- Home

- News & Analysis

- Weekly Summaries

- Vaccine Optimism and Geopolitical Tensions

Vaccine Optimism and Geopolitical Tensions

July 24, 2020By Deepta Bolaky

It was another eventful week with many dominant headlines that create an atmosphere of indecisiveness. We started the week with promising vaccine updates from AstraZeneca. Interim results from the ongoing Phase I/II COV001 trial, led by Oxford University, showed AZD1222 was tolerated and generated robust immune responses against the SARS-CoV-2 virus in all evaluated participants.

However, investors are balancing the vaccine updates and more stimulus packages against the simmering tensions between the US and China and the mounting number of COVID-19 cases. In an unprecedented move, the US has ordered China to close its consulate in Houston

Stock Market – Swings

Global stocks swung between losses and gains due to virus anxieties and geopolitical tensions. At the start of the week, risk sentiment remained buoyant on the back of positive vaccine updates. However, the use of the potential vaccine can only be expected in early 2021. The second wave of infections in certain countries is reviving concerns of a deeper economic downturn.

Wolrd Equity Indices

Source: Bloomberg

On Thursday, major US equity indices retreated by more than 1% for the first time in a month – the tech-heavy index fell the most by 2.3%.

Source: Bloomberg

On the earnings front, IBM, Coca-Cola, Philip Morris International, Snap Inc, Microsoft, Tesla Inc, Twitter and Intel Corp were among the big companies reporting their corporate earnings reports.

Twitter announced a 34% year-over-year growth in monetizable daily active usage (mDAU) and total revenue of $683 Million. The second quarter revenue was down by 19% year over year, reflecting a moderate recovery in advertising demand as advertising revenue totaled $562 million, a decrease of 23% year-over-year.

However, online social networking and microblogging company reported the highest year-over-year growth rate since they started to disclose their mDAU growth. The Company’s share price closed the day higher by 4.1% to $38.44 following the release of the earnings reports.

Forex Market

In the forex market, major currencies were stronger against the US dollar. The greenback struggled to find an upside momentum dragged by concerns over the mounting number of infections, uncertainty around the next round of stimulus package and escalating tensions between the US and China.

Source: Bloomberg Terminal

Commodity-linked currencies were among the best performers. The Aussie dollar was well-bid throughout the week and found some support on a less-dovish RBA minutes. Traders ignored Governor Lowe’s speech where he kept the door open for a rate cut. However, the bullish momentum took a hit on Thursday as risk appetite faltered. The AUDUSD retreated from a high of 0.7182 but remained above the 0.71 level.

AUDUSD (Daily Chart)

Source: GOMT4

Similarly, the Euro outperformed, lifted mainly by the unprecedented recovery package deal and budget agreed by the EU leaders to support their economy. Also, among major developed countries, daily activity gauges show that EU countries are recovering better post-coronavirus and are ahead of the US, UK and Canada.

The EURUSD pair rallied to the highest level seen since 2018 on the back of some sort of stability in the EU. As of writing, the pair was trading above the 1.16 level.

Source: GO MT4

Oil Market

Crude oil prices found some support on the overall broad optimism despite bearish weekly oil reports:

- The API reported an increase in weekly crude oil stock from previous -8.322M to 7.544M in the week of July 17.

- The EIA reported an increase of 4.9 million barrels from the previous week.

As of writing, WTI Crude oil (Nymex) and Brent Crude (ICE) were trading slightly lower at $41.18 and $43.40, respectively following the turnaround in risk sentiment.

Gold

Gold is on a rally – the XAUUSD pair is trading around the highest levels seen since September 2011. Given the ongoing uncertainty and geopolitical tensions, investors are hedging with safe-haven assets. As of writing, the XAUUSD pair is currently trading at $1,885.

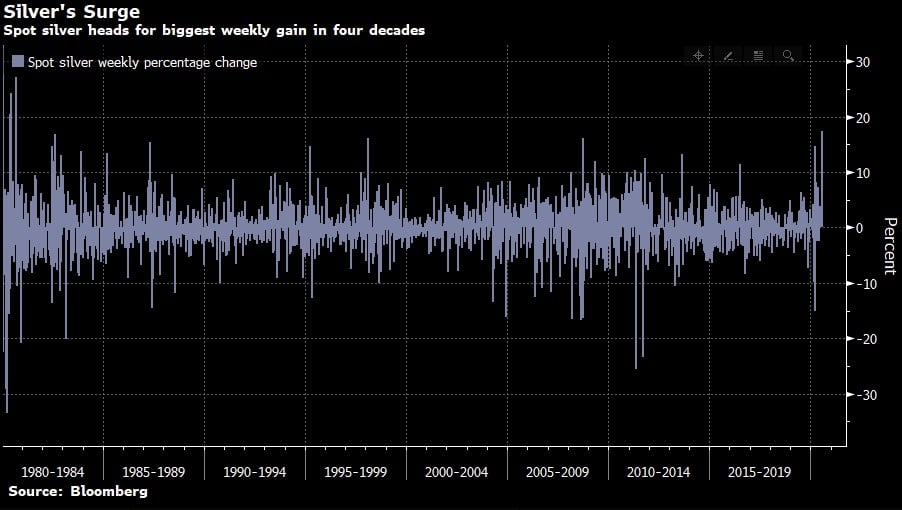

Silver is also on the rise and is poised to post its biggest weekly advance in about four decades.

Source: Bloomberg

By Deepta Bolaky

Key Upcoming Events

- Trade Balance and Exports (New Zealand)

- CBA Manufacturing PMI (Australia)

- Gfk Consumer Confidence and Retail Sales (UK)

- Markit Manufacturing and Services PMI (Germany)

| Monday, 27 July 2020 Indicative Index Dividends Dividends are in Points |

||||||

| ASX200 | WS30 | US500 | US2000 | NDX100 | CAC40 | STOXX50 |

| 0 | 0 | 0.017 | 0.006 | 0.141 | 0 | 0 |

| ESP35 | ITA40 | FTSE100 | DAX30 | HK50 | JP225 | INDIA50 |

| 2.343 | 0 | 0 | 0 | 0 | 0 | |

Disclaimer: Articles and videos from GO Markets analysts are based on their independent analysis. Views expressed are of their own and of a ‘general’ nature. Advice (if any) are not based on the reader’s personal objectives, financial situation or needs. Readers should, therefore, consider how appropriate the advice (if any) is to their objectives, financial situation and needs, before acting on the advice. For more information of trading, check out our forex trading courses.

Next: Week Ahead: FOMC and Quarterly Earnings from Apple, Alphabet, Amazon and Facebook.

Previous: Vaccine Optimism and Earnings