- Home

- News & Analysis

- Weekly Summaries

- Weekly Summary: Rising Virus Cases and Growing Fears of a Second Wave

Weekly Summary: Rising Virus Cases and Growing Fears of a Second Wave

June 19, 2020By Deepta Bolaky

Rising Virus Cases

It was a week of uncertainty amid the rise of coronavirus cases in certain US states and Beijing. New Zealand has also recorded three more active COVID-19 cases days after announcing the eradication of the virus. Beijing was the primary source of concern this week with new clusters of cases which prompted China to raise its emergency response, cancel more than 60% of flights and the shutdown of schools in the affected city.

The indecisiveness roared loud and clear in the markets as investors are reassessing global economic recovery and probability of more lockdown measures. The next coming weeks would be critical in determining whether countries would have to battle another wave of coronavirus cases.

Stock Market – Mixed Performance

Risk sentiment remains fragile across the week due to the worrying number of rising coronavirus cases. The performance of global stocks has been mixed as markets swung between gains and losses.

World Equity Indices

Source: Bloomberg

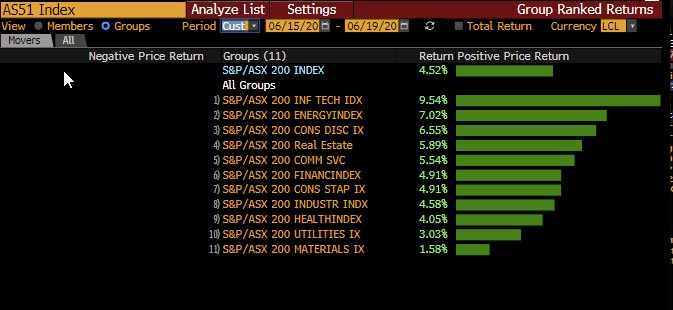

Australian Share Market

In the Australian share market, the index is poised to end the week in positive territory. As of writing, all sectors were in the green and the ASX200 was currently trading higher at 5,993.

Source: Bloomberg

In the morning trade on Friday, the index has briefly risen above the 6,000 level after a surge in May Retail Sales:

- Australian retail turnover rose 16.3 per cent in May 2020, seasonally adjusted, according to preliminary retail trade figures released today by the Australian Bureau of Statistics (ABS).

- This is the largest seasonally adjusted rise ever published in the 38 years of the Retail Trade survey, following the largest ever seasonally adjusted fall of 17.7 per cent in April 2020.

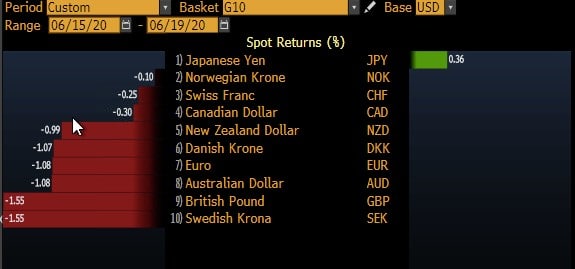

Forex Market

To the exception of the Japanese Yen, major currencies were weaker against the US dollar this week due to the growing fears of a second wave of coronavirus.

Source: Bloomberg Terminal

US Dollar

Even though in the semi-annual monetary policy report to the Congress, Chair Powell has reiterated its dovish tones on the recovery and the need for more fiscal stimulus, the greenback has found some support on some leading economic indicators:

- US Retail Sales: The US recorded an increase of 17.7% in retail and food services for May 2020 from the previous month.

- Industrial Production: Industrial Production came below expectations at 1.4% versus the 2.9% forecasted. However, it is still better than -12.5% in the previous month.

- Housing Sector: We saw a modest rebound in the housing market. A 4.3% increase in Housing Starts and a 14.4% rise in Building Permits.

- Jobless Claims: In the week ending June 13, the advance figure for seasonally adjusted initial claims was 1,508,000, a decrease of 58,000 from the previous week’s revised level.

