- Home

- News & Analysis

- Weekly Summaries

- The Pandemic and Geopolitical Risks

The Pandemic and Geopolitical Risks

July 10, 2020By Deepta Bolaky

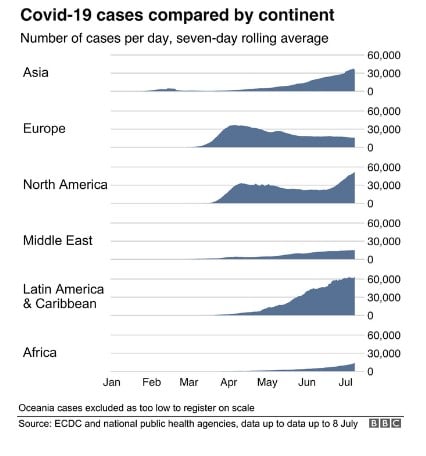

Virus Cases Continue to Surge

Earlier this week, the WHO warned that “the outbreak is accelerating and we have clearly not reached the peak of the pandemic”. There have now been 12.4 million cases of COVID-19 and more than 557,000 lives have been lost. Latin America & Caribbean, North America and Asia are seeing an increase in the number of cases.

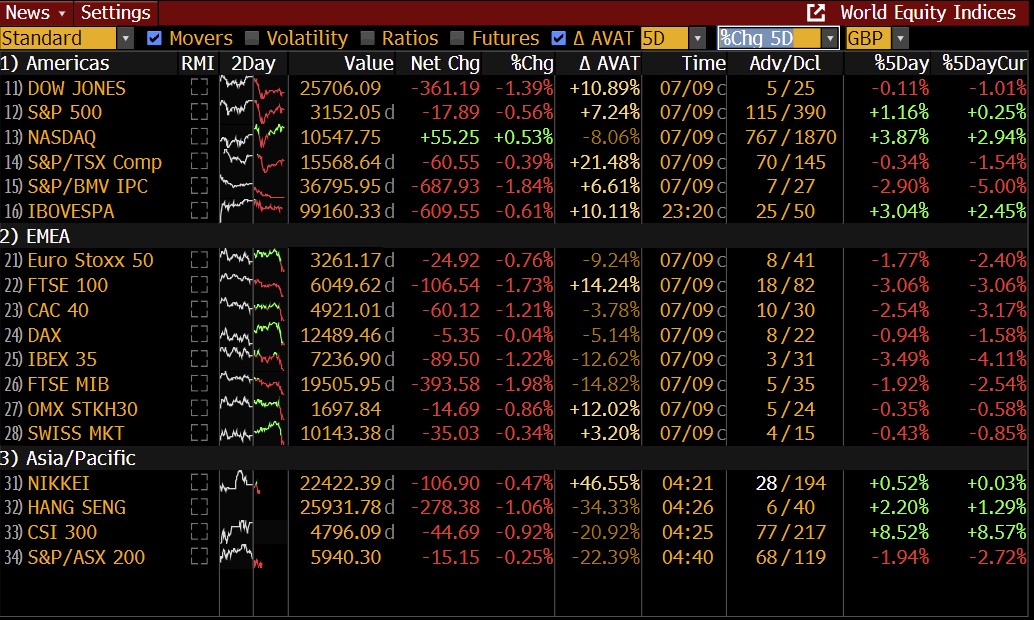

Stock Market – Swings

Global stocks swung between gains and losses this week as doubts of economic recovery resurfaced following the rising number of coronavirus cases. The stock market is finding support from improving economic data, extremely loose monetary policies and massive government spending plans but the pandemic remains a key concern.

Wolrd Equity Indices

Source: Bloomberg

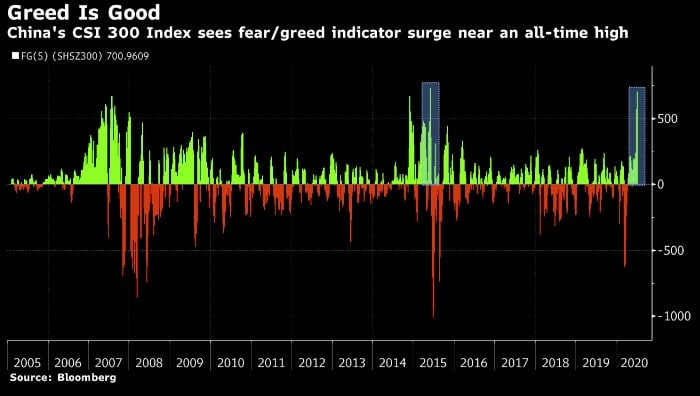

Chinese Stocks

This week we have seen a surge in the demand for Chinese stocks as the state media encourages inventors to put their money into equities. The CSI 300 is among the few that have performed well despite the volatility in risk sentiment.

