- Home

- News & Analysis

- Weekly Summaries

- Vaccine Optimism and Earnings

Vaccine Optimism and Earnings

July 17, 2020By Deepta Bolaky

Virus Cases, Vaccine and Geopolitical Tensions

It was an eventful week with many dominant headlines that took the markets on a wild swing. The week kicked off with the news that Pfizer and BioNTech granted FDA fast track designation for two investigational mRNA-based vaccine candidates against SARS-CoV-2 followed by Moderna Inc announcement that its potential COVID-19 vaccine has produced antibodies in an initial safety trial.

The positive vaccine-related updates have fueled the optimism seen in the financial markets this week. However, the significant spike in the number of infections, and geopolitical tensions remain the elements of caution. The brewing tensions between the US and China over Hong Kong took another dangerous turn – China vows to retaliate after the US ends its special status with Hong Kong earlier this week. Towards the end of the week, we take note that the US might be considering to ban travel on China’s communist party members.

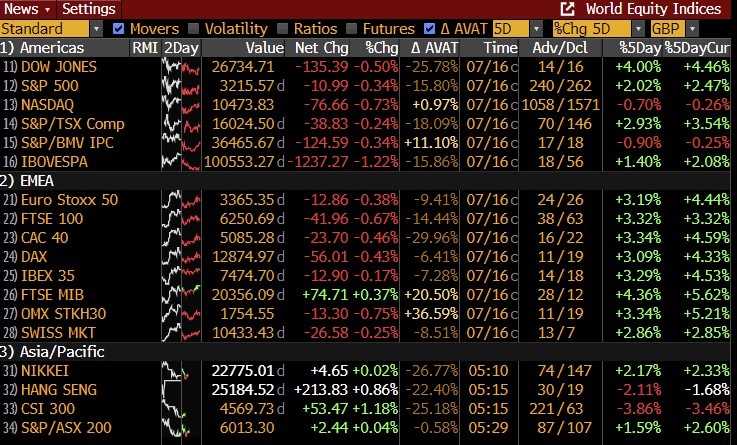

Stock Market – Swings

The promising progress towards a potential vaccine has steered the equity markets during the first half of the week. The momentum paused on Thursday following key earnings reports, growing number of COVID-19 cases and US labour data.

Wolrd Equity Indices

Source: Bloomberg

On the earnings front, big banks and Netflix reported the quarterly earnings reports. JP Morgan, Citigroup, Wells Fargo, Goldman Sachs, Bank of America and Morgan Stanley all made substantial provisions for loan losses.

JP Morgan, Goldman Sachs and Morgan Stanley reported earnings exceeding expectations. Banks like Goldman Sachs and JP Morgan managed to offset the loss in loan provisions with bond or stock trading:

- JP Morgan’s share price is higher at $100.

- Goldman Sachs’ share price is trading higher at $214.70.

- Morgan Stanley’s share price rose to $52.60.

Netflix was among the first to issue quarterly updates among the big tech stocks. The streaming giant reported a positive second-quarter earnings after the market close on Thursday but the warnings came from the predicted paid subscribers which is forecasted to be only 2.5m in the third-quarter. The Company fell by 10% or so in after hours trading.

Source: Bloomberg

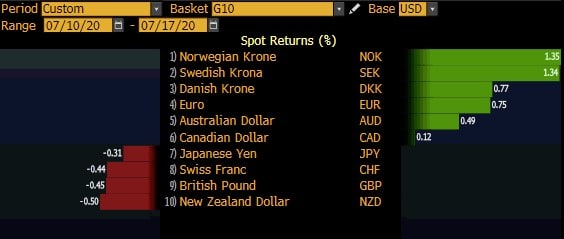

Forex Market

In the forex market, major currencies were mixed against the US dollar. Amid the broad optimism related to the vaccine updates, safe-haven currencies struggled to edge higher. Commodity-linked currencies and the Euro were among the best performers.

