- Home

- News & Analysis

- Economic Updates

- Non-farm payroll beats expectations

Non-farm payroll beats expectations

August 8, 2016Upcoming News

» No high impact data tonight

» 10:30pm (MED Impact) Building Permits – CAD

The big story that finished off last week was the Non-farm payroll employment change. The figure released was far better than what was being expected. The market was looking for 180K, 255K new jobs were delivered. Hourly earnings also increased from 0.2% to 0.3%. This had a very positive effect on the USD and equity markets. On a more disappointing note, Canada’s employment change had a shocking result of -31.2K to expected 10.2K. That’ the largest drop in nearly 5 years. The trade balance also came in worse than expected at -3.6B.

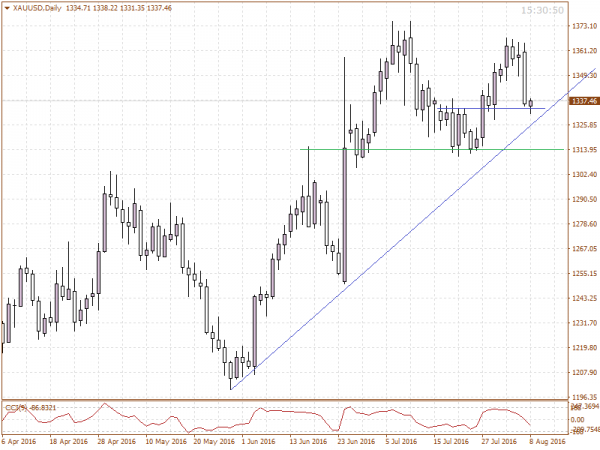

As the figures came in we saw big moves on the USD. This was especially apparent on the USDCAD as the data had a mirror effect, USD strength to CAD weakness. This pair moved up by 150 pips in 30 minutes. US stock indexes rallied off the better than expected data, DJIA +191.48 SP500 +18.62 NAS +54.87. European markets also followed the US lead with strong gains, DAX + 139.35 FTSE +53.31. As with all of these major releases, we always have a losing side. GOLD, Silver and risk currencies all dropped. GOLD lost $24 after spending most of the day testing 1365 high.

Mostly quiet trade in today’s Asain session. The Chinese trade balance was released at 12:59pm, beating expectations of 313B increasing to 343B. The AUDUSD found strength from this release trading up off its daily lows. With the positive leads Australian and Asian stocks have been trading higher. The JPN225 is up another 11.65 points, after gapping up on open. JPY has been mainly stronger but it’s been very quiet trade to this point. I’m looking for higher opens later this afternoon on the GER30 and UK100.

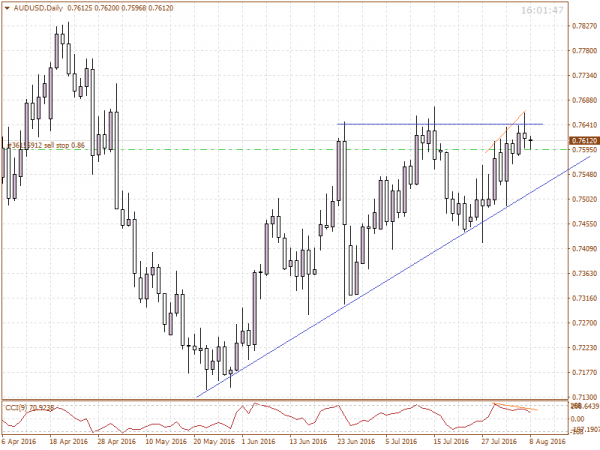

AUDUSD – We have seen some support come in today after the better than expected Chinese trade balance data. The NFP USD rally may end up being a flash in the pan, but I’m still seeing evidence the AUDUSD could be slowing down on the short term. 7640 is key resistance I’m seeing with that we have divergence forming. I’m looking for a break lower but as of yet we don’t have confirmation.

NAS100 – The monthly chart shows just how amazing this current rally up on the NAS has been. It started in the doom and gloom of 2008 and has been a very strong ascent to record closing highs this year. We’re barely off the all-time highs set in 2000. This current bull market has not felt like a bull market if compared to the hype that surrounded the 1995-2000 event.

XAUUSD – Lost $24 to close at 1335.90 on Friday’s session. It had been banging resistance at 1365 most the day Friday, but the real reason it dropped was only due to the positive Payroll data. On the short term, we have support starting to form from 1333. This area is a previous high we need more confirmation before we can say it’s confirmed. Price is still in an uptrend, but a break of 1330 could be setting up a longer correction with 1311 as a logical downside target.

Good Trading.

Please note that trading Forex and Derivatives carries a high level of risk, including the risk of losing substantially more than your initial investment. Also, you do not own or have any rights to the underlying assets. You should only trade if you can afford to carry these risks. Our offer is not designed to alter or modify any individual’s risk preference or encourage individuals to trade in a manner inconsistent with their own trading strategies.

All times are in AEST.

Written by Joseph Jeffriess, GO Markets Market Strategist

Next: Post Inauguration – approaching 100 days

Previous: Groundhog Day at the RBA, but where next for the Aussie dollar?