- Home

- News & Analysis

- Shares and Indices

- Wall Street vs. Main Street

Wall Street vs. Main Street

January 29, 2021By Klavs Valters

It has been an eventful week over in the United States this week. Some of the major companies, including Microsoft, Apple, Facebook, and Tesla announced their latest earnings. The Federal Reserve kept their interest rates unchanged at 0.25%. We also saw the US GDP expand by 4% in Q4 of 2020. However, these were not the most talked-about events this week.

Major hedge-funds on Wall Street were left with huge losses after it bet against a struggling American gaming company GameStop by short-selling its shares.

What is short-selling?

Short-selling is when an investor speculates that a stock or security will fall in price in the future.

The investor borrows the stock or security from a broker and immediately sells it with the hope of buying it back at a lower price.

Gains from short selling are limited as a stock can only go to 0. The losses do not have a cap as there is no limit as to how high a stock’s price may jump.

What happened?

The ”short” bet did not pay off for the big players on Wall Street after amateur traders rallied together on social media sites to take on the hedge-funds and pump the price of gaming retailer GameStop to new levels.

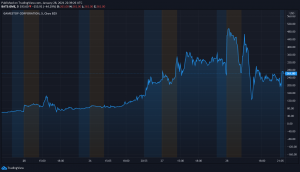

The share price of the GameStop has surged by over 1,550% this year alone after trading at $17 at the beginning of January. The stock ended the trading day at the $193 level on Thursday, rising up to the $261 level in post-market hours. The White House said it was ”monitoring” the latest price surge in GameStop and other stocks.

Hedge-funds and others that bet against GameStop have collectively lost more than $5bn, according to data analytics company S3.

Source: TradingView

It is an interesting time on Wall Street and it is definitely worth keeping an eye on the future developments moving forward.

By Klavs Valters

Disclaimer: The articles are from GO Markets analysts, based on their independent analysis or personal experiences. Views or opinions or trading styles expressed are of their own; should not be taken as either representative of or shared by GO Markets. Advice (if any), are of a ‘general’ nature and not based on your personal objectives, financial situation or needs. You should therefore consider how appropriate the advice (if any) is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next:

Previous: COTD: FTSE100