Source: Bloomberg Terminal

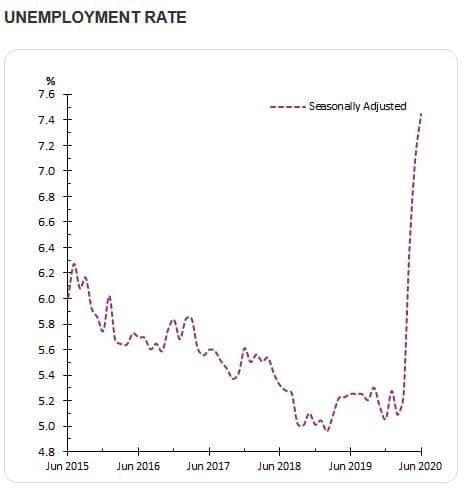

The Aussie dollar was mostly driven by the broader positive sentiment in the markets as mixed economic data failed to support the local currency:

- Consumer Sentiment: Melbourne Lockdowns erased all of last month’s impressive gain. The Westpac-Melbourne Institute Index of Consumer Sentiment fell 6.1% to 87.9 in July from 93.7 in June.

- Mixed Employment data: Employment increased 210,800 to 12,328,500 people: full-time decreased by 38,100 while Part-time increased by 249,000. Unemployment rate increased 0.4 pts to 7.4% as expected.

- Chinese data: China’s return to growth in the second quarter. Its GDP grew by 3.2% compared to a year ago. Industrial Production also expanded by 4.8% in June. However, Retail Sales fell 1.8% on-year.

As of writing, the AUDUSD pair is still navigating in a familiar range just below the 0.70 level.

Source: GOMT4

Similarly, the Euro performed relatively well across the week despite the dismal ZEW surveys and an on-hold ECB. As widely expected, the central bank kept the interest rate and the emergency coronavirus stimulus program unchanged. The EURUSD pair has retreated from this week high but remains in the green for the week. As of writing, it is currently trading at 1.1385.

Source: GOMT4

Oil Market

Crude oil prices found some support on the weekly reports despite the spike in coronavirus cases threatening some kind of more lockdowns to come in the coming days or weeks and speculations that OPEC and Russia might start scaling back the production cuts:

- The API a dip in the weekly crude oil stock from the previous 2M to -8.322M on July 10

- The US Energy Information Administration also reported a larger-than-expected draw. Crude Oil Stocks Change in the US dipped from the previous 5.654M to -7.5 million barrels in the week ending July 10th.

As of writing, WTI Crude oil (Nymex) and Brent Crude (ICE) were trading lower at $40.78 and $43.36, respectively.

Gold

On Thursday, the precious metal pared all the gains made earlier this week and dipped below the $1,800 level. Central banks like the ECB are staying on hold for some time which prompted some dollar strength on Thursday. As of writing, the XAUUSD pair is trading at $1,798.

By Deepta Bolaky

Key Upcoming Events

- Business NZ PMI (New Zealand)

- GfK Consumer Confidence (UK)

- EU Leaders Special Summit, and Consumer Price Index (Eurozone)

- Retail Sales (Canada)

- Michigan Consumer Sentiment Index (US)

| Monday, 20 July 2020 Indicative Index Dividends Dividends are in Points |

||||||

| ASX200 | WS30 | US500 | US2000 | NDX100 | CAC40 | STOXX50 |

| 0 | 0 | 0 | 0.001 | 0 | 0 | 1.828 |

| ESP35 | ITA40 | FTSE100 | DAX30 | HK50 | JP225 | INDIA50 |

| 0 | 64.858 | 0 | 0 | 0 | 0 | 0 |

Disclaimer: Articles and videos from GO Markets analysts are based on their independent analysis. Views expressed are of their own and of a ‘general’ nature. Advice (if any) are not based on the reader’s personal objectives, financial situation or needs. Readers should, therefore, consider how appropriate the advice (if any) is to their objectives, financial situation and needs, before acting on the advice. For more information of trading, check out our forex trading courses.

Next: Vaccine Optimism and Geopolitical Tensions

Previous: Week Ahead: Earnings Season