- Home

- News & Analysis

- Weekly Summaries

- Eyes on NFP and US Stimulus Package

Eyes on NFP and US Stimulus Package

August 7, 2020By Deepta Bolaky

Investors weighed the positives against the negatives this week. Economic data and earnings reports brought reassurance while the US stance on Chinese companies – TikTok and Wechat sparked fears that the tensions between the two countries may spiral into a new cold war.

As the week comes to an end, attention will switch to Nonfarm Payrolls and negotiations on the second coronavirus package.

Stock Market – Swings

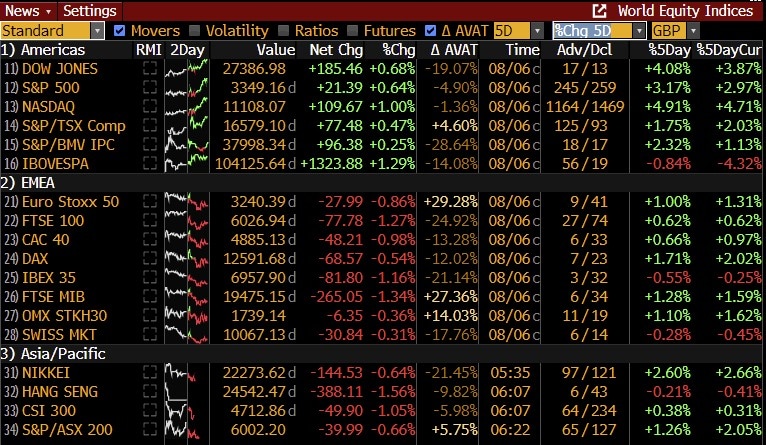

The improvement in the economic data continues to provide support to the stock market despite the mounting number of COVID-19 cases. European bourses underperformed compared to their US counterparts following further travel restrictions, mixed earnings reports and a cautious BoE.

Wolrd Equity Indices

Source: Bloomberg

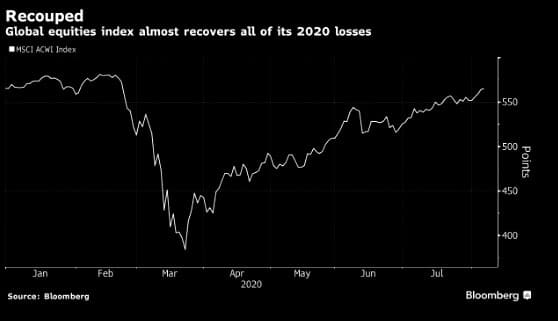

Global equities index almost recovers all of its 2020 losses on the back of the amount of stimulus being injected in the pandemic-induced economy. As the week comes to an end, investors are eyeing the US stimulus package following hopes that the Congress will agree on the second round of stimulus before the month-long break.

Source: Bloomberg

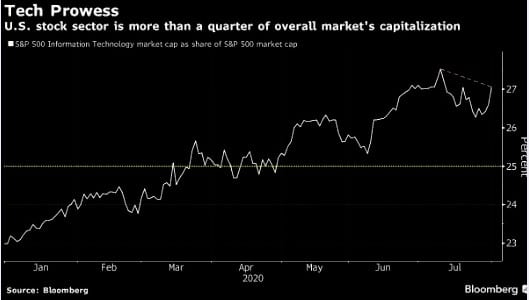

The US tech sector continues to outperform reiterating the resilience of the large-cap tech companies. The future gains in the stock market will likely be dependent on Fed policies and Congress’ fiscal stimulus policies.

Source: Bloomberg

One company which drew attention this week was Sea Ltd. The leading internet platform in Southeast Asia and Taiwan outshines Tesla and the FAANg group of companies and emerges as the world’s best performing large-cap stock.

Source: Bloomberg

Forex Market

In the forex market, major currencies were stronger against the US dollar. The greenback struggled to find an upside momentum dragged by concerns over the mounting number of infections, uncertainty around the next round of stimulus package and escalating tensions between the US and China. Higher-yielding currencies are amongst the best performers.

