- Home

- News & Analysis

- Economic Updates

- The pandemic year: investors navigating the new normal

The pandemic year: investors navigating the new normal

December 22, 2020By Deepta Bolaky

2020 has brought a rapid and unpredicted change. The new decade started with talks about climate change, the shifting trading landscape and trade frictions, Brexit, and the rise of political populism but the dynamics quickly changed to an unparalleled and unprecedented health crisis that rattled the markets throughout the whole year.

As we head into the holiday seasons, investors remain focused on COVID-19 pandemic which has forcefully plunged the world into a “New Normal”. The alarming speed of the spread of the virus across the world has transformed and reshaped the world in a short amount of time but with longer-lasting impact. As everyday life has been impacted, investors have also reassessed and realigned their investment strategies to face the new world.

Stock Market

Quarter 1 – A trio of crises & the great lockdown

The markets tumbled like dominoes hit by various headwinds at once ranging from geopolitical tensions between the US and China, Hong Kong and Iran, extreme weather conditions, an oil price war, and the novel coronavirus which forced various forms of lockdowns and social distancing across the globe. Faced by an unprecedented health crisis, and an oil crisis, the world was bracing for an unexpected economic crisis.

Volatility soared in the markets to decades high from an average of 20 to a high above 80 around mid-March causing several circuit breakers and trading halts on some stock exchanges. The stock market bottomed down, and major equity indices dropped in bear market territory ending an 11-year bull-run in the stock market. Global stocks experienced the worst week since the global financial markets.

Central banks and governments rushed in to intervene and cushion the freefall in the financial markets and support their economies which brought some degree of calm in the stock market.

Quarter 2 – The grand reopening & roadmap to recovery in a pandemic

Investors witnessed the grand reopening in the second quarter after the great lockdown in the first quarter. Massive fiscal stimulus, ultra-low levels of interest rates, central banks interventions and optimism on the reopenings helped the stock market to rebound as fiercely and aggressively as it initially fell.

The government and central banks have absorbed nearly all the shocks of the virus on the financial markets by injecting massive liquidity in the economy, keeping credit flowing and supporting their economy with huge fiscal stimulus plan among many others unconventional plans. On the reassurance that the intervention measures are not going to fizzle out anytime soon, investors have pushed global stocks higher:

- Major US equity indices rallied and record new highs.

- European stocks were flaring better. Even though the Eurozone was not economically strong pre-COVID-19 crisis, the better containment of the virus compared to the US and the historic unity European countries have shown during the coronavirus crisis has boosted confidence for European stocks

- Australian shares also rebounded significantly and reclaimed the 6,000 level to mark the best quarter in over a decade.

Quarter 3 – Vaccine optimism, Presidential election, and tech rally

While the vaccine updates and the US Presidential elections campaigns were at the forefront of the markets in the third quarter, global stimulus improving economic data, a better-than-expected earnings season and the resilience of the technology sector have lifted risk sentiment. Global equities have been on a staggering rally at the beginning of the quarter allowing the major equity indices to recover the losses made in the first quarter.

However, geopolitical risks – US/China tech war and the ending of the US pact on Hong Kong extradition and reciprocal tax treatment, the US stimulus gridlock, the rising number of coronavirus cases and the uncertainty around the pace of recovery created an environment of caution.

Investors were monitoring closely the interventions by central banks and governments to push stocks higher at the risk of the global economic backdrop and the stimulus-fueled economy. The month of September again lived up to its reputation of being the typical scary month for investors which saw major corrections in the stock market as investors were navigating in a highly uncertain environment.

Once the volatility around the US elections faded, investors were focused on the prospects of another round of national lockdowns and the lack of timely US stimulus support. The tech sector was at the centre of attention as the big tech leaders outshined when the world went into virtual reality mode. The industry biggest players: Amazon, Apple, Facebook, Alphabet, and Microsoft were somewhat well-equipped to rise to the challenges. The resilience and performance of the tech sector year-to-date stood out this year – mega-caps tech companies have tackled the pandemic relatively unscathed by its impact compared to the economic malaise other industries are facing.

- The Reshuffling of the Dow Jones Industrial Average: Another notable event was the reshuffling of the Dow – Amgen ($AMGN), Salesforce.com ($CRM) and Honeywell International ($HON) were added to the index while Pfizer ($PFE), Raytheon Technologies ($RTX) and Exxon Mobil ($XOM) were removed. The moves were spurred by Apple’s decision to split its stock which will reduce the Information Technology index weight.

- Apple Made History: Apple made history in August and retakes the market-cap lead from Microsoft to become the first US company to be valued at US$2 trillion.

- Sea Ltd: If immediate attention generally was on the FAANG group, Sea Ltd, the leading internet platform in Southeast Asia and Taiwan drew attention as well. The company outshines Tesla and the FAANG group of companies and emerged as the world’s best performing large-cap stock.