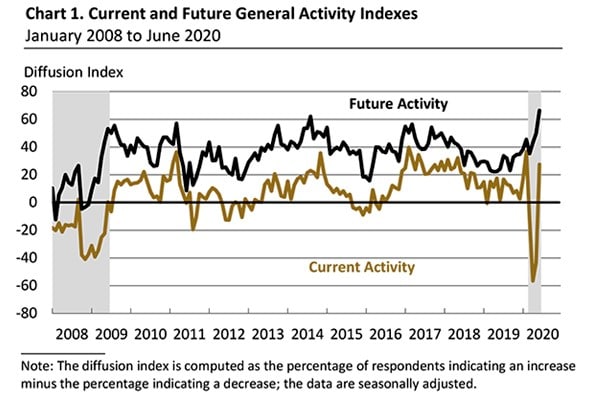

- Philadelphia Fed Manufacturing Survey: It was the first positive reading since February- the index for current general activity increased from -43.1 in May to 27.5 this month.

The British Pound

The Pound was among the worst-performing G10 currencies against the US dollar dragged mostly by a stronger greenback, Brexit-related noises and mixed Employment report:

- Employment Report: While ILO unemployment rate remained at 3.9% in the three months to April, beating expectations of 4.5%, claimant count rose by 528.9K in May, worse than anticipated, while the April reading was upwardly revised to 1032.7K from 856.5K.

- Bank of England: As widely expected, the BoE kept interest rates unchanged at 0.1% in a unanimous decision. The Committee also voted by a majority of 8-1 for the Bank of England to increase the target stock of purchased UK government bonds, financed by the issuance of central bank reserves, by an additional £100 billion, to take the total stock of asset purchases to £745 billion.

As the clock is ticking for Brexit, a no-deal scenario is being considered given the lack of positive developments. The GBPUSD pair dropped lower from a high of 1.2680 to the 1.24 level. As of writing, we note that the pair is consolidating around the 1.24 level.

GBPUSD (Hourly Chart)

Source: Bloomberg Terminal

Oil Market

Despite bearish oil weekly reports showing an increase in crude oil inventories, the Joint Ministerial Monitoring Committee meeting pushed oil prices higher.

“The Committee took note of the overall conformity of 87% for the month of May 2020. It also observed individual country conformity levels and reiterated the critical importance that all Participating Countries achieve their 100% level, and make up for any monthly shortfalls in the months of July, August and September.”

As OPEC+ looks to make up for shortfalls, WTI and Brent Crude gained upside momentum. As of writing, WTI Crude oil (Nymex) and Brent Crude (ICE) are trading at $39.01 and $41.69, respectively.

By Deepta Bolaky

Key Upcoming Events

- European Council Meeting (Eurozone)

- Public Sector Net Borrowing and Retail Sales (UK)

- Producer Price Index (Germany)

- Retail Sales (Canada)

| Monday, 22 June 2020 Indicative Index Dividends Dividends are in Points |

||||||

| ASX200 | WS30 | US500 | US2000 | NDX100 | CAC40 | STOXX50 |

| 0 | 0 | 0.0.002 | 0.008 | 0 | 0.106 | 2.72 |

| ESP35 | ITA40 | FTSE100 | DAX30 | HK50 | JP225 | INDIA50 |

| 0 | 61.046 | 0 | 0 | 68.741 | 0 | 0 |

Disclaimer: Articles and videos from GO Markets analysts are based on their independent analysis. Views expressed are of their own and of a ‘general’ nature. Advice (if any) are not based on the reader’s personal objectives, financial situation or needs. Readers should, therefore, consider how appropriate the advice (if any) is to their objectives, financial situation and needs, before acting on the advice. For more information on trading, check out our CFD trading courses.

Next: Weekly Summary: Rising Virus Cases and Volatile Trading

Previous: Weekly Summary: A Bloodbath in the Stock Market