- Home

- News & Analysis

- Weekly Summaries

- Weekly Summary: The Warnings and Grim Economic Data

Weekly Summary: The Warnings and Grim Economic Data

May 15, 2020By Deepta Bolaky

US Health Officials and Fed’s Warnings

Market participants are moving past reopening plans and are digesting the reality of this “new normal”. At a hearing before the Senate health committee, Dr Anthony Fauci, a US top infectious disease official, together with other health representatives, warned that an early reopening of certain states may set back an economic recovery.

Similarly, Federal Chair Jerome Powell also warned of the economic risks and how the coronavirus crisis raises longer-term concerns that could leave behind lasting damage to the productive capacity of the economy. The Fed referred to the downturn as “significantly worse than any recession since World War II”. The US economy erased a decade worth of jobs growth in just a couple of months.

The economic data is showing the devastating impact of the virus, and at the risks of coronavirus reinfection, world leaders are facing the tough job of reopening their economies to contain the fallout.

Stock Market

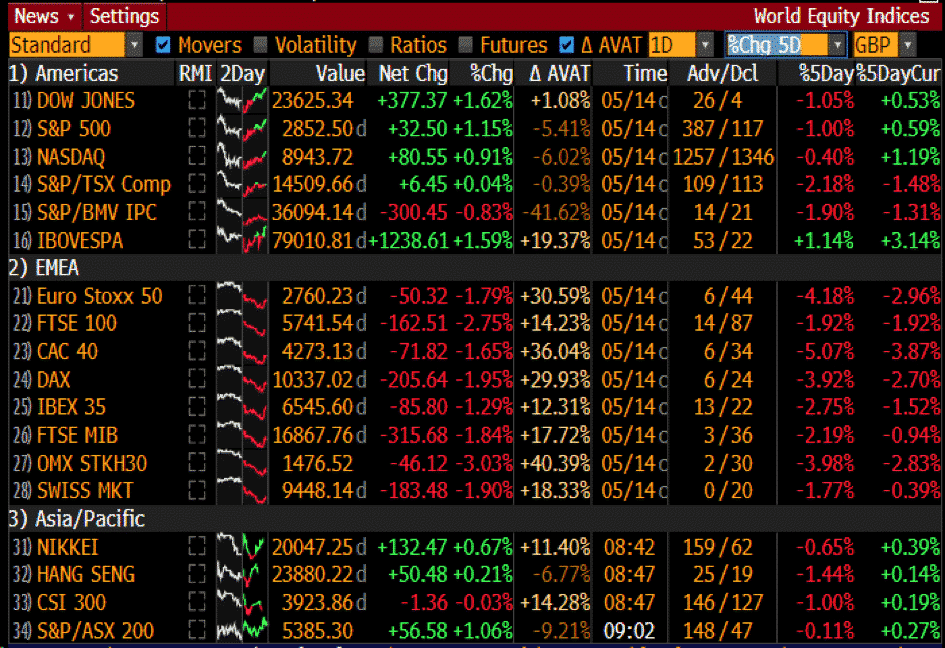

Global equities retreated this week as grim economic reports and warnings from policymakers and health officials weighed on risk sentiment. We have recently seen a tremendous rebound in the stock market, fuelled mainly by various forms of monetary and fiscal support, and the reassessment of the pandemic situation and reopening plans.

Economic data was expected to be drastic, but it is also backward-looking – which partially explains the distortions between the stock market and economic fundamentals. Investors were gearing up towards the easing of lockdowns, which initially buoyed risk sentiment and helped the stock market to bounce off from March lows. New warnings about the future being highly uncertain and the fact that the virus may have longer repercussions has dented some optimism.

The stock market seesawed between gains and losses this week as investors digested the economic reports, the warnings and escalated tensions between the US and China.

World Equity Indices (% Change)

Source: Bloomberg Terminal

Australian Jobs Data

As the Prime Minister pointed out, it was a tough day for Australia when the jobs data revealed that the economy has lost more than half a million jobs in one month. It is the biggest monthly fall in employment on record. The unemployment rate increased by from 5.2% to 6.2%, which is below the 8% forecasted figure, mostly due to the steep fall in participation rate and the Job Keeper package which allowed around six million people to keep their jobs.

Unfortunately, the labour report does not reflect the worst impact of the coronavirus. As the RBA and the Treasurer forecasted, the unemployment rate might jump to 10% by June. If governments can follow through its opening plans so that social distancing measures are fully eased, 850,000 jobs are expected to be reinstated.

