- Home

- News & Analysis

- Economic Updates

- NIO Making Waves

NIO Making Waves

November 12, 2020By Klavs Valters

The sales of electric cars exceeded the two million mark for the first time in 2019. By far the biggest electric automaker by market cap is Elon Musk’s Tesla. Its current market cap stands at $394.26 billion at the time of writing this, putting the electric automaker at the top of all automakers in the world. However, there is another electric car maker making waves in the industry.

About NIO

NIO is a Chinese car manufacturer founded in 2014 by William Li, a Chinese business executive, and entrepreneur. Its headquarters are based in Shanghai, China. It also has international offices in the United States, Germany, and the United Kingdom. It employs around 4,000 people worldwide. It recently became the 6th biggest automaker (by market cap) in the world overtaking US giant General Motors. The current market cap of NIO stands at $58.63 billion. The company describes itself as ‘’the next generation car company’’.

Source: Yahoo Finance

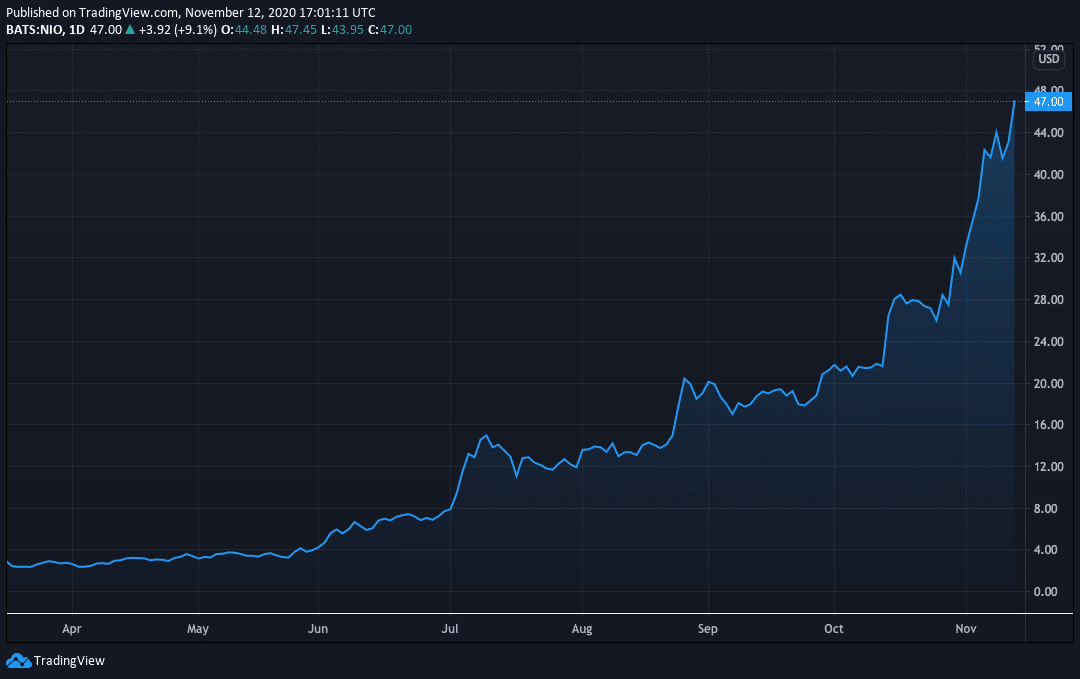

We have seen the price of NIO jump by over 1000% since the beginning of the year. But why has the share price been surging?

Record delivery numbers

NIO delivered 4,708 vehicles in September 2020, a new monthly record representing a strong 133.2% year-over-year growth. The deliveries consisted of 3,210 ES6s, the Company’s 5-seater high-performance premium smart electric SUV, 1,482 ES8s, the Company’s 6-seater, and 7-seater flagship premium smart electric SUV, and 16 EC6s, the Company’s 5-seater premium electric coupe SUV. NIO delivered 12,206 vehicles in the third quarter of 2020, representing an increase of 154.3% year-over-year and exceeding the higher end of the Company’s quarterly guidance.

JPMorgan price target upgrade

JPMorgan has increased their price target for the ”Chinese Tesla” a few times over the last few weeks, with the most recent upgrade released on the 9th of November. In a new note, JPMorgan analyst Rebecca Wen raised the price target from $40 to $46 per share. ”We believe NIO will be a long-term winner in the premium EV space, with ~ 30% market share by 2025,” Wen wrote in a note to clients. ”A higher valuation can be justified as NIO is leading the transformation of its business model in China’s smart EV market — from direct sales currently to potential monetization of both ‘B’ and ‘C’ customers through its platform and content offering in the future — similar to the phenomenon we witness in e-commerce business now.”

However, they may need to re-evaluate their recent price target as the share price reached $47 on the 12th of November.

These and other factors make NIO a stock to watch over the coming months.

NIO reports earnings next Tuesday, after the close of US markets.

By Klavs Valters

Disclaimer: The articles are from GO Markets analysts, based on their independent analysis or personal experiences. Views or opinions or trading styles expressed are of their own; should not be taken as either representative of or shared by GO Markets. Advice (if any), are of a ‘general’ nature and not based on your personal objectives, financial situation or needs. You should therefore consider how appropriate the advice (if any) is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next: 15 Asia-Pacific Countries Sign World’s Largest Free Trade Agreement at a Crucial Time

Previous: October: US Stimulus Noises and National Lockdowns