- Home

- News & Analysis

- Weekly Summaries

- Week Ahead: Ultra Loose Monetary Policies and Flash PMIs

Week Ahead: Ultra Loose Monetary Policies and Flash PMIs

September 21, 2020By Deepta Bolaky

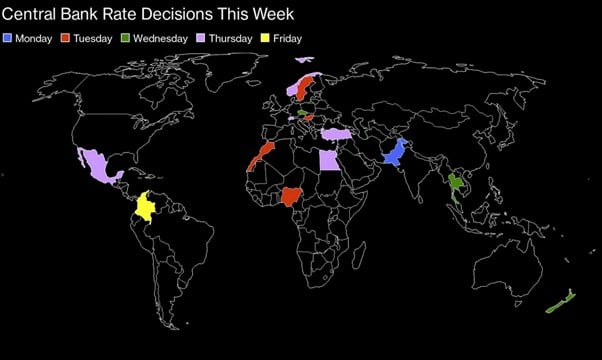

After the Fed’s confirmation last week that US interest rates will likely remain near zero through 2023, the immediate attention will switch to other central banks meetings this week for confirmation of the ultra-loose monetary policies around the globe.

Equity Markets

Global equities remain underpinned by the simmering tensions between the two most powerful economies and the weakness in the technology sector.

Ahead of the US election, the most-awaited political event of the year, risk appetite will likely remain fragile dragged by:

- Escalating tensions between US-China

- The political standoff in the US over the fiscal stimulus

- Central banks’ limited resources to provide further support to the economies

- COVID cases

Central Bank Meetings – RBNZ and SNB

The central bank of the most powerful economy may have set the tone for the markets. In the foreseeable future, the Fed sees interest rates remaining near zero through 2023. Among the various central banks’ meetings, the focus will be on the SNB and RBNZ meetings this week.

While no changes to policies and interest rates are expected, investors will continue to monitor RBNZ’s stance on negative interest rates which appear to be a viable tool if current measures in place are insufficient in maintaining the stability of the financial system in New Zealand.

Europe – Second Wave

After a relatively successful containment of the virus compared to other major countries, Europe is seeing a rise in the number of coronavirus cases again. European cities may face more social distancing or lockdown restrictions as the daily case numbers in the European Union and the United Kingdom are reaching new highs. Investors will likely continue to monitor the threat of a second wave and lockdown.

Key Economic Data to Watch

In the FX space, the performance of the US dollar against its counterparts was mixed. The Japanese Yen and Antipodeans currencies were well-bid against the greenback last week.

The Japanese Yen gained strength on the announcement that Japanese Chief Cabinet Secretary Yoshihide Suga will replace Shinzo Abe as the new leader. In a pandemic-induced environment, Japan may have avoided a new period of political uncertainty for Japan as the new Prime Minister looks set to follow the steps and framework pushed by the former Prime Minister Shinzo Abe.

The Antipodeans currencies were lifted by buoyant Retail Sales and Industrial Production data in China. Retail Sales year-on-year change turned positive for the first time since the virus outbreak started.

Overall, the US dollar gained some upside traction as a haven currency despite the Fed’s comments. The political gridlock over the fiscal stimulus remains the bearish factor for the greenback.

Flash PMIs

It is a relatively quieter economic calendar this week. Besides central banks meetings, the primary focus will be on the flash PMIs figures to be released across the week for major economies. It is a leading economic indicator that will allow investors to further gauge the worldwide economic recovery.

Commodities

Oil

Crude oil prices traded firmer on the upside last week lifted by buoyant weekly EIA and API reports. With the uncertainty on the demand outlook, traders will likely rely on crude oil inventory reports for fresh trading impetus.

Gold

Last week, gold prices swung between gains and losses amid geopolitical tensions, a stronger US dollar and the Fed’s comments. Overall, the precious metal remained resilient within familiar levels around $1,950. As gold keeps trading sideways, traders will keep monitoring geopolitical headlines, central banks decisions and leading economic data before pushing the gold price in a firm direction.

Key Events Ahead

Monday

- Chicago Fed National Activity Index (US)

- Inflation Report Hearings (UK)

Tuesday

- RBA’s Debelle Speech (Australia)

- BoE’s Governor Bailey Speech and CBI Industrial Trends Survey – Orders (UK)

- Existing Home Sales and Fed’s Chair Powell Speech (US)

- Consumer Confidence (Eurozone)

Wednesday

- Commonwealth Bank Services and Manufacturing PMI and Retail Sales (Australia)

- RBNZ Rate Statement and Interest Rate Decision (RBNZ)

- All Industry Activity Index (Japan)

- Gfk Consumer Confidence Survey and Markit Services, Manufacturing and Composite PMI (Germany)

- Markit Manufacturing Services, Manufacturing and Composite PMI (Eurozone)

- Markit Services and Manufacturing PMI (UK)

- Fed’s Mester speech, Housing Price Index, Markit Manufacturing, Services and Composite PMI (US)

Thursday

- Trade Balance, Exports and Imports (New Zealand)

- BoJ Monetary Policy Meeting Minutes (Japan)

- SNB Interest Rate Decision and Monetary Policy Assessment (Switzerland)

- Economic Bulletin (Eurozone)

- IFO – Business Climate, Current Assessment and Expectations (Germany)

- Jobless Claims, New Home Sales and Fed’s Williams Speech (US)

- BoE’s Governor Bailey Speech (UK)

Friday

- Gfk Consumer Confidence (UK)

- Durable Goods and Nondefense Capital Goods Orders (US)

By Deepta Bolaky

| Tuesday, 22 September 2020 Indicative Index Dividends Dividends are in Points |

||||||

| ASX200 | WS30 | US500 | US2000 | NDX100 | CAC40 | STOXX50 |

| 0.223 | 0 | 0.024 | 0.008 | 0.054 | 0 | 0 |

| ESP35 | ITA40 | FTSE100 | DAX30 | HK50 | JP225 | INDIA50 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Disclaimer: The articles are from GO Markets analysts, based on their independent analysis or personal experiences. Views or opinions or trading styles expressed are of their own; should not be taken as either representative of or shared by GO Markets. Advice (if any), are of a ‘general’ nature and not based on your personal objectives, financial situation or needs. You should therefore consider how appropriate the advice (if any) is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next: Week Summary – Central Banks and Rising COVID-19 cases in Europe & the UK

Previous: Tech Stocks, ECB Meeting and Brexit Talks in Focus