- Home

- News & Analysis

- Central Banks

- A Cautious Fed

A Cautious Fed

June 11, 2020By Deepta Bolaky

A Cautious Fed

FOMC Meeting

Investors were eagerly looking forward to the Fed’s statement and forecasts for clues on how the Fed is viewing the health of the economy after easing lockdown measures. Global central banks have played a crucial part in absorbing the pandemic-induced shocks in the global economy. Together with huge fiscal intervention, central bankers have swiftly deployed various monetary tools to keep credit flowing and provide support to businesses and households.

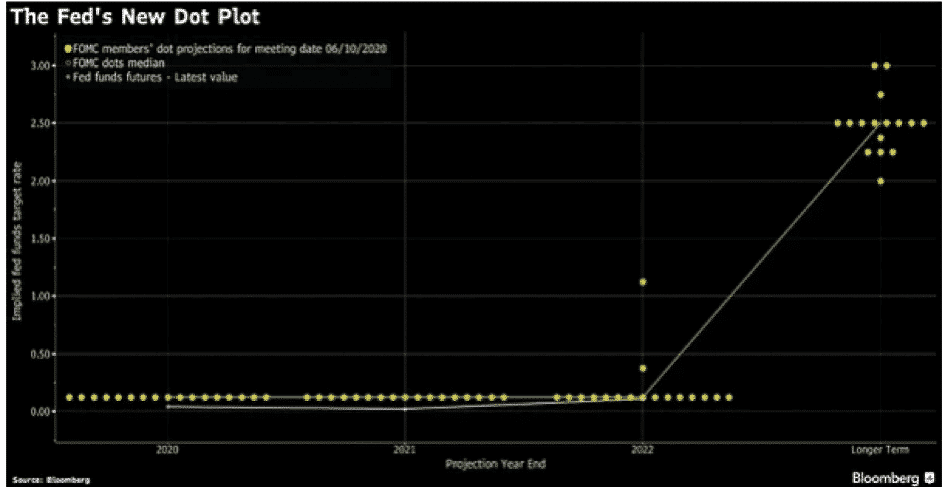

Dot Plots

Even though the financial conditions have improved from the support of the policy measures that was put in place, the Fed highlighted that the ongoing health crisis will continue to weigh on the economic activity, employment, and inflation in the near- term and may pose considerable risks for the medium-term outlook. On Wednesday, the Fed decided to maintain the target range for the federal funds rate at 0 to 0.25%.

“The Committee expects to maintain this target range until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals.”

Most importantly, market participants took note that the US interest rates will stay near to zero through 2022, ruling out the probability of raising rates anytime soon and a V-shaped recovery for the US economy.

Economic Projections

The Fed refrained from providing any forecasts during the pandemic given the tremendous uncertainties about the economic outlook. Much attention was, therefore, on the interest rate and economic forecasts.

- Gross Domestic Product: The Fed is expecting a contraction of 6.5% in 2020, followed by an expansion of 5% in 2021 and 3.5% in 2022.

- Unemployment Rate: The outlook for employment is also gloomy. After the US labour market experienced its worst monthly drop in history, the Fed is forecasting that the unemployment rate will reach a high of 9.3% by the end of 2020.

- Inflation: The Fed sees anaemic inflation which will remain below the target rate of 2% for the next three years.

The Long Road to Recovery

Markets are taking note of the long road to recovery following the FOMC meeting. US stocks retreated as the Fed’s comments and forecasts show that they will continue to loosen monetary policy. Shares in Asia also struggled to edge higher following a cautious Fed on Thursday.

World Equity Indices (% Change)

Source: Bloomberg Terminal

As of writing, the US and European stock futures slumped in the wake of the Fed’s decision.

Gold

A dovish-Fed have pushed the precious metal to a high around the $1,740 level. Gold has been trading sideways within a $70 range amid the reopening of economies, geopolitical risks and a weaker US dollar as traders were waiting for the next biggest catalyst.

By Deepta Bolaky

Disclaimer: Articles and videos from GO Markets analysts are based on their independent analysis. Views expressed are of their own and of a ‘general’ nature. Advice (if any) are not based on the reader’s personal objectives, financial situation or needs. Readers should, therefore, consider how appropriate the advice (if any) is to their objectives, financial situation and needs, before acting on the advice. For more information of trading, check out our forex trading courses.

Next: Interest Rates: Ultra Low, Near Zero or Negative?

Previous: Eyes on the Fed and the Dot Plots