- Home

- News & Analysis

- GO Daily News

- Overnight on Wall Street: Tuesday 14 October 2020

Overnight on Wall Street: Tuesday 14 October 2020

October 14, 2020By Deepta Bolaky

@DeeptaGOMarkets

Equity Markets

Risk aversion crept back into the markets following the deadlock in US stimulus negotiations, no Brexit breakthrough ahead of the deadline and the rising number of coronavirus cases in Europe.

Source: Bloomberg

European and US stocks closed in a sea of red on Tuesday:

- The Dow Jones Industrial Average lost 158 points or 0.6% to 28,680.

- S&P 500 fell by 22 points or 0.6% to 3,512.

- Nasdaq Composite erased 12 points or 0.1% to 11,864.

On the earnings front, both JP Morgan and Citigroup beat expectations and reported a surge in trading in financial markets. The banks have also slowed the pace of provisions for bad debts. More banks are set to report their third-quarter earnings in the next couple of days.

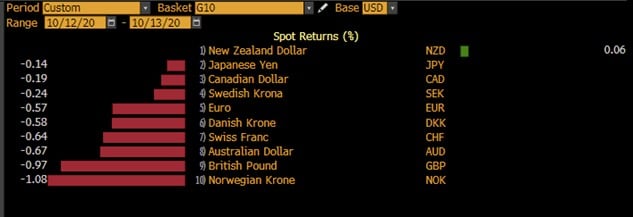

Currency Markets

In the FX space, the US dollar regained strength on its safe-haven status as risk appetite deteriorated overnight. To the exception of the New Zealand dollar, major G10 currencies were weaker against the greenback.

Source: Bloomberg

The British Pound struggled by Brexit woes and mixed employment reports:

- For June to August 2020, the estimated UK unemployment rate for all people was 4.5%; this is 0.6 percentage points higher than a year earlier and 0.4 percentage points higher than the previous quarter

- Growth in average total pay (including bonuses) among employees for the three months June to August was unchanged from a year ago, while regular pay (excluding bonuses) growth was positive at 0.8%.

Amid a subdued economic calendar, the Aussie dollar was left at the broader sentiment of the markets – US stimulus chaos and elevated tensions with China. The AUDUSD pair dropped from a high of 0.7213 level to a low of 0.7150.

For the chart of the day, Adam Taylor looks at EURJPY

Renewed selling interest in the EURJPY pair looks as if it may continue to lower levels during the upcoming sessions as the previous bullish technicals begin to waver.

The four-hour chart above shows a validated bullish trendline that originated towards the end of last month. Current support for this trendline sits at 124.30, and providing the price can stay above here, then the pair will remain bullish.

However, price action appears to be somewhat shaky with multiple failed attempts to break above the 200 MA line in yellow and a general loss of momentum as we see the shorter bursts of demand closer to the 125.08 high. We also have signs of some bearish divergence as displayed by the RSI indicator, and while the pair currently leans towards the oversold camp, there is still plenty of room for sellers to push this level further.

As mentioned earlier, the pair will need to hold above the 124.30 regions to keep within bullish sentiment. Otherwise, we could see EURJPY slip back down to 123.00 and 122.37, respectively.

Commodities

Crude oil prices advanced on upbeat Chinese imports data despite the concerns over supply and demand. The World Energy Outlook 2020 report reiterates the struggles of the energy market in the coming years:

- The Covid-19 pandemic has caused more disruption to the energy sector than any other event in recent history, leaving impacts that will be felt for years to come.

- The shadow of the pandemic looms large: “Global energy demand rebounds to its pre-crisis level in early 2023 in the STEPS, but this is delayed until 2025 in the event of a prolonged pandemic and deeper slump, as in the DRS.

- In the Sustainable Development Scenario (SDS), a surge in clean energy policies and investment puts the energy system on track to achieve sustainable energy objectives in full, including the Paris Agreement, energy access and air quality goals.

- The new Net Zero Emissions by 2050 case (NZE2050) extends the SDS analysis. A rising number of countries and companies are targeting net-zero emissions, typically by midcentury.

As of writing, WTI Crude oil (Nymex) and Brent Crude (ICE) were trading around $40.14 and $41.45 respectively. Traders are to keep an eye on the following events for fresh trading impetus:

- Oil Market Report October 2020

- API weekly report

Gold

Gold

The precious metal lost ground on a stronger US dollar and the US stimulus stalemate. The XAUUSD pair has dropped back below the $1,900 and is currently trading around the $1,890 level.

Source: GO MT4

By Deepta Bolaky

Key upcoming events

- Westpac Consumer Confidence and HIA New Home Sales (Australia)

- Industrial Production (Japan)

- Industrial Production (Eurozone)

- Producer Price Index (US)

- BoE’s Haldane Speech (U

| Thursday, 15 October 2020 Indicative Index Dividends Dividends are in Points |

||||||

| ASX200 | WS30 | US500 | US2000 | NDX100 | CAC40 | STOXX50 |

| 0 | 0 | 0.11 | 0.091 | 0 | 0 | 0 |

| ESP35 | ITA40 | FTSE100 | DAX30 | HK50 | JP225 | INDIA50 |

| 0 | 0 | 1.685 | 0 | 1.679 | 0 | 0 |

Disclaimer: The articles are from GO Markets analysts, based on their independent analysis or personal experiences. Views or opinions or trading styles expressed are of their own; should not be taken as either representative of or shared by GO Markets. Advice (if any), are of a ‘general’ nature and not based on your personal objectives, financial situation or needs. You should therefore consider how appropriate the advice (if any) is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next: COTD: USDCHF – Selling Into The Dollar Rallies

Previous: COTD: EURJPY – Loss Of Momentum Weighs Heavy