- Home

- News & Analysis

- Weekly Summaries

- Reversals of Lockdown Easings?

Reversals of Lockdown Easings?

June 29, 2020By Deepta Bolaky

Reversals of Lockdown Easings?

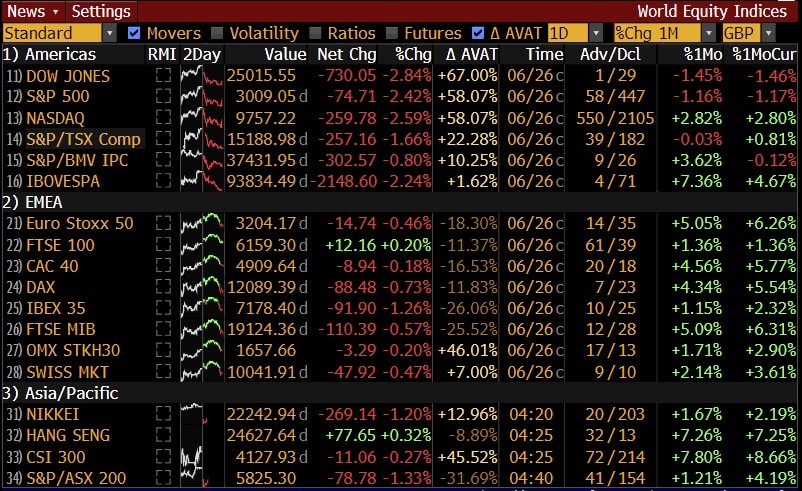

With more than 10 million coronavirus cases and half a million deaths over the weekend, rising fears of a second wave of virus infections may rattle the markets this week if the most-affected states start the reversal of lockdown easings. Amid a busy economic calendar, investors will likely try to gauge the recovery post-lockdown while also evaluating the impact of the recent virus concerns on the economic recovery.

Equity Markets

Investors are gearing up for another volatile week as they are warily watching the resurgence of COVID-19 cases in major countries. As the second quarter comes to an end, the outlook for the first month of a new quarter is looking uncertain compared to the heightened expectations of a recovery in the third quarter anticipated a month ago. As cases continue to spike in certain states in major countries, businesses and consumers are wary of the unfolding situation.

The fear of a second wave and the rolling back of reopening measures can have a negative impact on the stock market.

Source: Bloomberg

Wall Street

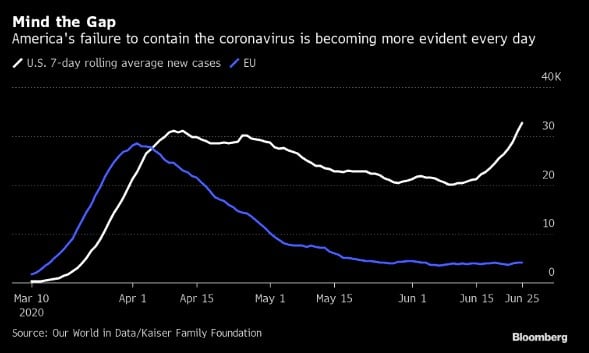

The situation in the US is alarming – major states are recording a spike in COVID-19 cases and will be forced to impose some forms of lockdown restrictions if the situation worsens. Investors are also waiting for updates on the next round of stimulus which could boost confidence. After a great run, Wall Street will probably be bracing for another volatile third quarter as the outlook remains murky.

European Bourses

European stocks appear to be flaring better than US stocks and the outlook seems also a bit more promising as we are about to enter the third quarter. The unprecedented and massive stimulus packages combined with more optimism on the virus front are helping European bourses to hold ground. Consumer and business surveys are also boosting the current optimism. The main driver behind the performance of the European stocks compared to the US remains the number of coronavirus cases in the US compared to Europe.

Forex

In the forex market, risk-aversion will likely remain the main theme at the start of the week as traders stay focused on the rising number of coronavirus cases. In a classic reaction, safe-haven currencies like the US dollar, Japanese Yen and Swiss franc may gain more upside traction compared to other major currencies if coronavirus cases continue to surge.

United States

Amid a slew of key economic data, the ADP report followed by Nonfarm payrolls will stand out the most. Surprisingly, after a staggering loss of 20 million jobs in April, May Nonfarm payroll figures showed an uptick of 2.5 million. June figures will likely confirm whether the rebound is sustainable to provide some short-term direction even though the rising number of COVID-19 cases may overshadow any positive data.

Australia

We will kick the week with Private sector credit numbers on Tuesday followed by manufacturing and housing data on Wednesday. However, Aussie traders will likely focus on China’s PMI figures and AUS Retail Sales to gauge consumer spending. The Australian dollar has been among the best performers against the US dollar fueled by the reopening of economies and higher commodity prices. However, the resurgence of coronavirus cases has dampened the bullish momentum and the AUDUSD pair traded within a tight range in the last few weeks.

AUDUSD (Daily Chart)

Source: GO MT4

Eurozone and UK

After last week’s flash figures, the final figures for manufacturing and services PMIs will hit markets. In the UK, the first-quarter GDP and Brexit-related developments will likely grab more attention.

Commodities

Oil

The oil market has also been feeling some pressure, dragged by virus fears and recent weekly oil reports:

- The API reported an increase of 1.75 million barrels on last Tuesday

- EIA weekly report posted a 1.4 million increase in crude oil inventories.

However, the oil market is finding support on surveys and data showing a pick up in activities that will fuel demand for oil. We expect traders to keep monitoring weekly reports and PMIs to gauge oil demand.

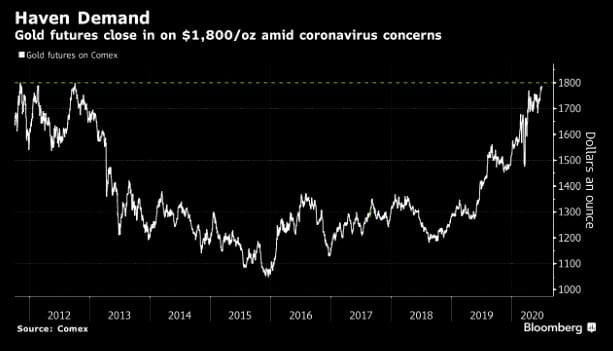

Gold

The rising number of coronavirus cases is driving the precious metal higher as investors sought some safety with haven assets. As of wring, gold futures are edging closer toward $1,800.

Source: Bloomberg Terminal

Key Events Ahead

By Deepta Bolaky

| Tuesday, 30 June 2020 Indicative Index Dividends Dividends are in Points |

||||||

| ASX200 | WS30 | US500 | US2000 | NDX100 | CAC40 | STOXX50 |

| 0 | 0 | 0.0248 | 0.062 | 1.035 | 0 | 0 |

| ESP35 | ITA40 | FTSE100 | DAX30 | HK50 | JP225 | INDIA50 |

| 1.22 | 0 | 0 | 0 | 6.614 | 0 | 0 |

Disclaimer: Articles and videos from GO Markets analysts are based on their independent analysis. Views expressed are of their own and of a ‘general’ nature. Advice (if any) are not based on the reader’s personal objectives, financial situation or needs. Readers should, therefore, consider how appropriate the advice (if any) is to their objectives, financial situation and needs, before acting on the advice. For more information of trading, check out our forex trading courses.

Next: Week Ahead: COVID-19: Crucial Days Ahead

Previous: Weekly Summary: Rising Virus Cases and Volatile Trading