- Home

- News & Analysis

- Weekly Summaries

- Week Summary – Central Banks and Rising COVID-19 cases in Europe & the UK

Week Summary – Central Banks and Rising COVID-19 cases in Europe & the UK

September 25, 2020By Deepta Bolaky

The renewed fears of a second wave of a coronavirus outbreak in the European Union and the United Kingdom have gripped markets this week. Until there is a vaccine, the world remains exposed to the possibility of the spread of the virus as and when activities resume. Risk appetite took a hit throughout the week as investors are grappling with the ongoing economic and health uncertainty.

Stock Market – Wild Swings

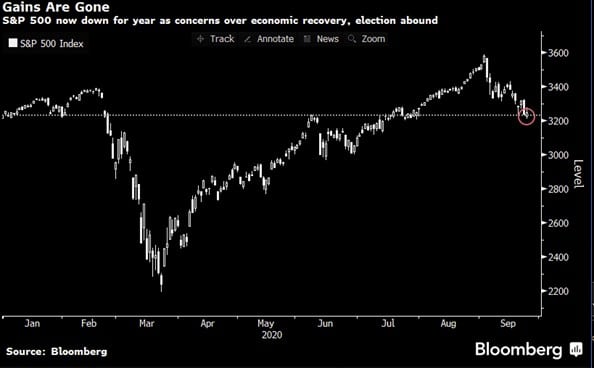

The stock market continues on a wild ride as sentiment remains fragile. Global stocks are underpinned by geopolitical risks, virus woes and economic uncertainties. The S&P 500 index, the bellwether of the large-cap US equities turned negative for the year over growing economic recovery concerns and uncertainty on the US election.

Since the end of August, major US equity indices have retreated by more than 1.5% on four occasions.

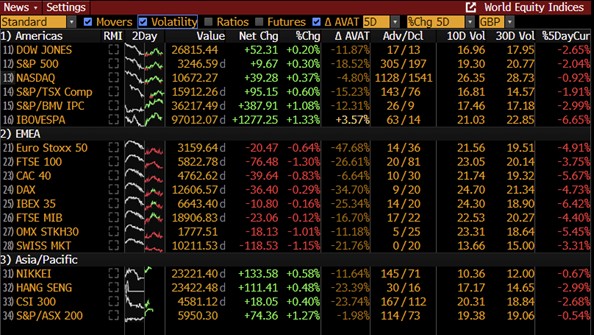

European stocks also struggled this week and swung between losses and gains as the Continent grappled with a resurgence of coronavirus cases. After Monday’s sell-off which saw European stocks plummeting by more than 3%, stocks in those regions remained on the downside.

Overall, global stocks were mostly in a sea of red and volatility in the stock market remains high.

Source: Bloomberg

Forex Market

In the forex market, the US dollar has made an impressive comeback this week. A broad-based risk-off sentiment, rising number of coronavirus cases in Europe and UK and a rout in the technology sector have helped the US dollar to regain its safe-haven status. All G10 currencies were weaker against the greenback.

Source: Bloomberg Terminal

Most importantly, aside from the Fed, other central banks are becoming increasingly more dovish which is providing support to the greenback against its peers:

Aussie Dollar – RBA Rate Cut Calls and Retail Sales

Traders are digesting the possibility of a rate cut and the option of negative interest rates which until this week was not considered as a viable option. The Deputy Governor, Guy Debelle’s speech on the Australian economy and Monetary policy provided further guidance on the current state of the Australian and global economies and the monetary actions the RBA has taken to support the local economy. Most importantly, Deputy Guy Debelle outlines the four possibilities for further monetary actions if the RBA decides that it is warranted.

1st Option: Buy bonds further along the curve, supplementing the three-year yield target.

2nd Option: FX Intervention

3rd Option: Lower rates in the economy a little more without going into negative territory.

4th Option: Negative rates? The empirical evidence on negative rates is mixed.

The options of the currency intervention and negative interest rates have always been the least preferred ones for the RBA. Yesterday, we note that the RBA is now prepared to explore these options as well if warranted.

The Aussie dollar was among the worst performers this week dampened by central bank comments and Retail Sales figures. The seasonally adjusted estimate fell 4.2% (-$1,276.3m) from July 2020 to August 2020. The AUDUSD pair has remained under pressure throughout most of the week and fell from a high of 0.73 to a low of 0.70:

Source: GO MT4

Euro – Appreciation of the Euro

ECB’S Fabio Panetta, a member of ECB’s execution board reiterated the need to monitor the appreciation of the Euro earlier this week:

“The appreciation of the euro is one factor that we need to watch closely with regard to its implications for the medium-term inflation outlook, particularly at a time when current and expected inflation rates are both very low.”

New Zealand Dollar– RBNZ Status Quo

Earlier this week, the RBNZ reflected on the possible need for further monetary stimulus and the bank maintained nearly the same statement which was relatively in-line with expectations. The instruments include:

- Funding for Lending Programme (FLP),

- A negative OCR

- Purchases of foreign assets.

Amid a relatively muted calendar, the New Zealand dollar was mostly left at the broader sentiment of the markets.

Aside from central banks meetings and speeches, attention was on the series of preliminary PMI figures in the US, Germany and Eurozone area. While we note an uptick in the manufacturing sectors, there is a decline in services activity following the ongoing social distancing measures.

Oil Market

After a tough start due to a stronger US dollar and mixed weekly oil reports, crude oil prices recovered some ground towards the end of the week:

- API report: Inventories rose from previous -9.517M to 0.691M in September 18.

- EIA report: Crude oil stocks changed at -1.6 million in the week ending September 18.

As of writing, WTI Crude oil (Nymex) and Brent Crude (ICE) were trading higher around $40.21 and $41.91 respectively.

Gold

Since August, the XAUUSD pair has been trading within a range as investors digested some positive vaccine updates, improving economic data and easing lockdown restrictions. As the greenback gathers strength, the XAUUSD pair is struggling to firm to the upside despite the geopolitical and economic uncertainties. Recently, the gold has plummeted and flashed a bearish signal after dropping below its 50-day moving average.

The XAUUSD pair plummeted below the key psychological level of $1,900. As of writing, the pair is currently trading around $1,865 level.

Source: GO MT4

Key Upcoming Events

- Gfk Consumer Confidence (UK)

- Durable Goods and Nondefense Capital Goods Orders (US)

By Deepta Bolaky

| Monday, 28 September 2020 Indicative Index Dividends Dividends are in Points |

||||||

| ASX200 | WS30 | US500 | US2000 | NDX100 | CAC40 | STOXX50 |

| 0.062 | 0 | 0.008 | 0.061 | 0 | 0 | 0 |

| ESP35 | ITA40 | FTSE100 | DAX30 | HK50 | JP225 | INDIA50 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Disclaimer: The articles are from GO Markets analysts, based on their independent analysis or personal experiences. Views or opinions or trading styles expressed are of their own; should not be taken as either representative of or shared by GO Markets. Advice (if any), are of a ‘general’ nature and not based on your personal objectives, financial situation or needs. You should therefore consider how appropriate the advice (if any) is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services G uide (FSG) for that product before making any decisions.

Next: Week Ahead: Reasons for Being Cautious

Previous: Week Ahead: Ultra Loose Monetary Policies and Flash PMIs