The last quarter – First vaccinations

Amid the election mayhem and a probable contested election, the gridlock in Congress, another wave of hard lockdowns, and Brexit chaos, investors had a breather with promising vaccine updates. The back and forth on the US stimulus coronavirus relief package and Brexit negotiations took the markets on a wild ride in the last quarter. Throughout the last few months, Pfizer and BioNTech, Moderna and AstraZeneca issued convincing statements of the progress of the vaccine trials.

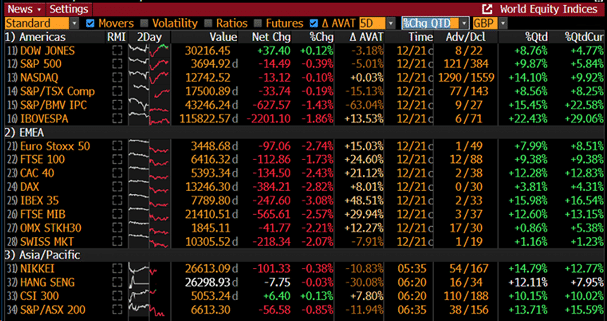

The emergency vaccine approvals and the first vaccinations across major countries like the US and the UK brought some relief following the ongoing surge in coronavirus cases in certain economies. Overall, there was enough optimism in the last few weeks for global equities to recover from October’s plunge.

Source: Bloomberg

US share market

Despite a contested election, the lack of timely fiscal support and the raging spread on the virus in the US, the share market was supported by the vaccine updates and first immunizations which took place earlier this month.

Source: Bloomberg

Similarly, the encouraging vaccine news was the bullish trigger for the European markets despite the further lockdowns in major European countries, tough Brexit negotiations and a slower economic recovery compared to its peers. As of writing, a new variant of the virus in the UK triggered a sell-off in the European markets. The CBOE Volatility Index jumped to the highest in a month above the 30 mark.

The new COVID mutation was mainly detected in the UK but the WHO confirmed its presence so far in Denmark, the Netherlands and Australia as well. Investors are closely monitoring statements on whether the new variant is more easily transmissible than the original strain of the disease.

The Australian share market – back in black

After the release of the Federal Budget, Australian shares started to decouple from US and European stocks as investors endorsed the government blitz which boosted confidence. During the month of November, the Australian share market has rallied significantly on the back of:

- The easing of lockdown restrictions in the second most populated state and the second’s largest city in the country.

- The positive vaccine updates coming from Pfizer and BioNTech, Moderna and AstraZeneca.

- The confidence in the Australian economy as compared to other major countries. Consumer confidence reached a 10-year high.

- Historically low-interest rates. Even though the RBA slashed interest rates to a historic low, there is a level of reassurance that the lower level of interest rates will stay for a longer period which means that the central bank is not expecting a deterioration in the Australian economy fuelling investors’ confidence.

- The Asia-Pacific Free Trade Agreement has provided another level of confidence at a time of global trade uncertainty. It has also elevated expectations that both countries might initiate some sort of dialogue after the Chinese Communist Party has frozen all communications with Australian ministers.

In November, the ASX recorded their best month in decades and briefly erased its 2020 losses before retreating lower. As of writing, the index is currently trading at around 6,601.

Forex market: the king dollar?

The US dollar went on a roller coaster ride throughout the year. In a classic reaction to an unpredictable and uncertain event like the pandemic, the demand for haven assets triggered a rally in the US dollar. As panic gripped markets, dollar funding pressures drove the US dollar index to a 3-year high above the 102 level. Even though policymakers stepped in to enhance flows, the greenback remained in elevated levels.

Source: Bloomberg

A significantly bigger stimulus package compared to its peers at the beginning fuelled hopes that the US economy would probably recover faster than other major economies. The US dollar was unable to maintain the bullish momentum over the following quarters as risk sentiment improved and the US was still battling hard the spread of the virus with no signs of slowing down and stimulus packages were not flowing in as required.

Major currencies remained stronger than the US dollar in the following quarters. Major central banks like the RBA had to tap into QE for the first time this year and many even contemplate or left the door open for negative interest rates if warranted.

Source: Bloomberg

The Euro gathered strength on the historic unity, some economic recovery, the ECB stimulus program and EU budget. The renewed lockdowns and Brexit woes remain the factors that may drove further volatility in the EUR pairs. The EURUSD pair is trading at a high above the 1.22 level.

The Antipodean currencies were among the top gainers lifted by the additional funding from the central banks, governments, renewed confidence, economic data and the better containment of the virus as compared to other major economies. The AUDUSD pair is trading nearly three-year high around the 0.750 level.

