- Home

- News & Analysis

- Oil and Metals

- OPEC and G20 Meetings Not Guaranteed

OPEC and G20 Meetings Not Guaranteed

April 8, 2020By Deepta Bolaky

On 8 March 2020, Saudi Arabia initiated an oil price war with Russia, triggering a rout in the oil market at a time where the world is facing a pandemic and many countries forced to shut down their activities and borders. Crude oil prices have lost nearly half of their prices, battled by a simultaneous demand and supply shock.

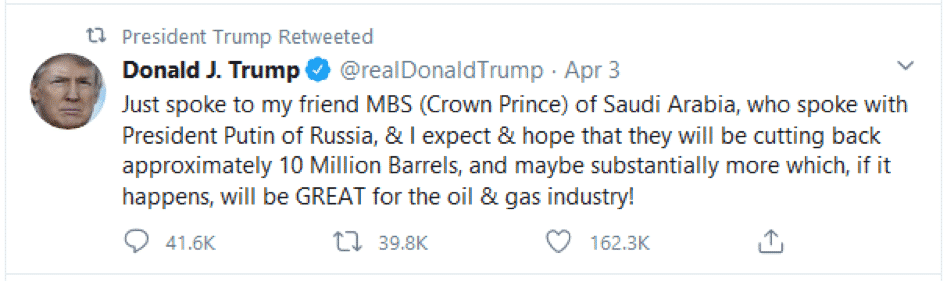

Last Thursday, President Trump tweeted about expectations of substantial production cuts, which has lifted hopes that OPEC and its allies will intervene to bring some stability in the oil and gas industry.

The Blame Game Delayed the OPEC meeting

President Trump’s actions resulted in an emergency OPEC meeting which was initially scheduled to take place on Monday. Over the weekend, the rift seemed to have widened as Russia dragged Saudi Arabia into the hostilities against the US Shale oil industry. The blame game has caused the meeting to be postponed which is “likely” going to take place on Thursday.

Multilateral Support Needed

|

Unprecedented measures are needed to tackle an unprecedented crisis. Are we going to see an alliance of oil producers other than OPEC+? |

A supply glut and weak demand have sent prices into a freefall, which is prompting growing calls of a multilateral commitment of oil producers to regularise the oil market. Among all the noises currently in the oil industry, traders need to pay particular attention to key factors:

Russia and Saudi Arabia

Market participants will need to monitor whether Russia and Saudi Arabia are willing to look passed the blame game and go back to the negotiable table. The first calming factor will be that both oil producers are able to resolve their differences and start a dialogue to cut oil production.

The US to Join Efforts

It is clear that for the interest of all producers, the efforts should not only come from OPEC+ members. Ever since the US President tweeted about the hopes of a truce between Saudi Arabia and Russia, the US has been under increased pressure to join global forces in cutting production amid crashing oil prices.

EIA Reports

The US Energy Information Administration slashed its expectations for US crude oil production by more than 1 million barrels – a day ahead of the much-awaited meeting. Despite the projected cuts by the EIA, the US is still expected to formally commit to production cuts. It appears to be the decisive factor that will restore peace in the industry.

G20 Meeting

It is reported that the G20 group of leading world economies will meet on Friday to host an emergency meeting with energy ministers. The aim of the meeting will focus on bringing nations together in an effort to stablilise the world energy markets.

Dual Meeting

The OPEC meeting followed by the G20 meeting could be a turning point for the oil and gas industry. Global efforts by OPEC+ members along with other key members, including the US, Canada and Brazil, among others, are key in bringing back confidence at a time where the oil market is facing the brunt of a pandemic.

Saudi Arabia has delayed setting May delivery prices of oil in anticipation that the meeting will end in a net positive. As of writing, we note that President Trump stated that he was not asked to participate in cutting production but “may” consider such a scenario if it would help to resolve the international disputes.

|

As the week comes to an end, attention will remain fixated on the upcoming meetings and any developments that will help investors to gauge the thinking of oil producers. |

By Deepta Bolaky

Disclaimer: Articles and videos from GO Markets analysts are based on their independent analysis. Views expressed are of their own and of a ‘general’ nature. Advice (if any) are not based on the reader’s personal objectives, financial situation or needs. Readers should, therefore, consider how appropriate the advice (if any) is to their objectives, financial situation and needs, before acting on the advice.

About GO Markets

GO Markets was established in Australia in 2006 as a provider of online CFD trading services. For over a decade, we have positioned ourselves as a firmly trusted and leading global regulated CFD provider. Traders can access more than 250 tradeable CFD instruments including Forex, Shares, Indices and Commodities.

Follow us on Twitter, Facebook and LinkedIn to stay up to date with the latest market news and analysis.

Next: A Summary of Major US Earnings Reports

Previous: First Quarter: Crisis, Volatility, and Opportunities