The Aussie dollar lost some ground and dropped below 65 US cents since the beginning of the week, dragged by a stronger US dollar, mixed local employment reports and Chinese data.

China’s Recovery

April figures were expected to confirm the pace of recovery of the world’s second-largest economy, which was the first country that was severely hit by COVID-19. After a slew of promising data, China’s Retail Sales figures and Industrial production were heavily eyed to gauge the momentum.

While China recorded a better-then-expected increase in industrial output of 3.9% in April, Retail Sales fell short of expectations at -7.5%. It reiterated the reality that getting customers to spend post-lockdown is proving to be a challenge.

Reserve Bank of New Zealand

Aside from the Fed’s speech, the Reserve Bank of New Zealand was also making headlines. While it was widely expected that the RBNZ will keep the Official Cash Rate at 0.25%, the surprising elements were the RBNZ’s willingness to reduce the cash rate further if and when required and expand the quantitative easing programme potential to $60 billion, up from the previous $33 billion limits.

The Kiwi retreated below 60 US cents after the central bank left the door open for negative interest rates while doubling the bond-buying purchases. As of writing, the New Zealand dollar is poised to finish the week as the worst performer of the G10 currencies against the greenback.

Haven Appeal

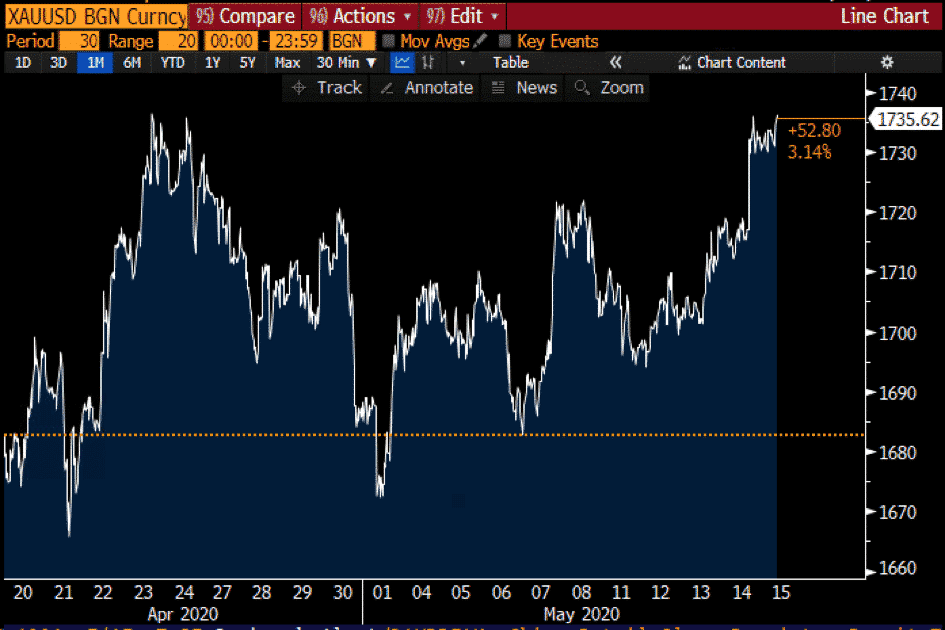

As risk sentiment deteriorates, the traditional safe-haven assets edged higher. The US dollar strengthened against major currencies. The index tracking the performance of a basket of currencies against the greenback reclaimed the 100 level.

Source: Bloomberg Terminal

Amid a risk-off environment and geopolitical tensions, gold rallied to $1,735 despite a stronger US dollar.

XAUUSD

Source: Bloomberg

By Deepta Bolaky

| Monday, 18 May 2020 Indicative Index Dividends Dividends are in Points |

||||||

| ASX200 | WS30 | US500 | US2000 | NDX100 | CAC40 | STOXX50 |

| 2.099 | 8.848 | 0.337 | 0.049 | 0 | 0 | 1.527 |

| ESP35 | ITA40 | FTSE100 | DAX30 | HK50 | JP225 | INDIA50 |

| 0 | 145.771 | 0 | 0 | 12.835 | 0 | 0 |

Disclaimer: Articles and videos from GO Markets analysts are based on their independent analysis. Views expressed are of their own and of a ‘general’ nature. Advice (if any) are not based on the reader’s personal objectives, financial situation or needs. Readers should, therefore, consider how appropriate the advice (if any) is to their objectives, financial situation and needs, before acting on the advice. For more information on trading, check out our CFD trading courses.

Next: Week Ahead – A War of Words Amid the Reopening

Previous: Week Ahead – The Reopening of the Plunging Economies