- Home

- News & Analysis

- GO Daily News

- Overnight on Wall Street: Wednesday 21 October 2020

Overnight on Wall Street: Wednesday 21 October 2020

October 21, 2020By Deepta Bolaky

@DeeptaGOMarkets

Equity Markets

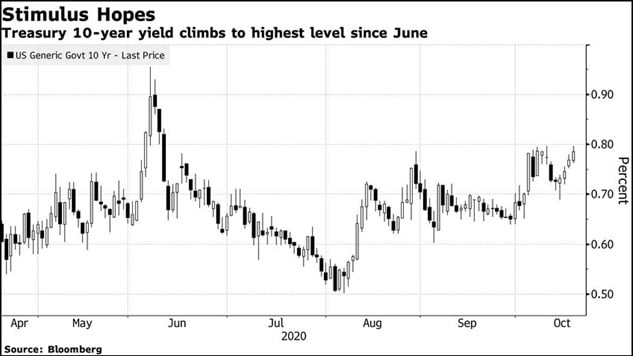

The stock market continues to be driven by hopes of US stimulus leading up to the most-awaited political event of the year. Global equities were mixed on Tuesday as stimulus chaos, Brexit woes, and virus concerns continue to rattle the financial markets.

Major US equity indices climbed higher on the hopes of an agreement but the momentum faded towards the last hours of trading where investors took note of no concrete progress towards the end of the day.

- The Dow Jones Industrial Average gained 113 points or 0.4% to 28,309.

- S&P 500 rose by 16 points or 0.5% to 3,443.

- Nasdaq Composite added 38 points or 0.3% to 11,516.

Source: Bloomberg

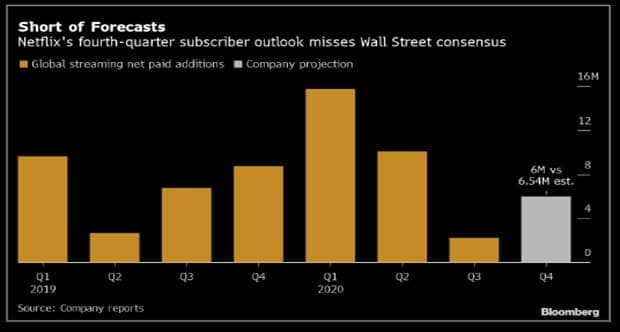

On the earnings front, major companies like Procter & Gamble, Snap Inc, and Phillips Morris International reported their quarterly results. However, the immediate attention was on the third-quarter 2020 financial results of Netflix released after market hours. The company’s share price fell by about 5% in extended trading hours as whilst the earlier quarter allowed the Company to beat the number of paid memberships in 2019 which was driven mostly by lockdowns – growth has slowed in the third quarter.

“Growth has slowed with 2.2m paid net adds in Q3 vs. 6.8m in Q3’19. We think this is primarily due to our record first half results and the pull-forward effect we described in our April and July letters. In the first nine months of 2020, we added 28.1m paid memberships, which exceeds the 27.8m that we added for all of 2019. In these challenging times, we’re dedicated to serving our members.”

Currency Markets

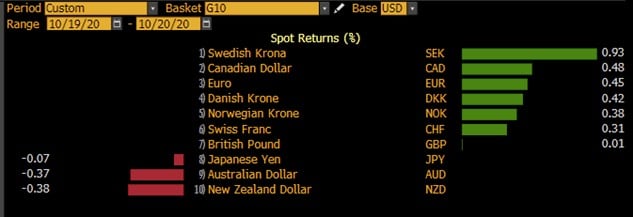

In the FX space, the US dollar edged lower as the day progressed with on and off optimistic tones towards the stimulus package. Amid a relatively subdued economic calendar, major currencies pairs were mostly driven by the broader sentiment of the markets.

Source: Bloomberg

The Canadian dollar and Euro were among the best performers against the greenback. The CAD rose higher mostly on the back of firmer commodity prices and a weaker US dollar.

The British Pound remained with familiar levels underpinned by Brexit woes while the Antipodeans underperformed following dovish central banks comments. The RBA minutes and assistant governor, Christopher Kent’s speech provided more insights on the debates of lowering interest rates without necessarily going into negative rates.

For the chart of the day, Adam Taylor takes a look at the DXY – Can the Dollar Rise To The Occasion?

The daily Ichimoku chart displayed mostly indecisive moves throughout August and printed a low of 91.74 last month. It seemed DXY essentially tip-toed sideways as the market attempted to factor in both the US election event and the second wave of COVID-19. As the current price resides within the cloud, this wavering sentiment appears unresolved and even slightly bearish.

Signs of Dollar weakness crept into this chart, most notably when the recent test of 94.74 failed at the top of the cloud. We also see DXY respecting September’s monthly pivot but then unable to find price stability, in the same manner, this month. If anything, the price appears to be clinging on to the cloud base for support instead.

Despite the negatives, it might not be all doom and gloom for the Dollar just yet. For starters, the cloud seems to be thinning towards the end of the year, representing less resistance for DXY should sentiment turn bullish.

It’s also worth remembering that there have only been two significant price highs in recent history. The first was back in 2016 at the time of the previous US election campaign and the second time occurred at the height of the pandemic this year. Could lightning strike twice?

Particularly as we approach the month of November, there is a potential scenario whereby both the US election and a full-blown second wave of the virus could coincide and ignite another Dollar rally. If so, the Index may target the 97.00 regions once clear of the resistance at 95.00. Alternatively, we may see these types of events cancel each other out, with the price grinding lower to 2018 lows around 88.00.

Either way, this chart will undoubtedly be one to keep on the radar.

Commodities

Crude oil prices posted some marginal gains on Tuesday despite much uncertainty on the demand outlook and downbeat API inventory report:

- 0.584 million barrels of stockpiles were added in the week ending October 16 compared to a draw of 5.42 in the previous release.

As of writing, WTI Crude oil (Nymex) and Brent Crude (ICE) were trading firmer at around $41.46 and $43.16 respectively.

Gold

Gold

Gold edged higher on the broad dollar weakness while traders await more updates on the stimulus front. As of writing, the XAUUSD pair is trading around $1,910.

Source: GO MT4

By Deepta Bolaky

Key upcoming events

- Westpac Leading Index (Australia)

- BoJ’s Sakurai Speech (Japan)

- Consumer Price Index, PPI Core Output, Retail Price Index and BoE’s Ramsden Speech (UK)

- ECB’s President Lagarde, Lane and De Guindos Speech (Eurozone)

- BoC Consumer Price Index and Retail Sales (Canada)

- Fed’s Brainard Speech and Beige Book (US)

- ECB’s De Guindos Speech (Eurozone)

| Thursday, 22 October 2020 Indicative Index Dividends Dividends are in Points |

||||||

| ASX200 | WS30 | US500 | US2000 | NDX100 | CAC40 | STOXX50 |

| 0 | 5.202 | 0.287 | 0.042 | 0 | 0 | 0 |

| ESP35 | ITA40 | FTSE100 | DAX30 | HK50 | JP225 | INDIA50 |

| 0 | 0 | 1.727 | 0 | 0 | 0 | 0.504 |

Disclaimer: The articles are from GO Markets analysts, based on their independent analysis or personal experiences. Views or opinions or trading styles expressed are of their own; should not be taken as either representative of or shared by GO Markets. Advice (if any), are of a ‘general’ nature and not based on your personal objectives, financial situation or needs. You should therefore consider how appropriate the advice (if any) is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next: Overnight on Wall Street: Thursday 22 October 2020

Previous: DXY – Can The Dollar Rise To The Occasion?