- Home

- News & Analysis

- Economic Updates

- CSL stops phase 2/3 COVID-19 vaccine trials: Australian Govt cancels order

CSL stops phase 2/3 COVID-19 vaccine trials: Australian Govt cancels order

December 11, 2020By Deepta Bolaky

CSL, a leading global biotech company headquartered in Melbourne announced its update on its COVID-19 vaccine developed in collaboration with the University of Queensland. The Company revealed while the Phase 1 trial “elicits a robust response” towards the virus and “has a strong safety profile”, the molecular clamp antibodies did cause a false positive on a range of HIV assays.

In agreement with the Australian government, the Company also announced that they will not carry forward with Phase 2 and 3 trials and will concentrate on the production of AstraZeneca and University of Oxford vaccine which is yet to pass regulatory approvals.

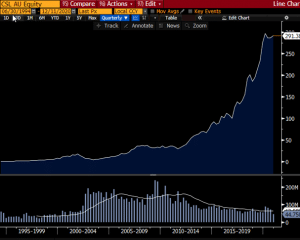

CSL’s share price tumbled on the open following the COVID-19 vaccine trial updates. As of writing, the Company’s share price has dropped by more than 3% and is currently at around $291.60.

Source: Bloomberg

As one of the Australia’s most valuable companies, a global biotech company which compete on the global stage as one of the largest and fastest-growing protein-based biotechnology businesses and a leading provider of in-licensed vaccine, we do not expect CSL’s profit to be severely affected. CSL also does not anticipate that this announcement will have any impact on previously provided financial guidance for FY2021.

The biotech company has been on a tremendous rally since the last five years which allowed its share price to more than double in that period. In its latest R&D briefing, the Company outlines how the company is advancing a novel research portfolio across four strategic scientific platforms across six therapeutic areas and two businesses (CSL Behring and Seqirus) to help patients lead full lives, protect public health and drive future business growth.

(Follow the link for the full statement: https://www.csl.com/news/2020/20201020-annual-research-and-development-day-briefing)

Source: Bloomberg

By Deepta Bolaky

Disclaimer: The articles are from GO Markets analysts, based on their independent analysis or personal experiences. Views or opinions or trading styles expressed are of their own; should not be taken as either representative of or shared by GO Markets. Advice (if any), are of a ‘general’ nature and not based on your personal objectives, financial situation or needs. You should therefore consider how appropriate the advice (if any) is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next: The pandemic year: investors navigating the new normal

Previous: Consumer confidence at 10-year high