- Home

- News & Analysis

- Central Banks

- Fundamental and Technical Forecasts Ahead of the FOMC meeting

Fundamental and Technical Forecasts Ahead of the FOMC meeting

September 24, 2018By Deepta Bolaky

The FOMC Meeting is set to be the highlight of the week as it might revive the rising trend of the US dollar.

Watchful eyes are glued to the reactions of the financial markets as the new tariffs officially take effect today. The policy divergence between the Fed and other central banks have put the US dollar in the spotlight and traders are keen to see how the Fed will play a probable fourth rate hike in December.

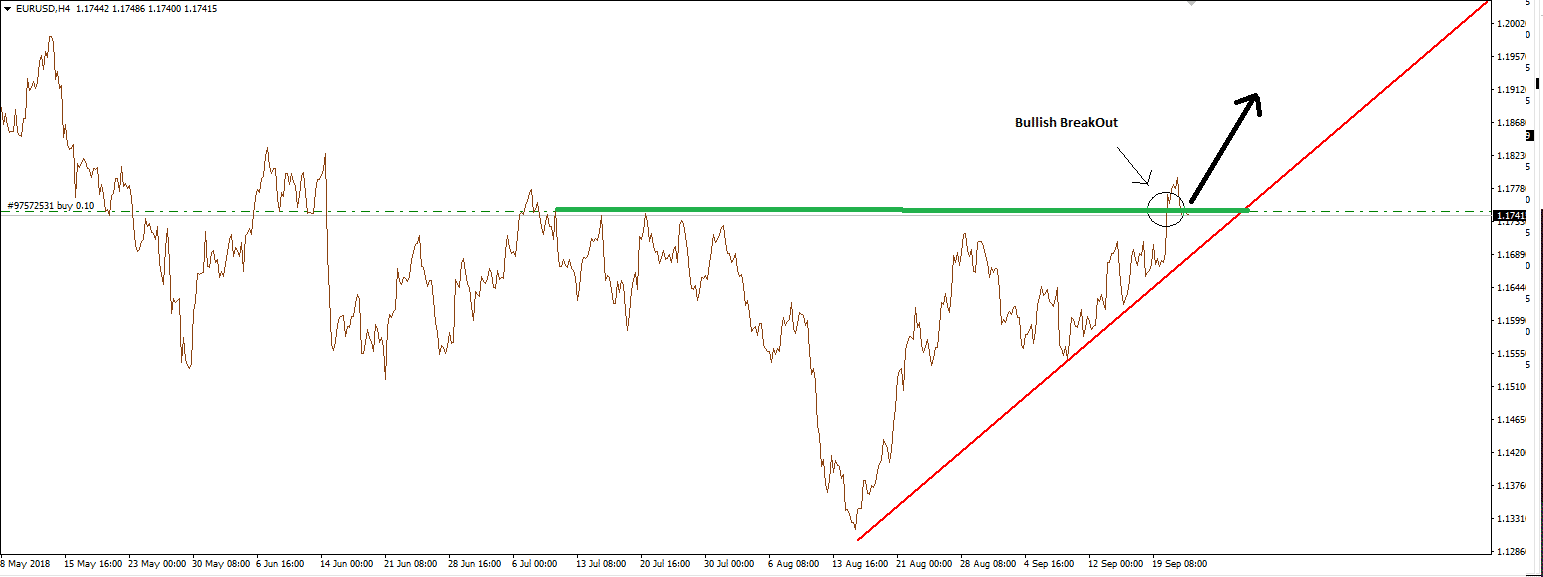

EURUSD

Fundamental Analysis

The EURUSD pair mainly found support by a weak US dollar last week. As we progressed into a new week, the Germany IFO Business Climate and EX CPI figures will be the main events on the data front for the Euro. Core inflation is expected to remain the same while elevated energy prices should drive headline inflation slightly higher at 2.1%. On the political front, attention will be on the Italian Budget.

Technical Analysis

The pair has formed an ascending triangle and the breakout through the resistance level might be the signal of a bullish formation. The uptrend line shows that sellers are losing control and bulls are pushing the pair higher. It is currently trading around the 1.1740 level, and a firm confirmation above that level could provide bulls with trading opportunities.

