- Home

- News & Analysis

- Economic Updates

- NIO August delivery numbers are in

NIO August delivery numbers are in

September 2, 2021By Klavs Valters

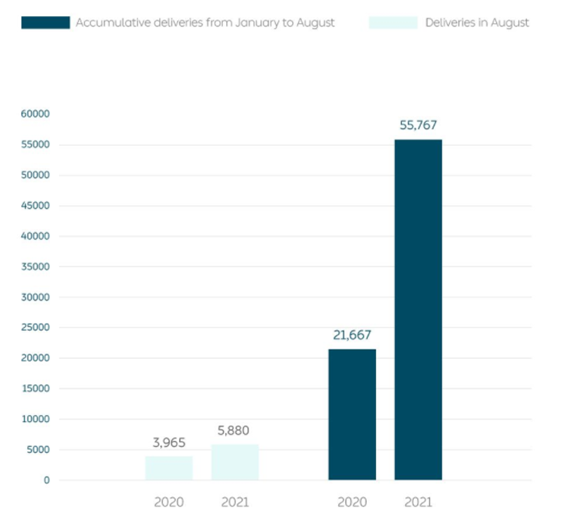

NIO reported its latest delivery numbers for last month before the opening bell on Wednesday. The ”Chinese Tesla” delivered a total of 5,880 vehicles in August – a 48.3% year-on-year increase.

About NIO

NIO is a Chinese car manufacturer founded in 2014 by William Li, a Chinese business executive, and entrepreneur. Its headquarters are based in Shanghai, China. It also has international offices in the United States, Germany, and the United Kingdom. It employs around 4,000 people worldwide.

August delivery numbers

The deliveries in August consisted of:

- 1,738 ES8s – the company’s six-seater or seven-seater flagship premium smart electric SUV

- 2,342 ES6s – the company’s five-seater high-performance premium smart electric SUV

- 1,800 EC6s – the company’s five-seater premium smart electric coupe SUV

NIO has delivered a total of 131,408 cars as of 31st August 2021.

The company revised its delivery outlook for Q3 from 22,500 to 23,500 vehicles due to the ongoing supply chain constraints which has hit the electric car industry.

Share price of NIO was little changed during the trading day on Wednesday, trading at around $39 per share. The stock is up by around 95% in the past year.

NIO Inc. Chart (1Y)

You can trade NIO Inc. (NIO) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD. Click here for more information. Trading Derivatives carries a high level of risk.

Sources: NIO, TradingView

By Klavs Valters

Disclaimer: The articles are from GO Markets analysts, based on their independent analysis or personal experiences. Views or opinions or trading styles expressed are of their own; should not be taken as either representative of or shared by GO Markets. Advice (if any), are of a ‘general’ nature and not based on your personal objectives, financial situation or needs. You should therefore consider how appropriate the advice (if any) is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next: Preview: Non-Farm Payroll announcement

Previous: Zoom beats Q2 expectations