- Home

- News & Analysis

- Articles

- Trading Tools: Trading Central

Trading Tools: Trading Central

March 23, 2016Imagine having access to technical analysis across all the major markets, updated around the clock in real-time and of the same calibre that investment banks around the world receive daily.

Then consider having all your favourite Forex and Commodity markets analysed with a trade entry, exit, profit taking levels and a price projection.

And what if you could have the analysis running live on your MT4 charts providing trading opportunities throughout your trading day, allowing you to focus on your position sizing?

It may sound like a pipedream, but in fact, this is what you have sitting at your fingertips for those who qualify (don’t worry, qualification is quite simple). What we are talking about is the technical analysis service provided by the research house, Trading Central, and they have been helping traders with their service since 1999.

So who are Trading Central and how can they help me?

Trading Central is an independent and leading provider of financial research and technical analysis of financial products.

Their approach is simple yet very affective – they combine a technical analysis approach to determine price targets using a range of trading indicators.

They now provide their services to more than 100 global financial institutions in 30 countries around the globe.

We are proud to say we have partnered with Trading Central as a result of their proven track record in delivering high-quality analysis of the financial markets and in particular, they extensively cover the Forex and Commodity markets for qualified GO Markets clients.

Top 3 ways you can benefit from their research

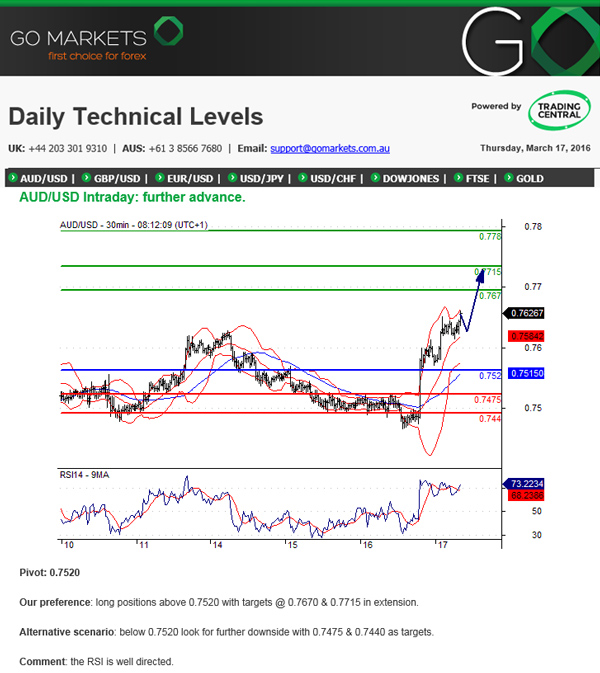

1. Daily Newsletters with trade alerts

Delivered twice a day, the daily Forex technical analysis email service provides you with visual and technical analysis newsletters that detail trading strategies, predictions, commentaries as well as key levels (support, resistance, target, stop pivots) on multiple time frames.

The newsletter provides short to medium term analysis on the following products: AUDUSD, EURJPY, EURUSD, GBPUSD, USDJPY, HANG SENG, SPI 200, & SPOT GOLD.

We regularly get feedback on how handy it is to have the key pivot points outlined clearly on each of the instruments they analyse.

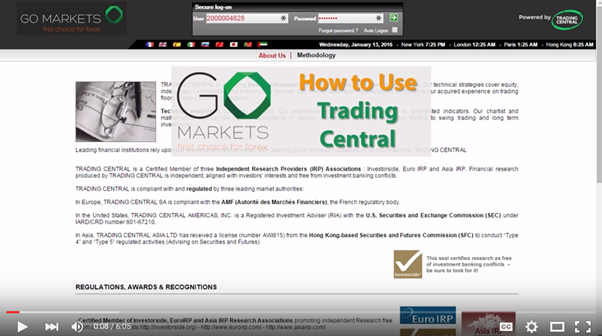

2. Web Portal / Research Platform

Access Trading Central’s global research directly through the Trading Central web portal. Receive up-to-the-minute technical analysis on forex, indices and precious metals as Trading Central provides updates throughout the trading day.

If you’re a regular technical analysis user who knows what you are looking for, the web portal is a quick and easy way to search for intra-day, short and mid-term updates. There’s a ‘search box’ for instant access, or you can select a report on individual asset classes (Indices, Forex and Commodities).

For those traders who have specific criteria, the web portal has pre-made filters allowing for a quick search and the ability to customise the screen. In addition, you are able to have instant access to the information that matters to you by creating a customizable watch list.

3. Technical Analysis Plug In

The Technical Analysis plug-in in MT4 is a user friendly interface offering actionable content and customizable timeframes, allowing traders to fill in orders and program trades based on levels provided by Trading Central.

The MT4 plugin displays Trading Central’s technical analysis strategies, views and market commentaries, as well as Trading Central’s key levels (support, resistance, targets, stop pivots) directly on your MT4 platform. It also allows you to execute orders directly from your MT4 charts based on the levels provided by Trading Central.

So whether you’re a novice or an experienced trader, Trading Central can be used to either provide original trade ideas, or provide a handy second opinion.

How to qualify to receive the Trading Central daily analysis for free

To get access to Trading Central, simply open a live trading account and deposit a minimum of $500. If you have an existing GO Markets trading account, please contact our Support Team.

If you have any questions, please email support@gomarkets.com or contact (03) 8566 7680.

The opinions and information conveyed in the GO Markets newsletter are the views of the author and are not designed to constitute advice. Trading Forex and CFD’s is high risk. Please read our PDS documents and smart trader guide to ensure that you fully understand the risks involved.

|

Next: Cross-Asset Morning Report APAC Feb 13th

Previous: Trading Opportunities from Japan's Shock Interest Rate Decision