- Home

- News & Analysis

- Weekly Summaries

- Week Ahead: Central Bank Minutes, Australian Budget, US Fiscal Stimulus Package and President Trump’s Illness

Week Ahead: Central Bank Minutes, Australian Budget, US Fiscal Stimulus Package and President Trump’s Illness

October 5, 2020By Deepta Bolaky

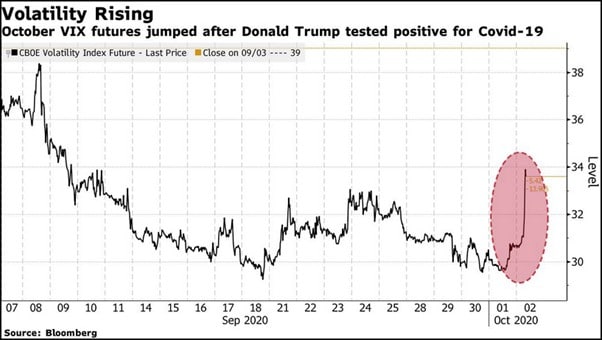

After a scary month of September for investors, global risk sentiment will likely remain fragile. The immediate attention this week will fall on the health updates of President Trump and the US fiscal stimulus package.

Equity Markets

Global equities went on a wild ride and saw some major corrections in September. Geopolitical tensions, Brexit woes, US stimulus gridlock, the uncertainty about the economic recovery, fears of a second coronavirus outbreak and a tech rout in the stock market have created an environment of caution.

US Presidential Election

After President Donald Trump tweeted that he and the first lady had been tested positive for COVID-19, US stocks sold off in a volatile trading session. Market participants are trying to evaluate the impact of the election campaign. After the first presidential debate last week, former Vice President Joe Biden might have gained slightly more in the polls. However, the calendar for further debates is in jeopardy given that President Trump has contracted the coronavirus.

US Fiscal Stimulus Package

Aside from the most-awaited political event of the year, the focus will remain on the stimulus package. Both parties were a bit more optimistic on Friday that a deal needs to get done. The US stock market will likely remain underpinned by the stimulus gridlock as investors note that more can only be done through fiscal support following the Fed’s recent comments.

Various Forms of Restrictions

As COVID-19 cases surge, many countries or cities are imposing various forms of lockdowns or restrictions. European cities are seeing a rise in the number of COVID cases which are prompting leaders to institute some forms of lockdown measures. Investors are likely to monitor the resurgence of the novel coronavirus and the measures being taken to gauge the severity of the lockdowns again.

Key Economic Data to Watch

In the FX space, the renewed hope of stimulus in the US has tamed down the demand for haven currencies. The US dollar and the Japanese Yen retreated to the downside while riskier currencies closed higher.

Source: Bloomberg

The US Dollar

Last week, the downbeat September jobs report provided little support to the US dollar. The currency kickstarted this week on the back foot following the contradictory reports on the President’s health over the weekend. Looking ahead, the Fed minutes, stimulus package and President Trump’s health updates will be the key drivers for the price action of the greenback.

The Antipodeans

The Antipodeans currencies which were recently dampened by the dovish comments from the respective central banks were among the best performers last week. Amid a relatively busy calendar, the AUD traders will be eyeing the RBA interest rate decision and the Budget. Even though there were talks about the various options for monetary policies which include further rate cuts or negative interest rates, no changes to monetary policies are expected at this meeting.

The RBA will likely await for the Australian Budget to see the support on the fiscal side before their next move.

The Pound

The latest positive headlines around the Brexit deal has helped the Pound to climb higher. However, traders will likely keep monitoring the various forms of regional lockdowns in the UK due to rising coronavirus cases. On the economic front, the GDP print this Friday will be of utmost importance.

Commodities

Oil

Crude oil prices remain underpinned by the growing concerns over the demand outlook. As of writing, WTI Crude oil (Nymex) and Brent Crude (ICE) were trading around $37.64 and $39.77 respectively. The most relevant event for the energy markets this week will be the Short Term Energy Outlook which will be released by the EIA on Tuesday.

Gold

Recently, a strengthening US dollar has put additional downward pressure on the precious metal despite the geopolitical and economic uncertainties. The gold plummeted below the key psychological level of $1,900.

Towards the end of last week, the XAUUSD pair reclaimed the $1,900 mark after the announcement of President Trump being hospitalised. Gold traders will be looking for the Fed minutes, updates on the US President health, US stimulus package and the coronavirus shutdowns/restrictions in major countries for fresh trading impetus.

Key Events Ahead

Monday

- Commonwealth Bank Services PMI and TD Securities Inflation (Australia)

- Eurogroup Meeting, Markit PMI Composite and Retail Sales (Eurozone)

- Markit Services PMI (Germany)

- BoE’s Haldane Speech (UK)

- Markit Services PMI & Composite, ISM Services New Orders, PMI, Employment Index and Prices Paid (US)

Tuesday

- NZIER Business Confidence and GDT Price Index (New Zealand)

AiG Performance of Construction Index, Imports, Exports, Trade Balance, RBA Interest Rate Decision & Statement and Budget Release (Australia) - BRC Like-For-Like Retail Sales (UK)

- Factory Orders (Germany)

- Trade Balance and Fed’s Chair Powell Speech (US)

Wednesday

- Leading economic Index (Japan)

- Industrial Production (Germany)

- ECB’s Lagarde Speech (Eurozone)

- Ivey Purchasing Managers Index (Canada)

- FOMC Minutes and Fed’s Williams Speech (US)

Thursday

- Current Account (Japan)

- Unemployment Rate and SNB’s Chairman Jordan speech (Switzerland)

- Trade Balance (Germany)

- ECB’s Mersch Speech and Monetary Policy Meeting Accounts (Eurozone)

- Jobless Claims (US)

- BoC’s Governor Macklem Speech (Canada)

Friday

- Overall Household Spending (Japan)

- Caixin Services PMI (China)

- Manufacturing & Industrial Production, Gross Domestic Product and NIESR GDP Estimate (UK)

- Unemployment Rate, Participation Rate, Average Hourly, Net Change in Employment (Canada)

- BoE’s Haldane Speech (UK)

By Deepta Bolaky

| Tuesday, 06 October 2020 Indicative Index Dividends Dividends are in Points |

||||||

| ASX200 | WS30 | US500 | US2000 | NDX100 | CAC40 | STOXX50 |

| 0 | 0 | 0.134 | 0.033 | 1.035 | 0 | 0 |

| ESP35 | ITA40 | FTSE100 | DAX30 | HK50 | JP225 | INDIA50 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Disclaimer: The articles are from GO Markets analysts, based on their independent analysis or personal experiences. Views or opinions or trading styles expressed are of their own; should not be taken as either representative of or shared by GO Markets. Advice (if any), are of a ‘general’ nature and not based on your personal objectives, financial situation or needs. You should therefore consider how appropriate the advice (if any) is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next: Week Summary – Back-and-Forth on Stimulus

Previous: Week Ahead: Reasons for Being Cautious