Source: Bloomberg

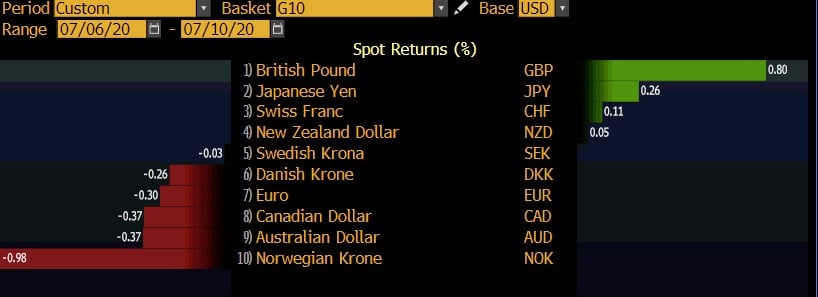

Forex Market

In the forex market, major currencies were mixed against the US dollar.

Amid a subdued economic calendar, much attention was focused on the COVID-19 cases and geopolitical themes. The greenback managed to intermittently edge higher lifted by concerns of a second outbreak and geopolitical tensions. Other safe-haven currencies like the Japanese Yen and Swiss franc also found some upside momentum.

Source: Bloomberg Terminal

The British Pound scaled higher this week bolstered by Brexit-related headlines and Chancellor Rishi Sunak’s recovery plan:

- Useful discussion (and nice dinner!) with David Frost last night. The team will continue negotiating in good faith today. We are working hard for a fair agreement with the, including on fisheries and a level playing field.

- The Chancellor announced a package of measures to support jobs in every part of the country, give businesses the confidence to retain and hire, and provide people with the tools they need to get better jobs.

A possible Brexit breakthrough and the recovery plan has helped the GBPUSD pair to rally to a high of 1.2669 before retreating lower on the recent comments of Michel Barnier. The Chief negotiator confirmed that there are still significant divergences between the EU and the UK.

Source: GO MT4

Oil Market

Crude oil prices struggled to find upside momentum following bearish oil reports and a fragile risk sentiment:

- The API reported a build of 2 million barrels in crude oil inventories

- The Energy Information Administration reported a rise of 5.7 million barrels of crude oil in the week to July 3

As of writing, WTI Crude oil (Nymex) and Brent Crude (ICE) were trading lower at $39.38and $42.16, respectively.

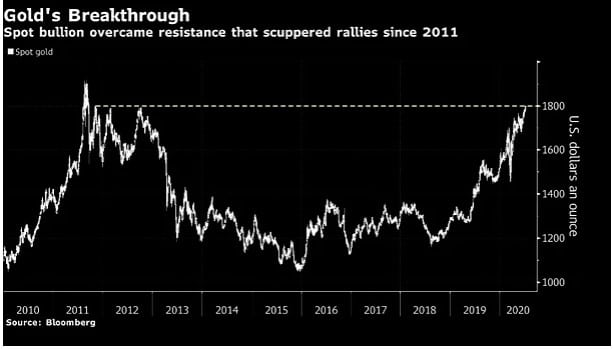

Gold

The uncertain environment drove Gold to $1,800 for the first time since 2011. The XAUUSD pair hit a high of $1,818 before retreating lower. The doubts of economic recovery following the resurgence of virus cases remain the primary factor of caution for markets which will continue to support the precious metal. As of writing, the XAUUSD pair were still trading at multi-year high slightly above the $1,800 mark.

Source: Bloomberg Terminal

By Deepta Bolaky

Key Upcoming Events

- EcoFin Meeting (Eurozone)

- Producer Price Index (US)

- Unemployment Rate, Participation Rate, Average Hourly Wages, and Net Change in Employment (Canada)

| Monday, 13 July 2020 Indicative Index Dividends Dividends are in Points |

||||||

| ASX200 | WS30 | US500 | US2000 | NDX100 | CAC40 | STOXX50 |

| 0 | 0 | 0 | 0.005 | 0 | 0 | 0 |

| ESP35 | ITA40 | FTSE100 | DAX30 | HK50 | JP225 | INDIA50 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0.72 |

Disclaimer: Articles and videos from GO Markets analysts are based on their independent analysis. Views expressed are of their own and of a ‘general’ nature. Advice (if any) are not based on the reader’s personal objectives, financial situation or needs. Readers should, therefore, consider how appropriate the advice (if any) is to their objectives, financial situation and needs, before acting on the advice. For more information of trading, check out our forex trading courses.

Next: Week Ahead: Earnings Season

Previous: Week Ahead: COVID-19: Crucial Days Ahead