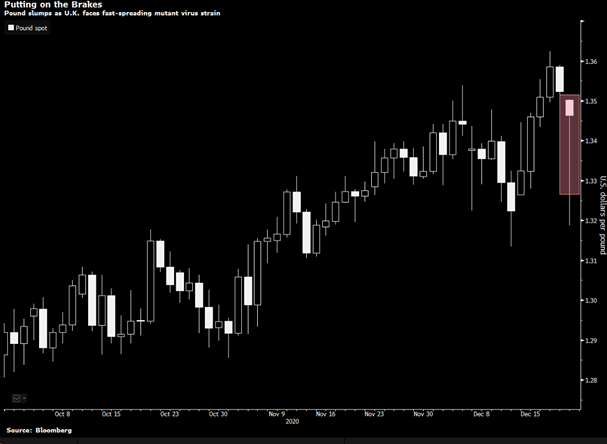

Source: Bloomberg

As the Brexit deadline looms, the Pound swung between gains and losses driven by contradictory headlines and statements from both the EU and the UK. Traders grew more hopeful in the last few days when both parties appear committed to seeing a deal through despite significant differences on three critical issues: level playing field, governance and fisheries. Investors were taken on a roller-coaster ride following intensifying deal negotiations and on-and-off positive and negative announcements.

Brexit hopes drove the GBPUSD pair to an intraday high of 1.3624 last week. The Pound plummeted on the news of a new variant of the virus and as of writing, the pair retreating lower to the 1.33 level.

Gold rally

At the start of the year, the US dollar and Gold were moving in tandem due to the prevailing uncertainties – QE, low-interest rates, trade frictions, geopolitical tensions, global debt and growth uncertainties, gold hoarding by central banks have driven the gold price higher just below the $1,700 mark.

However, Gold was initially liquidated due to the wider and rapid spread of the coronavirus across the globe. The precious metal is viewed as a highly liquid asset and investors were in a need of cash due to margin calls and other liquidity requirements. COVID-19-induced liquidity issues caused the yellow metal to plunge to a low of $1,451.55.

The yellow metal rallied at the start of the third quarter to a high of $2,075 in the month of July but traded within a narrow range as investors digested some positive vaccines updates, improving economic data and easing lockdown restrictions. The XAUUSD pair plunged below a key psychological level below the $1,900 mark but held on to elevated levels.

From the health crisis point of view, the vaccine updates are fuelling the hopes of a quicker recovery and providing reassurance to investors. However, the amount of stimulus injected into the global economy over the last couple of months is evidence that the economic and financial recovery might take some time. Gold is still trading at a decade-high around the $1,880 mark.

Oil market

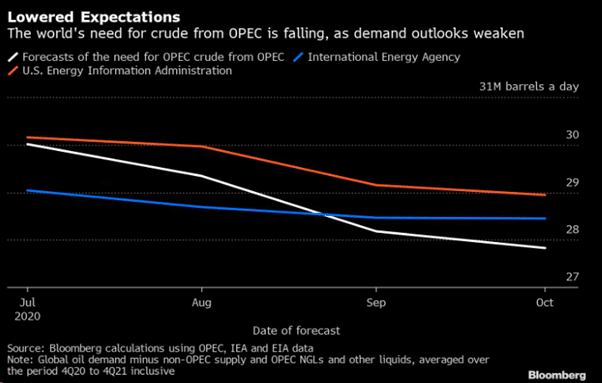

An oil price war and the ongoing pandemic struck the crude oil market at a time where the industry was already faced with a simultaneous demand and supply shock. As the world grapples with the ongoing pandemic, different forms of lockdowns across the globe have severely impacted key industries of consumers of oil. Global activities have slowed down on a massive scale with empty roads, grounded aircraft, plunging car sales and disrupted supply chains abruptly sapping oil demand.

The extent of the disruptions in the energy market caused by the pandemic will probably leave a lasting impact on the oil market which may take years to overcome. Traders are analysing whether the impact of the pandemic will either accelerate the pace in using renewables or delay that process.

Crude oil prices have mostly remained stuck within a range below the $50 after the big plunge earlier this year. With a dire demand outlook from as per the October reports, there are increasing pressure from OPEC members and its allies to balance the supply side and avoid flooding the oil market with extra supply.

In a pandemic-induced environment, investors are navigating a new normal with COVID-19. Despite the painful year on the health front, the stock market had a great year driven by the prompt interventions in the financial markets by central banks and governments around the globe.

While a vaccine provided a sense of relief, we are ending the year with much uncertainty on the geopolitical, economical and health front.

By Deepta Bolaky

Disclaimer: The articles are from GO Markets analysts, based on their independent analysis or personal experiences. Views or opinions or trading styles expressed are of their own; should not be taken as either representative of or shared by GO Markets. Advice (if any), are of a ‘general’ nature and not based on your personal objectives, financial situation or needs. You should therefore consider how appropriate the advice (if any) is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next: Preview: Non-Farm Payroll Announcement

Previous: CSL stops phase 2/3 COVID-19 vaccine trials: Australian Govt cancels order