Source: Bloomberg Terminal

On the economic front, investors were pleased with the improvement in the manufacturing sector:

- ISM manufacturing index can better-than-expected at 54.2 vs. 53.6 estimates. This figure indicates expansion in the overall economy for the third month in a row after a contraction in April, which ended a period of 131 consecutive months of growth.

- Germany Markit manufacturing PMI registered 51.0 in July, up from 45.2 in June. This was the first reading above the 50.0 no-change mark since December 2018 and represented a further recovery from April’s recent low of 34.5, recorded at the height of lockdown measures related to the COVID-19 outbreak.

- The euro area’s manufacturing economy recorded its first growth in a year-and-a-half during July as output and demand continued to recover in line with the further easing of restrictions on activity related to the global coronavirus disease (COVID-19). After accounting for seasonality, the IHS Markit Eurozone Manufacturing PMI®registered 51.8, up from 47.4 in the previous month and an improvement on the earlier flash reading.

- Canadian manufacturers signalled a rebound in production volumes at 52.9 in July, up from 47.8 in June. The index registered is the first expansion for the first time in five months. The rebound was led by improving customer demand as more parts of the economy reopen after stoppages during the pandemic.

However, in the face of new lockdown restrictions, investors will likely keep monitoring the data over a couple of weeks to assess if there is any reversal in the recovery. In the US, ADP jobs report shows that the private sector added only 167,000 jobs in July which may be a sign that the US economic recovery may be at risk of reversing:

The US dollar remained on the backfoot against its counterparts ahead of the much-awaited Nonfarm Payroll report.

Oil Market

Crude oil prices edged higher on promising manufacturing data and bullish weekly oil reports:

- API weekly crude oil stock declined to -8.587M in July 31 from previous -6.829M

- U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 7.4 million barrels from the previous week.

As of writing, WTI Crude oil (Nymex) and Brent Crude (ICE) were trading higher at $41.71 and $44.88, respectively following the turnaround in risk sentiment.

Gold

Gold reached a new milestone. Fears of a second outbreak and new forms of travel restrictions are overshadowing the recovery outlook. Gold is on an unstoppable rally despite the improvement in the economic data. Virus woes and escalating tensions between the US and China over the executive order to ban Chinese companies, TikTok and WeChat are forcing investors to seek some safety with safe-haven assets like gold.

The precious metal is set for the best weekly run in more than a decade. After reaching a high of $2,072.25 earlier this week, the XAUUSD pair is currently trading just below the $2,060 mark.

Source: Bloomberg

Where is the next target level?

Source: Bloomberg

By Deepta Bolaky

Key Upcoming Events

- Nonfarm Payrolls, Average Hourly Earnings, Labour Force Participation Rate, U6 Underemployment Rate and Unemployment Rate (US)

- Unemployment Rate, Participation Rate, Average Hourly Wages, Net Change in Employment, and Ivey Purchasing Managers Index (Canada)

| Monday, 10 August 2020 Indicative Index Dividends Dividends are in Points |

||||||

| ASX200 | WS30 | US500 | US2000 | NDX100 | CAC40 | STOXX50 |

| 0 | 0 | 0.045 | 0.027 | 0.192 | 0 | 0 |

| ESP35 | ITA40 | FTSE100 | DAX30 | HK50 | JP225 | INDIA50 |

| 0 | 0 | 0 | 0 | 0 | 0 | |

Disclaimer: Articles and videos from GO Markets analysts are based on their independent analysis. Views expressed are of their own and of a ‘general’ nature. Advice (if any) are not based on the reader’s personal objectives, financial situation or needs. Readers should, therefore, consider how appropriate the advice (if any) is to their objectives, financial situation and needs, before acting on the advice. For more information of trading, check out our forex trading courses.

Next: COVID-19 Cases in Europe, Tech War, Industrial and Sales Updates

Previous: Covid-19: Economic Damage and Central Banks Decisions