- Home

- News & Analysis

- Weekly Summaries

- Week Summary – US Stimulus & Politics, Brexit and COVID-19

Week Summary – US Stimulus & Politics, Brexit and COVID-19

October 16, 2020By Deepta Bolaky

It was another wild week driven by geopolitics and COVID-19 updates. Risk sentiment remains fragile dragged by the chaotic US stimulus negotiations, Brexit woes and the resurgence of coronavirus cases in some parts of the world while vaccine trials suffered major setbacks.

Stock Market – The Tweet

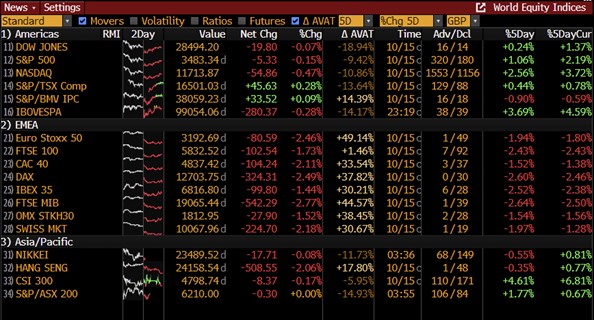

In a pandemic-induced environment where second waves of coronavirus are recorded in certain parts of the world, investors are mostly concerned on the amount of stimulus being put in the financial markets to support the global economy and the expectations of a vaccine to allow global activities to resume to normal levels.

This week was a reminder that more stimulus in the US before the election is highly unlikely and that there might be further delays in the race of a potential COVID-19 vaccine. Global equities went on a roller coaster ride swinging from losses to gains amid a risk-on and risk-off environment.

Source: Bloomberg

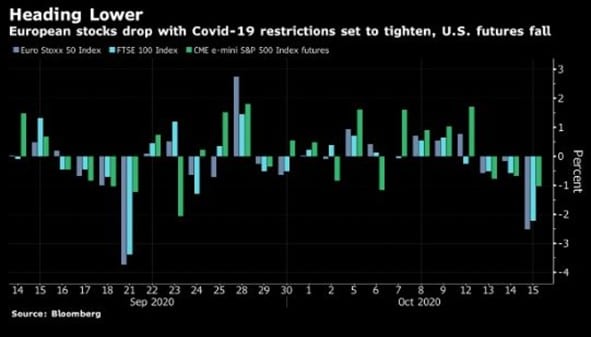

European stocks fell deeper as more restrictions across European regions loom.

On the earnings front, the third-quarter earnings season kicked off with major US banks. In an ultra-low interest rates environment, the financial industry is struggling faced by a series of pressures triggered by the ongoing pandemic crisis. Over the months, banks had made significant provisions for credit losses and saw major declines in asset management revenues.

- JP Morgan and Citigroup beat expectations and reported a surge in trading in financial markets. The banks have also slowed the pace of provisions for bad debts.

- Bank of America and Wells Fargo’s corporate results were disappointing as they saw a profit hit.

- Goldman Sachs posted a surge in quarterly profit. The firm’s quarterly results reflected strong net revenues of $10.78 billion, record quarterly diluted EPS of $9.68 and annualized ROE of 17.5%, the highest quarterly ROE since 2010. Investment Banking generated quarterly net revenues of $1.97 billion, including the second-highest quarterly net revenues in Equity underwriting.

- Morgan Stanley’s net revenues were up 16% and net income up 25%, reflecting strength across all business segments with a stronger-than-expected trading profit.

Forex Market

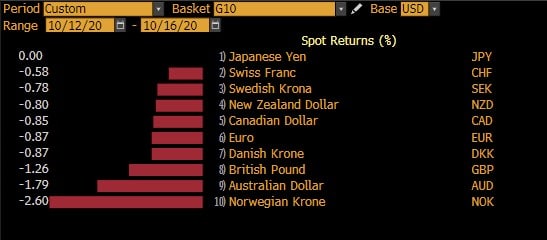

In the forex market, the US dollar is regaining strength against major G10 currencies lifted by the risk-off sentiment. Amid a relatively subdued economic calendar, safe-haven currencies like the greenback and the Japanese Yen were better bid as major pairs were mostly left at the broader sentiment of the markets.

Source: Bloomberg

Aussie Dollar – Rate Cut Calls and Employment data

The Aussie dollar traded mostly on the backfoot this week dragged by elevated tensions with China, mixed employment data and the calls for a November rate cut.

The jobs data were not as drastic as expected but may still be a driving factor for a rate cut next month. Employment fell by 30,000 people in September and the unemployment rate has risen slightly higher to 6.9% from 6.8% instead of the 7.1% predicted. Victoria has seen most of the job losses given the currency lockdown restrictions.