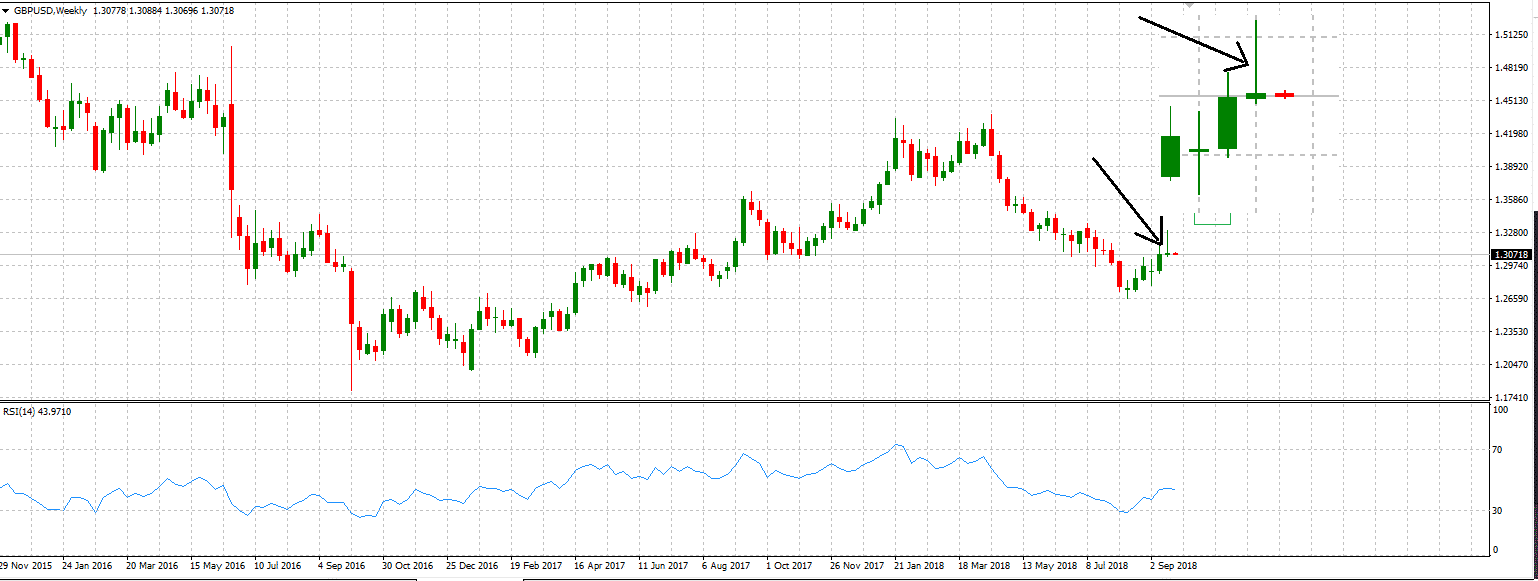

GBPUSD

Fundamental Analysis

After the renewed confidence over positive Brexit news, the Sterling is trading on the back foot again. A lack of economic releases on the UK-calendar will cause the pair to be mostly driven by Brexit related news.

Technical Analysis

After falling out of the overbought RSI conditions, the Gravestone Doji candle which formed on the weekly chart in an uptrend pattern shows that the selling pressures were able to push prices back down to the opening price of the week. This can signal that the uptrend could be over and long positions should trade cautiously. However, Friday’s sell-off might also be panic-selling so bears should wait and see for a clear down direction to act.

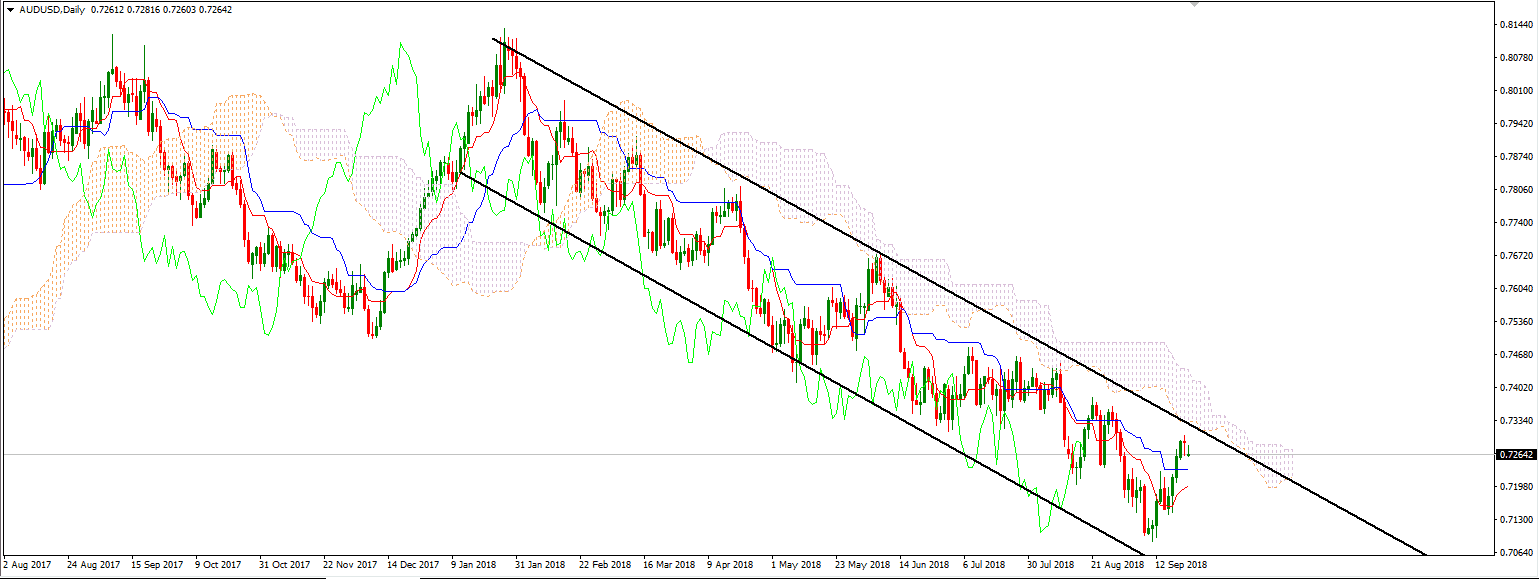

AUDUSD

Fundamental Analysis

This pair remains vulnerable to the US-Sino trade war. A lack of macroeconomic data during the week with only some releases on Friday will likely stay driven by trade angst.

Technical Analysis

On the technical side, the pair remains trapped in a bearish channel. The pair has stayed dampened in since the beginning of the February 2018.

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

Next: FOMC Brief – Sep 2018 Rate Hike

Previous: Bank of England Rate Decision – Preview