- Home

- News & Analysis

- Weekly Summaries

- Vaccine distribution, ECB, EU Summit, Brexit, and US stimulus talks

Vaccine distribution, ECB, EU Summit, Brexit, and US stimulus talks

December 7, 2020By Deepta Bolaky

Amid the optimism related to vaccine approvals and distributions, Europe will stand out this week with a busy economic calendar – ZEW surveys, ECB interest rate decision and the EU Summit.

Equity markets

Investors are closely watching countries and their immunisation program. Russia has already begun vaccinations and the UK plans to roll out vaccinations this week. Global equities have remained well-supported by the positive vaccine updates which are creating hopes of a return to normality.

US vaccinations

The United States is also waiting for the FDA’s approval of the vaccine created by Pfizer and BioNTech which is scheduled to come on Thursday.

US stimulus talks

The softer job growth seen on Friday has spurred speculations that fiscal and monetary policy will be needed to stimulate the economy. Nonfarm payroll employment rose by 245k, below the expectations of 469k and unemployment rate edged down to 6.7% from 6.9%. Investors are taking note of the renewed efforts to strike a deal before the year ends. We expect stimulus talks to dominate headlines and drive risk sentiment.

Brexit

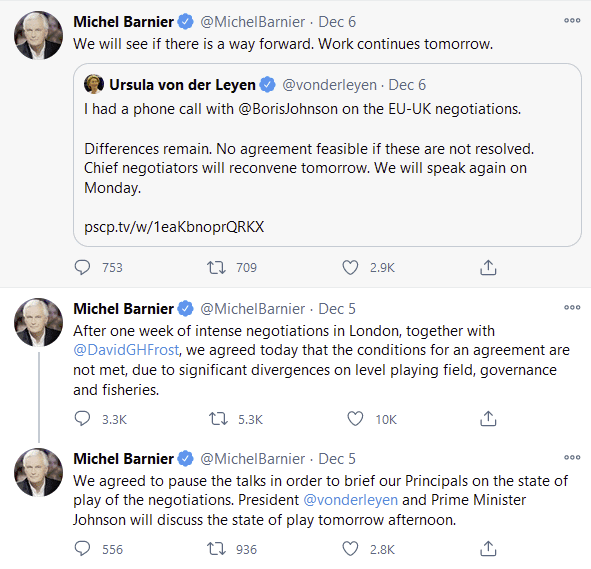

With only a few weeks to go before the transition period ends, Brexit talks have reached an important turning point. The UK and the European Union is yet to agree on a deal with major disagreements arising on a fair deal on fisheries. Over the weekend, both the EU’s Brexit negotiator, Michel Barnier and EU’s Commission leader, Ursula von der Leyen tweeted about the lack of progress on key issues.

The negotiations are planned to continue on Monday and we can expect Brexit talks to bring more volatility to the stock market as the 31 December deadline is looming.

Key economic data to watch

ECB rate statement

The renewed lockdowns across the European regions have dampened the economic rebound seen after the first wave of the coronavirus outbreak. The immediate attention will be on the more easing monetary measures of further expansion of the Pandemic Emergency Asset Purchase program to support the economy given the stalemate on the fiscal side.

EU Summit

EU leaders will meet on Thursday and Friday to discuss the budget. The row between Hungary and Poland with the European Union over the massive budget and recovery package are clouding the prospects of a deal at the summit at a time where member states. All eyes will be on the EU leaders to find a compromise on the conditionality clause.

UK – busy Thursday

On Thursday, Manufacturing and Industrial Production along with GDP figures will be released and assessed against the recent lockdown amid a week of intense Brexit negotiations and the rolling out of the Pfizer and BioNTech vaccine.

Commodities

Oil – Oil Production Compromise Deal

The oil industry has remained pressurized by a supply glut and the ongoing uncertainty on the demand outlook with respect to the structural changes in the energy market and the pandemic. The recent vaccine updates have been providing support to a fundamentally battered energy market. On the supply side, the oil market welcomed the compromise reached by the OPEC members and its allies. Overall, in light of the current oil market fundamentals and the outlook for 2021, the OPEC+ agreed to reconfirm the existing commitment from 12 April 2020, then amended in June and September 2020, to gradually return 2 mb/d, given consideration to market conditions. Also, beginning in January 2021, participating countries decided to voluntarily adjust production by 0.5 mb/d from 7.7 mb/d to 7.2 mb/d.

Last week, crude oil prices firmed higher buoyed by the compromise deal despite this week’s bearish oil reports. As of writing, WTI Crude oil (Nymex) and Brent Crude (ICE) were trading at around $46.09 and $49.12 respectively. Traders will likely keep monitoring weekly oil reports and vaccine updates for fresh trading impetus.

Gold

The precious metal has a rough ride for the past few weeks following positive vaccine updates and the US stimulus gridlock. The XAUUSD pair managed to reclaim the $1,800 mark last week on renewed hopes around the stimulus talks. As of writing, the XAUUSD pair is currently trading around $1,836. The stimulus negotiations will likely remain the primary driver for the yellow metal.

Key events ahead

Monday

- RBA’s Governor Lowe Speech (Australia)

- Trade Balance, Exports, and Imports (China)

- Leading Economic Index (Japan)

- Industrial Production (Germany)

- Ivey Purchasing Managers Index (Canada)

Tuesday

- Overall Household Spending, Current Account, and Gross Domestic Product (Japan)

- BRC Like-for-Like Retail Sales (UK)

- House Prices Index (Australia)

- Unemployment Rate (Switzerland)

- ZEW Survey – Economic Sentiment and Gross Domestic Product (Eurozone)

- ZEW Survey – Economic Sentiment and Current Situation (Germany)

- Nonfarm Productivity and Unit Labor Costs (US)

Wednesday

- Westpac Consumer Confidence (Australia)

- Consumer and Producer Price Index (China)

- Trade Balance (Germany)

- BoC Rate Statement and Interest Rate Decision (Canada)

Thursday

- European Council Meeting (Eurozone)

- Consumer Inflation Expectations (Australia)

- Manufacturing & Industrial Production, and Gross Domestic Product (UK)

- ECB Interest & Deposit Rate Decision and ECB Monetary Policy Statement and Press Conference (Eurozone)

- Consumer Price Index, Jobless Claims, and Monthly Budget (US)

- REINZ House Price Index and Business NZ PMI (New Zealand)

Friday

- European Council Meeting (Eurozone)

- Financial Stability Report (UK)

- Harmonized Index of Consumer Prices (Germany)

- Foreign Direct Investment (China)

- Producer Price Index, Michigan Consumer Sentiment Index and COVID-19 Vaccine Announcement (US)

By Deepta Bolaky

| Tuesday, 08 November 2020 Indicative Index Dividends Dividends are in Points |

||||||

| ASX200 | WS30 | US500 | US2000 | NDX100 | CAC40 | STOXX50 |

| 0 | 0 | 0.097 | 0.008 | 0.186 | 0 | 0 |

| ESP35 | ITA40 | FTSE100 | DAX30 | HK50 | JP225 | INDIA50 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Disclaimer: The articles are from GO Markets analysts, based on their independent analysis or personal experiences. Views or opinions or trading styles expressed are of their own; should not be taken as either representative of or shared by GO Markets. Advice (if any), are of a ‘general’ nature and not based on your personal objectives, financial situation or needs. You should therefore consider how appropriate the advice (if any) is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next: Vaccine updates, Brexit, EU budget and IPOs

Previous: First vaccine approval, OPEC deal , Brexit & US stimulus hopes