All in all, the unemployment figures do not account for the people formally employed under the JobKeeper program but which are not actively working.

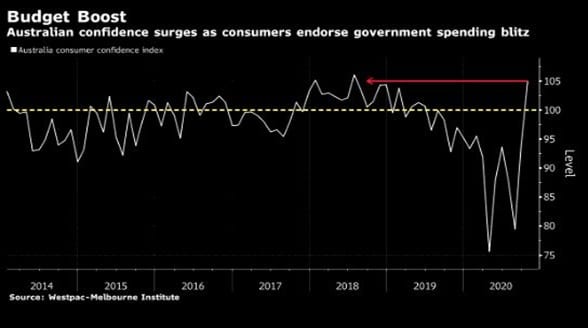

However, on the bright side, Australian confidence seems to surge with the new Budget as consumers validate the government spending blitz.

As of writing, the AUDUSD pair is currently trading around the 0.70 level.

Source: GO MT4

British Pound – Brexit and Economic data

The British Pound remained underpinned by Brexit woes. The currency found some relied on the news that Brexit talks will extend beyond the self-imposed deadline by the UK Prime Minister on October 15. After rallying above the 1.30 level, the GBPUSD pair fell to the 1.28 level.

On the economic front, employment reports were mixed:

- For June to August 2020, the estimated UK unemployment rate for all people was 4.5%; this is 0.6 percentage points higher than a year earlier and 0.4 percentage points higher than the previous quarter

- Growth in average total pay (including bonuses) among employees for the three months June to August was unchanged from a year ago, while regular pay (excluding bonuses) growth was positive at 0.8%.

Source: GO MT4

Oil Market

Crude oil prices found support on upbeat Chinese imports data, bullish weekly reports and October’s Oil Market Report by the IEA:

- As per the October report, volumes of crude oil held in floating storage fell sharply by 70 mb (2.33 mb/d) to 139.1 mb in September. The IEA is also predicting a significant stock draw in the fourth quarter.

- The API report has shown that crude oil stock fell from previous 0.951M to -5.42M in the week ending October 9.

- As per the EIA, crude oil stocks change in the US was -3.8 million barrels in the week ending October 9th.

However, the World Energy Outlook 2020 report released earlier this week reiterates the struggles of the energy market in the coming years:

- The Covid-19 pandemic has caused more disruption to the energy sector than any other event in recent history, leaving impacts that will be felt for years to come.

- The shadow of the pandemic looms large: “Global energy demand rebounds to its pre-crisis level in early 2023 in the STEPS, but this is delayed until 2025 in the event of a prolonged pandemic and deeper slump, as in the DRS.

- In the Sustainable Development Scenario (SDS), a surge in clean energy policies and investment puts the energy system on track to achieve sustainable energy objectives in full, including the Paris Agreement, energy access and air quality goals.

- The new Net Zero Emissions by 2050 case (NZE2050) extends the SDS analysis. A rising number of countries and companies are targeting net-zero emissions, typically by midcentury.

As of writing, WTI Crude oil (Nymex) and Brent Crude (ICE) were trading around $40.82 and $42.99 respectively.

Gold

The precious metal remains driven by stimulus negotiations and the movement of the US dollar. The XAUUSD pair swung between losses and gains across the week. As of writing, the pair has reclaimed the key psychological level of $1,900 level.

Source: GO MT4

Key Upcoming Events

- Business NZ PMI (New Zealand)

- European Council Meeting and Consumer Price Index (Eurozone)

- IMF Meeting, Retail Sales, Industrial Production and Michigan Consumer Sentiment Index (US)

By Deepta Bolaky

| Monday, 19 October 2020 Indicative Index Dividends Dividends are in Points |

||||||

| ASX200 | WS30 | US500 | US2000 | NDX100 | CAC40 | STOXX50 |

| o | 0 | o | 0.005 | 0 | 0 | 0 |

| ESP35 | ITA40 | FTSE100 | DAX30 | HK50 | JP225 | INDIA50 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Disclaimer: The articles are from GO Markets analysts, based on their independent analysis or personal experiences. Views or opinions or trading styles expressed are of their own; should not be taken as either representative of or shared by GO Markets. Advice (if any), are of a ‘general’ nature and not based on your personal objectives, financial situation or needs. You should therefore consider how appropriate the advice (if any) is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next: Week Ahead: US Election Polls, Central Bank Speeches, and Flash PMIs

Previous: Week Ahead: 2020 US Election Remains The Key Market Theme