brexit negotiations at the start of next month.

Oil Market

The oil market recovered a semblance of normality during the month. The production cuts by OPEC and non-OPEC allies officially kick-started at the start of May. A combination of productions, buoyant inventory reports and the prospects of increasing demand has supported the oil market. As demand and supply fundamentals continue to show signs of improvement, crude oil future prices caught the rebound wave.

Ahead of the OPEC+ June meeting scheduled to take place in two weeks, traders also took note of the conversation between Russia and Saudi Arabia and their need for close coordination and commitment to production cuts. However, the upside momentum has tamed due to the geopolitical risks and a lack of conviction that Russia will extend or commit to deeper cuts.

Source: Bloomberg

Gold

As geopolitical tensions rattled the markets, gold rose to a high of $1,765 during the month before retreating to the downside. Despite the risk-on sentiment and the rally in the stock market, an environment of caution is keeping the precious metal above the $1,700 mark.

By Deepta Bolaky

Disclaimer: Articles and videos from GO Markets analysts are based on their independent analysis. Views expressed are of their own and of a ‘general’ nature. Advice (if any) are not based on the reader’s personal objectives, financial situation or needs. Readers should, therefore, consider how appropriate the advice (if any) is to their objectives, financial situation and needs, before acting on the advice. For more information of trading, check out our forex trading courses.

Next: Week Ahead: Trumpolitics, Central Banks and Nonfarm Payrolls

Previous: EURUSD: EU Recovery Plan and EU’s Frugal Four