- Home

- News & Analysis

- Shares and Indices

- ASX200 Trading Lower; Panic–Buying Drives Record Surge in Retail

ASX200 Trading Lower; Panic–Buying Drives Record Surge in Retail

May 6, 2020By Deepta Bolaky

The Australian share market struggled to edge higher despite overnight gains on Wall Street. The S&P/ASX200 dropped on the open after a two-day advance as all three US equity benchmarks had pared gains in the final hours of trading dragged by dovish Fed comments.

In the afternoon, the index was down 37 points or 0.70% to 5,370. All Ordinaries was trading lower by 28 points or 0.51% to 5,450.

The majority of the sectors were trading in negative territory but significant losses of more than 1% were seen in the real estate and financial sectors. Bank stocks were heavily weighing on the index with Westpac, ANZ and NAB all down by 2% or more, while CBA was trading around 1% lower.

Source: Bloomberg

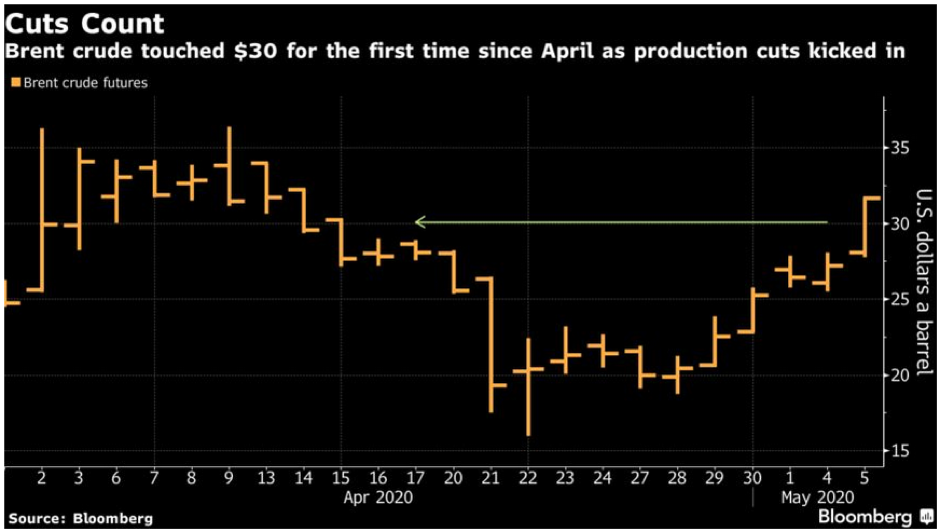

As of writing, the energy sector was the best-performing sector, supported by a surge in crude oil prices. For the first time since April, Brent Crude oil futures rose above $30 as production cuts started kicking in.

Source: Bloomberg

On the economic front, the Aussie Retail Sales turnover came above expectations at 8.5% in March compared to the 8.2% forecasted. Australia saw both record rises in food retailing and record falls in cafes, restaurants and takeaway food services. Panic-buying has driven the increases in food retailing (24.1%), household goods retailing (9.1%) and other retailing (16.6%) which has helped to compensate for the significant drop in other categories.

The Aussie dollar remains relatively muted at 64.30 US cents, despite the upbeat Retail Sales data.

By Deepta Bolaky

Disclaimer: Articles and videos from GO Markets analysts are based on their independent analysis. Views expressed are of their own and of a ‘general’ nature. Advice (if any) are not based on the reader’s personal objectives, financial situation or needs. Readers should, therefore, consider how appropriate the advice (if any) is to their objectives, financial situation and needs, before acting on the advice.

About GO Markets

GO Markets was established in Australia in 2006 as a provider of online CFD trading services. For over a decade, we have positioned ourselves as a firmly trusted and leading global regulated CFD provider. Traders can access more than 250 tradeable CFD instruments including Forex, Shares, Indices and Commodities.

Follow us on Twitter, Facebook and LinkedIn to stay up to date with the latest market news and analysis.

Next: The Reopening Experiment and Geopolitical Risks

Previous: Tyson Foods & Skyworks Earnings Reports